Beth Taps Her Phone At A Payment Terminal

Holbox

Mar 15, 2025 · 6 min read

Table of Contents

Beth Taps Her Phone at a Payment Terminal: A Deep Dive into the Evolution of Mobile Payments

The simple act of Beth tapping her phone at a payment terminal represents a monumental shift in how we conduct transactions. It's a seemingly insignificant gesture, yet it encapsulates years of technological innovation, shifts in consumer behavior, and the ongoing evolution of the financial landscape. This seemingly mundane action speaks volumes about the future of money and the increasingly frictionless nature of commerce. Let's explore the intricacies behind this seemingly simple tap.

The Technology Behind the Tap: NFC and Beyond

At the heart of Beth's contactless payment lies Near Field Communication (NFC) technology. This short-range wireless technology allows two devices, in this case, Beth's phone and the payment terminal, to communicate securely over a very short distance, typically a few centimeters. This secure communication enables the transfer of payment information without the need for physical contact or the insertion of a card. But NFC is just one piece of a larger puzzle.

The Role of Secure Elements and Tokenization:

To ensure security, sensitive payment information isn't directly transmitted. Instead, a process called tokenization is employed. This involves replacing the actual credit card number with a unique digital identifier, or token, that can be used for transactions. This token is stored securely within a secure element on Beth's phone, a dedicated chip that protects the sensitive data from unauthorized access. Even if Beth's phone were compromised, the actual card details remain safe.

The Payment Network's Crucial Role:

The transaction doesn't end with the tap. The tokenized information is then transmitted to the payment network (e.g., Visa, Mastercard, American Express), which verifies the transaction and authorizes the payment. This involves complex processes of authentication and fraud prevention, ensuring that the transaction is legitimate and secure. The network then communicates back to the terminal, confirming the successful payment. This intricate dance of data exchange happens in mere seconds, making the entire process seamless for Beth.

The Consumer Experience: Convenience and Security Redefined

For Beth, and millions like her, tapping their phone offers unparalleled convenience. No more fumbling for wallets, searching for the right card, or waiting for chip card processing. The simplicity and speed are undeniable benefits. But it's not just convenience. The perception of security plays a significant role in the widespread adoption of mobile payments.

Addressing Security Concerns:

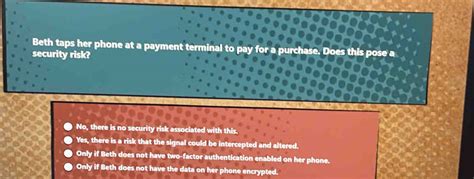

While technology strives for perfection, security concerns inevitably arise. Concerns about data breaches, phone theft, and unauthorized access are valid. However, the robust security measures built into mobile payment systems, such as tokenization and biometric authentication (fingerprint or facial recognition), mitigate these risks significantly.

The Expanding Ecosystem: Beyond Credit Cards:

The tap isn't limited to credit cards. Many mobile payment systems support debit cards, loyalty programs, and even digital wallets like Apple Pay, Google Pay, and Samsung Pay. This expanding ecosystem further enhances the versatility and convenience of mobile payments, catering to a wide range of consumer needs and preferences.

The Impact on Businesses: Streamlined Operations and Increased Sales

The adoption of mobile payment technology has profoundly impacted businesses of all sizes. It has streamlined operations, improved customer experiences, and potentially boosted sales.

Reduced Transaction Costs:

By reducing reliance on traditional card readers and processing fees associated with physical cards, businesses can save money on transaction costs. This translates to higher profit margins, especially beneficial for small businesses.

Enhanced Customer Experience:

Faster checkout times improve customer satisfaction, reducing queues and frustration. This leads to increased customer loyalty and potentially higher sales. The ease of payment can also encourage impulse purchases.

Data-Driven Insights:

Mobile payment systems often provide businesses with valuable data about customer purchasing habits, preferences, and spending patterns. This information can be used to personalize marketing campaigns, optimize inventory management, and improve overall business strategies.

The Future of Mobile Payments: Emerging Trends and Innovations

The evolution of mobile payments continues at a rapid pace, with several exciting trends and innovations on the horizon.

Biometric Authentication:

Beyond fingerprint and facial recognition, advancements in biometric technologies, such as voice recognition and iris scanning, are enhancing security and convenience further.

Blockchain and Cryptocurrency Integration:

The integration of blockchain technology and cryptocurrencies into mobile payment systems offers the potential for decentralized and more secure transactions. This could revolutionize cross-border payments and reduce reliance on traditional financial institutions.

Artificial Intelligence (AI) and Machine Learning (ML):

AI and ML are playing an increasingly important role in fraud detection, risk assessment, and personalized payment experiences. This enables more proactive fraud prevention and tailored offers to customers.

The Rise of Super Apps:

Super apps, which integrate various services such as payments, messaging, transportation, and e-commerce, are becoming increasingly popular in many parts of the world. This convergence of services creates a more holistic and convenient mobile ecosystem.

Beth's Tap: A Microcosm of Technological Advancement

Beth's seemingly simple action of tapping her phone at a payment terminal is a microcosm of the significant technological advancements that have transformed the way we interact with money. It represents a journey from cumbersome cash transactions to a seamless, secure, and increasingly frictionless digital experience. The implications are far-reaching, impacting consumers, businesses, and the broader financial landscape. This simple tap is a testament to the power of innovation and its ability to reshape our daily lives. As technology continues to evolve, we can expect even more significant advancements in mobile payments, making transactions even faster, more secure, and more convenient for everyone.

Beyond the Tap: The Social and Economic Implications

The shift towards mobile payments extends beyond mere convenience. It has profound social and economic implications, influencing financial inclusion, economic growth, and even social interactions.

Financial Inclusion:

Mobile payments have the potential to empower the unbanked and underbanked populations by providing them with access to financial services. In developing countries, where traditional banking infrastructure might be limited, mobile payments offer a critical pathway to financial inclusion, fostering economic empowerment and growth.

Economic Growth:

The efficiency and cost-effectiveness of mobile payments contribute to economic growth by reducing transaction costs and facilitating commerce. Faster and more efficient transactions stimulate economic activity and create new opportunities for businesses and individuals.

Changing Social Interactions:

The rise of mobile payments is subtly changing social interactions. The exchange of money, once a potentially awkward social transaction, becomes more streamlined and less personal. This shift has both advantages and disadvantages, impacting social dynamics in both subtle and significant ways.

The Future is Contactless: Embracing the Evolution

Beth's tap signifies more than just a payment; it represents a future where contactless transactions are the norm. The continuing evolution of mobile payment technologies promises to further streamline commerce, enhance security, and redefine the relationship between consumers, businesses, and the financial world. The journey from cash to tap is ongoing, and the future is undoubtedly contactless.

Latest Posts

Latest Posts

-

A Positive Return On Investment For Education Happens When

Mar 17, 2025

-

What Is The Value Of I

Mar 17, 2025

-

The Accounts In The Ledger Of Monroe Entertainment Co

Mar 17, 2025

-

A Process Cost Accounting System Is Most Appropriate When

Mar 17, 2025

-

An Example Of A Breach Of Ephi Is

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about Beth Taps Her Phone At A Payment Terminal . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.