Dividends In Arrears On Cumulative Preferred Stock

Holbox

Mar 21, 2025 · 7 min read

Table of Contents

- Dividends In Arrears On Cumulative Preferred Stock

- Table of Contents

- Dividends in Arrears on Cumulative Preferred Stock: A Comprehensive Guide

- What are Dividends?

- Preferred Stock vs. Common Stock: A Key Distinction

- Cumulative Preferred Stock: Understanding the Basics

- Dividends in Arrears: The Implications

- 1. Financial Burden on the Company:

- 2. Impact on the Company's Credit Rating:

- 3. Negative Investor Perception:

- 4. Potential for Legal Action:

- 5. Difficulty in Raising Capital:

- Strategies for Addressing Dividends in Arrears

- 1. Restructuring Debt:

- 2. Cost Reduction Measures:

- 3. Asset Sales:

- 4. Increase in Equity Financing:

- 5. Improved Operational Efficiency:

- Investor Considerations: Cumulative Preferred Stock and Arrears

- 1. Due Diligence:

- 2. Risk Assessment:

- 3. Dividend Payment History:

- 4. Understanding the Terms of the Offering:

- 5. Diversification:

- Conclusion: Navigating the Complexities of Dividends in Arrears

- Latest Posts

- Latest Posts

- Related Post

Dividends in Arrears on Cumulative Preferred Stock: A Comprehensive Guide

Dividends are a crucial aspect of investing in stocks, especially preferred stocks. Understanding how dividends work, particularly concerning cumulative preferred stock and the implications of dividends in arrears, is vital for both investors and company executives. This article delves deep into the intricacies of dividends in arrears on cumulative preferred stock, exploring their implications for investors, companies, and the overall financial landscape.

What are Dividends?

Dividends represent a portion of a company's profits distributed to its shareholders. Companies distribute dividends as a way to reward investors for their contributions and to signal financial health and stability. There are two main types of stock: common stock and preferred stock. Each has its own dividend structure and priority.

Preferred Stock vs. Common Stock: A Key Distinction

Common stock holders are typically last in line to receive dividends. They only receive dividends after all other obligations, including preferred stock dividends, have been met. The amount of the dividend is often variable, determined by the company's board of directors based on performance and financial conditions.

Preferred stock, on the other hand, offers several advantages. One key differentiator is the dividend structure. Preferred stockholders usually receive a fixed dividend rate, stated as a percentage of the stock's par value. This fixed rate provides a degree of predictability and stability for investors compared to the variability of common stock dividends.

There are two main types of preferred stock concerning dividend payments: cumulative and non-cumulative. The distinction lies in how unpaid dividends are handled.

Cumulative Preferred Stock: Understanding the Basics

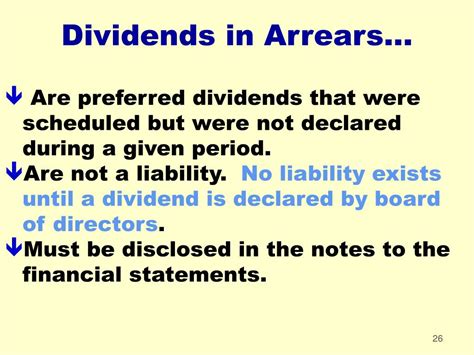

Cumulative preferred stock is characterized by its ability to accumulate unpaid dividends. If a company fails to pay dividends in a given period, these dividends are not lost. Instead, they accumulate and must be paid before any dividends are paid to common stockholders. This "in arrears" situation means that the company owes these past-due dividends. These arrears represent a significant financial obligation for the company.

Dividends in Arrears: The Implications

Dividends in arrears on cumulative preferred stock signify that the company has not paid the promised dividends to its preferred shareholders for one or more periods. This has several important consequences:

1. Financial Burden on the Company:

Having dividends in arrears puts a significant financial strain on the company. The accumulated arrears represent a debt that must be settled before any dividends can be distributed to common stockholders. This can severely limit a company's financial flexibility, especially during periods of economic downturn or financial distress. Paying off these arrears often requires diverting resources from other crucial areas, such as research and development, capital expenditure, or debt reduction.

2. Impact on the Company's Credit Rating:

Unpaid dividends can negatively impact a company's credit rating. Credit rating agencies assess a company's financial health and stability, and a consistent inability to meet its dividend obligations is a strong indicator of financial weakness. A lower credit rating leads to higher borrowing costs and may make it difficult for the company to raise capital in the future. This is a significant concern for companies relying on debt financing.

