Accounts Recievalb. Eare Normally Reported At The

Holbox

Mar 16, 2025 · 7 min read

Table of Contents

Accounts Receivable: How They're Normally Reported and Why It Matters

Accounts receivable (A/R) are a critical component of a company's financial health, representing money owed to a business for goods or services sold on credit. Understanding how A/R is reported, the intricacies involved, and the implications for financial analysis is crucial for both businesses and investors. This comprehensive guide delves into the reporting of accounts receivable, covering everything from the basics to advanced considerations.

What are Accounts Receivable?

Before delving into reporting, let's establish a firm understanding of what accounts receivable actually are. Simply put, accounts receivable represent the amounts a company expects to receive from customers for goods or services already delivered but not yet paid for. This arises from credit sales, where payment terms are extended beyond the immediate point of sale. Think of it as a short-term loan provided by the company to its customers.

The value of A/R is reflected on the balance sheet, a key financial statement providing a snapshot of a company's assets, liabilities, and equity at a specific point in time. It’s categorized as a current asset, meaning it's expected to be converted into cash within one year or the company's operating cycle, whichever is longer.

Examples of situations creating Accounts Receivable:

- Sales on Credit: A company sells goods to a customer with payment terms of "net 30," meaning payment is due within 30 days.

- Service Provision: A consulting firm completes a project for a client but hasn't yet received payment.

- Installment Sales: A company sells a product with a payment plan spread over several months.

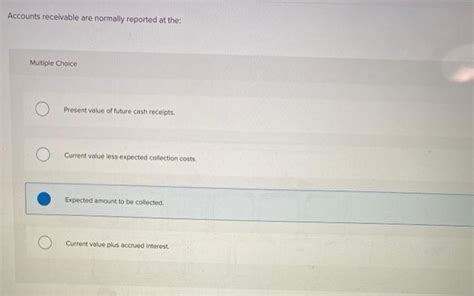

How Accounts Receivable are Normally Reported

Accounts receivable are typically reported on the balance sheet under the current assets section. The amount shown represents the net realizable value of the receivables. This means the gross amount of outstanding invoices is reduced by an allowance for doubtful accounts.

1. Gross Accounts Receivable

This is the total amount of money owed to the company by its customers. It's the sum of all outstanding invoices and other amounts due. This figure represents the total value of receivables before considering potential losses.

2. Allowance for Doubtful Accounts

Not all accounts receivable are collectible. Some customers may fail to pay due to insolvency, disputes, or other reasons. To account for this possibility, companies create an allowance for doubtful accounts, also known as the allowance for bad debts. This is a contra-asset account, meaning it reduces the value of the gross accounts receivable. The allowance is an estimate, based on historical data, current economic conditions, and the company's credit policies.

3. Net Accounts Receivable

This is the value reported on the balance sheet. It's calculated by subtracting the allowance for doubtful accounts from the gross accounts receivable:

Net Accounts Receivable = Gross Accounts Receivable - Allowance for Doubtful Accounts

For example:

- Gross Accounts Receivable: $100,000

- Allowance for Doubtful Accounts: $5,000

- Net Accounts Receivable: $95,000 ($100,000 - $5,000)

The $95,000 is the amount that appears on the balance sheet, representing the company's best estimate of the amount it actually expects to collect.

The Importance of Accurate Reporting

Accurate reporting of accounts receivable is critical for several reasons:

-

Financial Statement Reliability: Accurate A/R reporting ensures the reliability of the balance sheet and other financial statements, providing a true and fair view of the company's financial position. Inaccurate reporting can mislead investors and creditors.

-

Credit Risk Assessment: The level of A/R and the allowance for doubtful accounts provide insights into a company's credit risk. High A/R and a large allowance suggest potential problems with collecting payments.

-

Cash Flow Forecasting: Accurate A/R information is essential for accurate cash flow forecasting. Companies need to know when and how much cash they can expect to receive from customers.

-

Debt Covenant Compliance: Many loan agreements include covenants that restrict a company's level of A/R. Accurate reporting is crucial to ensure compliance with these covenants.

