Cash Flows From Investing Activities Do Not Include

Holbox

Mar 21, 2025 · 5 min read

Table of Contents

- Cash Flows From Investing Activities Do Not Include

- Table of Contents

- Cash Flows from Investing Activities: What They Don't Include

- What are Cash Flows from Investing Activities?

- Understanding the Exclusions: What Doesn't Belong in Investing Activities?

- 1. Operating Activities

- 2. Financing Activities

- 3. Short-Term Investments

- 4. Internal Transactions and Non-Cash Transactions

- 5. Changes in Working Capital

- Analyzing Cash Flows from Investing Activities: Key Considerations

- Conclusion: A Clearer Picture of Investing Activities

- Latest Posts

- Latest Posts

- Related Post

Cash Flows from Investing Activities: What They Don't Include

Understanding cash flows is crucial for assessing a company's financial health and future prospects. One key component of the statement of cash flows is cash flows from investing activities. However, many find this section confusing. This comprehensive guide clarifies what doesn't fall under cash flows from investing activities, helping you interpret financial statements more effectively.

What are Cash Flows from Investing Activities?

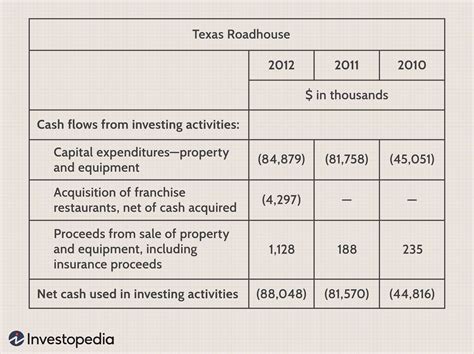

Before diving into exclusions, let's establish what does constitute cash flows from investing activities. This section of the statement of cash flows reflects the cash inflows and outflows resulting from a company's investments in long-term assets and securities. This includes:

- Acquisitions of long-term assets: Purchasing property, plant, and equipment (PP&E), intangible assets (patents, copyrights), and other long-term assets. This is usually a significant cash outflow.

- Proceeds from the sale of long-term assets: Selling PP&E, intangible assets, or other long-term assets generates a cash inflow. The gain or loss on the sale is reported separately in the income statement, but the cash received is reflected here.

- Acquisitions and disposals of investments: Buying and selling stocks, bonds, and other securities (excluding trading securities, which are usually classified as operating activities). These can be both inflows and outflows depending on the company's investment strategy.

- Loans made to other entities: Providing loans to other companies or individuals is considered an investment activity. The repayment of these loans will be an inflow.

- Acquisitions of subsidiaries or other businesses: Major acquisitions significantly impact the investing activities section, often representing substantial cash outflows.

Understanding the Exclusions: What Doesn't Belong in Investing Activities?

The key to understanding cash flows from investing activities lies in grasping what is excluded. These exclusions are often where confusion arises. Here's a detailed breakdown:

1. Operating Activities

This is perhaps the most common source of confusion. Cash flows related to the company's core business operations are categorized under operating activities. This includes:

- Cash received from customers: Payment for goods or services sold.

- Cash paid to suppliers: Purchases of raw materials, inventory, and other supplies.

- Cash paid for salaries and wages: Compensation to employees.

- Cash paid for interest and taxes: Financial obligations related to debt and taxes.

- Cash payments related to accounts receivable and payable: Collections from customers and payments to suppliers.

Why these are excluded: These transactions are part of the day-to-day running of the business and are not considered investments in long-term assets.

2. Financing Activities

Financing activities concern how a company raises capital and manages its debt. This section includes:

- Issuance of debt: Borrowing money through bonds or loans. This results in a cash inflow.

- Repayment of debt: Paying back borrowed funds, causing a cash outflow.

- Issuance of equity: Selling shares of stock to raise capital (cash inflow).

- Repurchase of equity: Buying back company shares (cash outflow).

- Payment of dividends: Distributing profits to shareholders (cash outflow).

Why these are excluded: These activities relate to the company's capital structure and are separate from investments in long-term assets.

3. Short-Term Investments

While investments are generally included, short-term investments, particularly those held for trading purposes, are usually classified under operating activities. This is because:

- Trading securities are considered part of the company's operating cycle. Their sale is viewed as a regular part of the business's revenue generation strategy, rather than a long-term investment.

- Frequent buying and selling of these securities make it less relevant to categorize them under investing activities. The classification focuses on their operational role rather than a long-term investment strategy.

4. Internal Transactions and Non-Cash Transactions

Certain transactions, even though they may relate to long-term assets, are not reflected in the cash flow statement:

- Internal transfers of assets: Moving assets within the company (e.g., transferring equipment between departments) does not involve an external cash exchange and isn't recorded.

- Non-cash transactions: Acquisitions funded entirely by issuing stock or debt do not involve a cash outflow, despite the acquisition of a long-term asset. These are often disclosed as supplementary information to the statement of cash flows.

- Depreciation and Amortization: These are non-cash expenses that reduce the book value of assets but do not involve an immediate cash outflow. They are reflected in the income statement, impacting net income, but not directly in cash flows from investing activities.

5. Changes in Working Capital

Changes in working capital (current assets and liabilities) are reported in the operating activities section. These include:

- Increases or decreases in accounts receivable: Reflecting changes in customer credit.

- Increases or decreases in inventory: Changes in the level of goods held for sale.

- Increases or decreases in accounts payable: Changes in amounts owed to suppliers.

Why these are excluded from investing activities: These fluctuations represent the short-term management of operational resources, not investments in long-term assets.

Analyzing Cash Flows from Investing Activities: Key Considerations

Understanding the exclusions helps you accurately interpret the cash flows from investing activities. A high level of outflow may indicate significant capital expenditures, potentially for expansion or modernization. Consistent outflows without commensurate inflows could suggest financial strain. Conversely, high inflows might indicate asset sales or divestments.

Analyzing this section alongside other financial statements, particularly the balance sheet and income statement, provides a more complete picture of a company's financial position and performance. Look for trends over time to understand the company's long-term investment strategy and whether it's effectively allocating capital.

Conclusion: A Clearer Picture of Investing Activities

Cash flows from investing activities provide vital insights into a company's investment strategy and its ability to generate returns from long-term assets. By understanding what is not included, you can avoid misinterpretations and develop a clearer understanding of a company's financial health. Remember to always analyze this section in conjunction with other financial statements for a comprehensive view of the company's performance and strategic direction. This nuanced understanding empowers you to make informed decisions based on a clear interpretation of financial information.

Latest Posts

Latest Posts

-

The Lamp Stack Of Open Source Products Is Used

Mar 28, 2025

-

A Political Benefit Of Economic Integration Is That It

Mar 28, 2025

-

All Of The Following Are Goals Of Resuscitation Except

Mar 28, 2025

-

Click On Each Chiral Center In The Cholesterol Derivative Below

Mar 28, 2025

-

Iso 9000 Currently Stresses Of A Certified Organization

Mar 28, 2025

Related Post

Thank you for visiting our website which covers about Cash Flows From Investing Activities Do Not Include . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.