Consider The Following T Account For Cash

Holbox

Mar 27, 2025 · 6 min read

Table of Contents

- Consider The Following T Account For Cash

- Table of Contents

- Consider the Following T-Account for Cash: A Comprehensive Guide to Understanding Cash Flows

- Understanding the Cash T-Account

- Analyzing the Cash Flow with the T-Account

- Beyond the Basics: Enhancing Cash T-Account Analysis

- 1. Categorization of Cash Flows:

- 2. Reconciling with Bank Statements:

- 3. Budgeting and Forecasting:

- Applications of Cash T-Accounts

- Advanced Techniques and Considerations

- Conclusion: Mastering the Cash T-Account

- Latest Posts

- Latest Posts

- Related Post

Consider the Following T-Account for Cash: A Comprehensive Guide to Understanding Cash Flows

The humble T-account, a staple of accounting education, provides a surprisingly powerful tool for understanding the flow of cash within a business. Let's delve into the intricacies of a cash T-account, exploring its construction, interpretation, and significance in financial analysis. This comprehensive guide will cover everything from basic principles to advanced applications, equipping you with the knowledge to effectively utilize cash T-accounts for informed decision-making.

Understanding the Cash T-Account

A T-account is a visual representation of a general ledger account. Its structure, resembling the letter "T," neatly separates debits (left side) and credits (right side). For a cash T-account, the debits represent increases in cash, while credits represent decreases. This simple yet effective format allows for clear tracking of all cash transactions.

Key Components of a Cash T-Account:

- Account Title: Clearly identifies the account as "Cash." This is crucial for accurate record-keeping.

- Debits (Left Side): Record all increases in cash. This includes cash received from sales, loan proceeds, investments, and other sources.

- Credits (Right Side): Record all decreases in cash. This includes cash payments for expenses, purchases, loan repayments, and dividends.

- Beginning Balance: The cash balance at the start of the accounting period. This is entered on the side (debit or credit) reflecting the balance's nature.

- Ending Balance: The cash balance at the end of the accounting period. This is calculated by subtracting total credits from the sum of the beginning balance and total debits.

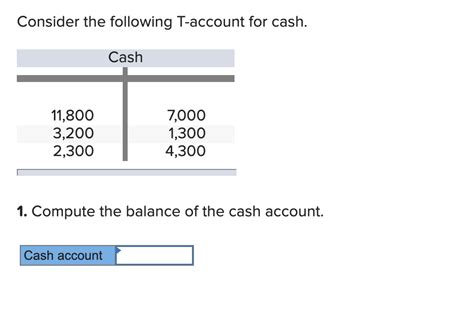

Example of a Simple Cash T-Account:

Let's illustrate with a simplified example:

Cash

| Debit | Credit |

|-------------|-------------|

| Beginning Balance: $10,000 | |

| Sales Revenue: $5,000 | Rent Expense: $1,000 |

| Loan Proceeds: $2,000 | Utilities Expense: $500 |

| | Salaries Expense: $2,000 |

| | |

| **Ending Balance: $13,500** | **Total Credits: $3,500** |

| **Total Debits: $17,000** | |

In this example, the beginning cash balance was $10,000. Various inflows (debits) increased the cash balance, while outflows (credits) decreased it. The ending balance reflects the net effect of all transactions during the period.

Analyzing the Cash Flow with the T-Account

The beauty of a cash T-account lies in its ability to provide a clear and concise overview of cash inflows and outflows. By meticulously recording all transactions, the account facilitates a comprehensive analysis of the company's liquidity. Analyzing the T-account reveals key insights into:

-

Cash inflows: Identifying the primary sources of cash receipts is vital for understanding the business model's sustainability. A heavily reliance on short-term loans or external financing may raise concerns about long-term viability. Conversely, a strong inflow from sales suggests healthy demand and efficient operations.

-

Cash outflows: Analyzing cash outflows reveals areas where the company spends its money. A disproportionate amount spent on certain expenses, such as salaries or inventory, may necessitate further investigation and potential cost-cutting measures.