3. Negative Investor Perception:

Dividends in arrears can severely damage investor confidence. The failure to meet dividend obligations signals mismanagement, financial instability, or both. This can lead to a decline in the company's stock price, making it harder to attract new investors and potentially triggering a sell-off by existing shareholders. Negative investor sentiment can have long-term implications for the company's ability to secure funding and maintain its market position.

4. Potential for Legal Action:

In some cases, preferred shareholders may take legal action against the company if dividends remain in arrears for an extended period. This could result in lawsuits and legal costs, adding to the company's financial burdens. The legal implications depend heavily on the specific terms and conditions outlined in the company's charter and offering documents.

5. Difficulty in Raising Capital:

Companies with dividends in arrears often face difficulties in raising additional capital. Investors are less likely to invest in a company with a history of failing to meet its dividend obligations. This can significantly hamper the company's ability to grow and expand its operations.

Strategies for Addressing Dividends in Arrears

Companies facing the challenge of dividends in arrears need to develop strategies to address the situation and restore investor confidence. These strategies can include:

1. Restructuring Debt:

Restructuring existing debt can free up cash flow to pay off dividends in arrears. Negotiating with creditors to extend repayment terms or lower interest rates can provide crucial financial breathing room.

2. Cost Reduction Measures:

Implementing cost reduction measures across various departments can help improve the company's cash flow. This may involve streamlining operations, reducing unnecessary expenses, or renegotiating contracts with suppliers.

3. Asset Sales:

Selling non-core assets can provide a quick influx of cash to help pay off dividends in arrears. This involves identifying assets that are not crucial to the company's core operations and selling them to generate capital.

4. Increase in Equity Financing:

Raising additional capital through equity financing can improve the company's financial position and provide the resources needed to pay off dividends in arrears. This may involve issuing new shares or seeking additional investment from venture capitalists or private equity firms.

5. Improved Operational Efficiency:

Improving operational efficiency throughout the company can generate greater profitability and improve cash flow. This may involve investing in new technologies, improving supply chain management, or implementing lean manufacturing techniques.

Investor Considerations: Cumulative Preferred Stock and Arrears

For investors, understanding the implications of cumulative preferred stock and dividends in arrears is crucial for making informed investment decisions. Before investing in preferred stock, it's important to carefully review the company's financial statements, track its dividend payment history, and understand the terms of the preferred stock offering.

Here are some key considerations for investors:

1. Due Diligence:

Thorough due diligence is essential before investing in any preferred stock, particularly cumulative preferred stock. Review the company's financial statements, paying close attention to its cash flow, debt levels, and dividend payment history. Analyze the company's overall financial health and stability.

2. Risk Assessment:

Assess the risk associated with investing in the specific company and the cumulative preferred stock. Consider the company's industry, its competitive landscape, and the potential impact of economic downturns or unforeseen circumstances.

3. Dividend Payment History:

Scrutinize the company's dividend payment history to identify any instances of missed or delayed dividend payments. A history of consistent dividend payments suggests greater stability, while a history of missed payments indicates increased risk.

4. Understanding the Terms of the Offering:

Carefully review the terms and conditions of the preferred stock offering, paying particular attention to the dividend payment terms, including the fixed rate, payment dates, and the accumulation of arrears.

5. Diversification:

As with any investment, diversification is key. Don't put all your eggs in one basket. Spread your investments across multiple companies and asset classes to reduce risk.

Conclusion: Navigating the Complexities of Dividends in Arrears

Dividends in arrears on cumulative preferred stock present a complex challenge for both companies and investors. For companies, it represents a significant financial burden that can impact credit ratings, investor confidence, and the ability to raise capital. For investors, it represents a significant risk that necessitates thorough due diligence and careful risk assessment. Understanding the intricacies of dividends in arrears, the implications for both companies and investors, and the strategies available for addressing the situation is essential for navigating the complexities of the financial markets. Careful planning, proactive financial management, and a strong understanding of the preferred stock offering's terms are crucial elements in successfully navigating this aspect of financial markets. By understanding these nuances, both companies and investors can make informed decisions to mitigate potential risks and maximize returns.

Latest Posts

Latest Posts

-

Your Company Offers A Single Premium

Mar 29, 2025

-

Draw The Structure Of 4 Isopropyl 2 4 5 Trimethylheptane

Mar 29, 2025

-

The Disadvantage Of Turning While Reversing Is

Mar 29, 2025

-

Determine The T Value In Each Of The Cases

Mar 29, 2025

-

What Are The Primary Effects Of Cost Push Inflation

Mar 29, 2025

Related Post

Thank you for visiting our website which covers about Dividends In Arrears On Cumulative Preferred Stock . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.