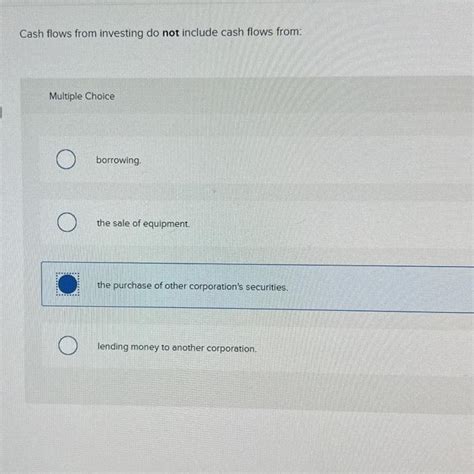

Cash Flows From Investing Do Not Include Cash Flows From

Holbox

Mar 19, 2025 · 7 min read

Table of Contents

Cash Flows from Investing Do Not Include Cash Flows From: A Comprehensive Guide

Understanding cash flow statements is crucial for any business, whether it's a small startup or a multinational corporation. These statements provide a clear picture of how money moves in and out of a company during a specific period. One key section of the cash flow statement focuses on cash flows from investing activities. But what exactly does and doesn't fall under this category? This comprehensive guide will delve deep into this important topic, clarifying the inclusions and exclusions and highlighting the importance of accurate reporting.

What are Cash Flows from Investing Activities?

Cash flows from investing activities represent the net cash used or provided by a company's investments in long-term assets. These are assets intended to generate future income or benefits, extending beyond the current operating cycle. The goal is to determine how effectively a company is managing its capital expenditures and investments to drive future growth and profitability. This section of the cash flow statement reveals insights into a company’s long-term strategic decisions.

Think of it this way: investing activities are about the acquisition and disposal of assets that are expected to provide benefits far beyond the current year's operations. It's about building a strong foundation for the future, rather than managing day-to-day operations.

Key Inclusions in Cash Flows from Investing Activities

Several key items are always included in the cash flows from investing activities section. These are the core components that define this aspect of the financial statement:

1. Purchase and Sale of Long-Term Assets:

This is the largest component, encompassing transactions related to:

- Property, Plant, and Equipment (PP&E): This includes the acquisition or disposal of land, buildings, machinery, equipment, and other fixed assets crucial for operations. Cash outflow is recorded for purchases, and cash inflow for sales.

- Intangible Assets: Purchases or sales of patents, copyrights, trademarks, and other intangible assets that provide long-term value to the business are included here.

- Other Long-Term Investments: Acquisitions or disposals of investments in other companies (long-term equity investments, for example) are also classified under this category. This doesn't include short-term investments, which are typically categorized under operating activities.

2. Acquisition and Disposal of Subsidiaries and Business Units:

Significant transactions involving the acquisition or sale of entire businesses or subsidiaries fall under investing activities. These are large-scale investments reflecting strategic corporate decisions. The cash involved in these transactions is substantial and significantly impacts the company's overall financial position.

3. Lending and Borrowing (Long-Term):

While short-term loans are generally categorized under financing activities, long-term loans made to other entities are classified as investing activities. Similarly, proceeds from long-term debt issued by the company itself are classified under financing activities, not investing. The distinction is based on the intended use of the funds.

4. Investment in Securities (Long-Term):

Investments in long-term securities, like bonds, represent investing activities. The purchase represents an outflow, while the sale (or maturity) represents an inflow. Short-term investments, however, are usually part of operating activities.

Key Exclusions from Cash Flows from Investing Activities

It's equally crucial to understand what doesn't belong in cash flows from investing activities. Misclassifying these items can significantly distort the picture of a company's investment strategy and overall financial health.

1. Cash Flows from Operating Activities:

This is a critical distinction. Operating activities concern the day-to-day running of the business. Examples include:

- Cash receipts from customers: This is the money generated from the core business operations.

- Cash payments to suppliers: Payments for goods and services required for operations.

- Cash payments for salaries and wages: Compensation to employees involved in the daily operations.

- Interest received on short-term investments: Returns on short-term, highly liquid investments are considered operating activities.