-

Net cash flow: The difference between total cash inflows and outflows during the accounting period. A positive net cash flow indicates the business is generating more cash than it's spending, while a negative net cash flow indicates the opposite.

Beyond the Basics: Enhancing Cash T-Account Analysis

While a basic T-account offers a foundational understanding, more sophisticated analysis can be achieved by incorporating additional elements:

1. Categorization of Cash Flows:

Rather than simply listing debits and credits, categorize them. Group similar transactions under headings like:

- Operating Activities: Cash flows related to the core business operations, such as sales revenue, cost of goods sold, and operating expenses.

- Investing Activities: Cash flows related to the acquisition and disposal of long-term assets, such as property, plant, and equipment (PP&E).

- Financing Activities: Cash flows related to funding the business, such as debt financing, equity financing, and dividend payments.

This categorization enhances the analytical power of the T-account, aligning with the indirect method of preparing the statement of cash flows.

2. Reconciling with Bank Statements:

Regularly reconcile the cash T-account with bank statements to ensure accuracy and identify any discrepancies. This crucial step helps detect errors, fraudulent activities, and outstanding checks or deposits.

3. Budgeting and Forecasting:

By projecting future cash flows and incorporating them into the T-account, businesses can effectively budget and forecast their financial position. This forward-looking approach allows for proactive financial planning and mitigation of potential cash flow shortfalls.

Applications of Cash T-Accounts

Cash T-accounts are not merely accounting tools; they are vital for a range of business activities:

-

Financial Statement Preparation: The information gleaned from the cash T-account is crucial for preparing the statement of cash flows, a key component of a company's financial statements.

-

Creditworthiness Assessment: Lenders often analyze cash flow information to assess a company's ability to repay loans. A well-maintained cash T-account provides a clear picture of the company's financial health.

-

Internal Control: The detailed record-keeping inherent in the cash T-account contributes to strong internal controls, minimizing the risk of errors and fraud.

-

Performance Evaluation: Monitoring cash flows over time allows businesses to track their financial performance and identify trends. This information assists in strategic decision-making and resource allocation.

-

Investment Decisions: Detailed cash flow analysis facilitates sound investment decisions, helping businesses allocate resources efficiently and maximize returns.

Advanced Techniques and Considerations

While the basic T-account serves as a robust tool, certain techniques can further enhance its analytical capabilities:

-

Sub-accounts: Create sub-accounts within the main "Cash" account to segregate different cash sources (e.g., Cash - Sales, Cash - Loans, Cash - Investments). This provides a granular view of cash flows from various sources.

-

Spreadsheet Software: Leverage spreadsheet software such as Microsoft Excel or Google Sheets to automate the T-account process. This streamlines data entry, calculations, and reporting.

-

Cash Flow Projections: Project future cash flows by incorporating sales forecasts, expense budgets, and anticipated capital expenditures. This proactive approach enables businesses to anticipate potential cash shortages or surpluses.

Conclusion: Mastering the Cash T-Account

The cash T-account, despite its seemingly simple structure, is a fundamental tool for understanding and managing cash flows. By meticulously tracking cash inflows and outflows, categorizing transactions, and regularly reconciling the account with bank statements, businesses can gain valuable insights into their financial health. Mastering the cash T-account equips businesses with the knowledge to make informed decisions, enhance financial planning, and ultimately achieve sustainable growth. The detailed analysis facilitated by this simple tool is invaluable for assessing liquidity, identifying areas for improvement, and optimizing financial performance. By understanding the power of the cash T-account, businesses can transform their financial management and position themselves for success.

Latest Posts

Latest Posts

-

Asp Provided Amnesty Collection Points Are Available

Mar 30, 2025

-

Is Nh4br Acidic Basic Or Neutral

Mar 30, 2025

-

A Large Population Of Land Turtles On An Isolated Island

Mar 30, 2025

-

Demand Is Said To Be Inelastic If

Mar 30, 2025

-

What Is This Number Text 70266

Mar 30, 2025

Related Post

Thank you for visiting our website which covers about Consider The Following T Account For Cash . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.