- Interest paid on short-term debt: Payments related to short-term borrowing are classified as operating activities. Long-term interest payments are often shown separately, usually under financing activities.

- Taxes paid: Payments of income taxes are part of operating activities.

These are all vital components of the business's routine functioning and are not related to long-term investments.

2. Cash Flows from Financing Activities:

Financing activities relate to how a company raises and manages its capital. These include:

- Issuance of debt: Proceeds from issuing bonds or taking out loans.

- Repayment of debt: Principal payments on loans.

- Issuance of equity: Proceeds from selling company stock.

- Repurchase of equity: Buying back the company's own stock.

- Dividend payments: Cash paid out to shareholders.

These activities are about the company's capital structure and not its investments in long-term assets to generate future returns.

3. Cash Flows Related to Short-Term Investments:

Short-term investments are highly liquid and intended for immediate use, not long-term returns. Their cash flows are generally included in operating activities. These include treasury bills, commercial paper, and money market funds. They are fundamentally different from long-term investments like stocks or bonds held for appreciation.

4. Non-Cash Transactions:

Crucially, non-cash transactions are excluded from the statement of cash flows entirely, regardless of the category. Examples include:

- Acquisition of assets through debt financing: While the asset is an investing activity, the debt financing is a financing activity. The transaction itself isn’t a cash flow.

- Stock-based compensation: Issuing stock options to employees doesn't involve a direct cash exchange.

- Depreciation and amortization: These are non-cash expenses that reduce the value of assets over time but don't involve actual cash outflow. They are reflected in the income statement but not in the cash flow statement.

The Importance of Accurate Classification

Accurate classification of cash flows is paramount for several reasons:

- Financial Reporting: Correctly categorizing cash flows ensures transparent and reliable financial reporting, providing a true picture of a company's financial health to stakeholders.

- Investment Decisions: Investors rely on accurate cash flow statements to evaluate a company's performance, investment strategy, and future potential. Misclassifications can lead to inaccurate investment decisions.

- Creditworthiness: Lenders use cash flow information to assess a company's creditworthiness. Inaccurate reporting can negatively impact a company’s ability to secure financing.

- Internal Management: Internal management uses cash flow information for strategic planning, budgeting, and resource allocation. Accurate information is essential for effective decision-making.

- Regulatory Compliance: Accurate reporting is mandatory for compliance with accounting standards such as Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS).

Analyzing Cash Flows from Investing Activities: Key Metrics

Analyzing the cash flows from investing activities goes beyond simply looking at the net cash flow figure. Several metrics provide a deeper understanding of a company's investment strategy and its effectiveness:

- Return on Investment (ROI): This measures the profitability of investments, comparing the net gain (or loss) to the initial investment cost.

- Payback Period: This determines the time it takes for an investment to generate enough cash flow to recover its initial cost.

- Net Present Value (NPV): This considers the time value of money, discounting future cash flows to their present value to assess the overall profitability of an investment.

- Internal Rate of Return (IRR): This is the discount rate that makes the NPV of an investment equal to zero, indicating the investment's profitability.

Conclusion

Understanding the intricacies of cash flows from investing activities is critical for anyone involved in financial analysis, investment decisions, or business management. By accurately classifying cash flows and analyzing relevant metrics, stakeholders can gain valuable insights into a company's long-term strategic direction, investment performance, and overall financial health. Remember, the key is to differentiate between long-term capital investments that are designed to generate future returns and short-term operational expenditures or financing activities. This distinction is crucial for a clear and accurate picture of the company's financial performance and future prospects. Maintaining the integrity of this section of the cash flow statement is fundamental to responsible and transparent financial reporting.

Latest Posts

Latest Posts

-

Which Two Statements Are True Of Product Positioning

Mar 20, 2025

-

Sort These Nucleotide Building Blocks By Their Name Or Classification

Mar 20, 2025

-

Effective Capacity Is Always Blank Design Capacity

Mar 20, 2025

-

Which Of The Following Is A Normative Economic Statement

Mar 20, 2025

-

Draw The Major Organic Product Of The Reaction Shown Below

Mar 20, 2025

Related Post

Thank you for visiting our website which covers about Cash Flows From Investing Do Not Include Cash Flows From . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.