-

Internal Controls: Effective internal controls over A/R help prevent fraud and ensure accurate record-keeping. Regular review and reconciliation of A/R are vital components of these controls.

Methods for Estimating Allowance for Doubtful Accounts

Several methods are used to estimate the allowance for doubtful accounts, each with its own advantages and disadvantages. The choice of method depends on factors such as the company's industry, size, and historical data.

1. Percentage of Sales Method

This method estimates the allowance based on a percentage of credit sales for a specific period. It's simple to apply but may not accurately reflect the actual collectability of existing receivables.

2. Percentage of Receivables Method

This method applies a percentage to the existing accounts receivable balance. It's more directly related to the actual receivables but can be less accurate if the aging of receivables is not considered.

3. Aging of Receivables Method

This is generally considered the most accurate method. It categorizes receivables based on their age (e.g., 0-30 days, 31-60 days, 61-90 days, over 90 days) and assigns different percentages of uncollectibility to each category. Older receivables are typically assigned higher percentages because they're less likely to be collected.

Analyzing Accounts Receivable Turnover

Accounts receivable turnover is a crucial ratio used to assess the efficiency of a company's credit and collection policies. It indicates how quickly a company collects its receivables. The calculation is:

Accounts Receivable Turnover = Net Credit Sales / Average Accounts Receivable

A higher turnover ratio suggests efficient collection processes, while a lower ratio may indicate problems with collecting payments. The average accounts receivable is usually calculated as the average of the beginning and ending balances for the period.

Days Sales Outstanding (DSO)

Days Sales Outstanding (DSO) is another key metric related to A/R. It measures the average number of days it takes a company to collect payment after a sale. The formula is:

Days Sales Outstanding (DSO) = (Average Accounts Receivable / Net Credit Sales) * Number of Days in the Period

A lower DSO is generally preferable, as it signifies faster collection of receivables and improved cash flow. Comparing a company's DSO to industry benchmarks provides valuable insights into its performance.

Factors Affecting Accounts Receivable

Several factors influence a company's accounts receivable balance:

-

Credit Policies: Lenient credit policies may lead to higher A/R but increased risk of bad debts. Stricter policies may reduce A/R but potentially lose sales. Finding the right balance is crucial.

-

Economic Conditions: During economic downturns, customers may be less able to pay their debts, leading to increased A/R and a higher allowance for doubtful accounts.

-

Industry Practices: Different industries have different payment terms and collection practices. This affects the level and turnover of A/R.

-

Collection Efforts: Effective collection efforts, such as timely follow-ups and aggressive debt recovery strategies, can improve A/R turnover.

-

Customer Relationships: Strong customer relationships can contribute to timely payments and lower bad debts.

Analyzing Accounts Receivable in the Context of Other Financial Ratios

Analyzing A/R in isolation provides limited insights. It's essential to consider it alongside other financial ratios to obtain a comprehensive understanding of a company's financial health. For instance, comparing A/R turnover to inventory turnover can reveal potential imbalances in the operational cycle. Similarly, analyzing A/R in conjunction with profitability ratios can highlight the impact of credit policies on overall financial performance.

The Auditor's Role in Accounts Receivable

Independent auditors play a crucial role in verifying the accuracy of a company's accounts receivable balance. They perform procedures such as:

- Confirmation: Sending requests to customers to confirm the amounts owed.

- Inspection: Examining supporting documentation such as invoices and payment records.

- Analytical Procedures: Comparing the A/R balance to prior periods and industry benchmarks.

These procedures aim to provide reasonable assurance that the A/R balance is fairly presented in accordance with generally accepted accounting principles (GAAP).

Conclusion

Accounts receivable represent a significant aspect of a company's financial health and operational efficiency. Understanding how A/R is reported, the methods used for estimating bad debts, and the relevant ratios for analysis is crucial for investors, creditors, and business managers alike. By effectively managing and monitoring A/R, companies can improve cash flow, minimize losses, and enhance their overall financial performance. The information presented here is for general guidance only; specific accounting practices and regulations may vary. Always consult with a financial professional for tailored advice.

Latest Posts

Latest Posts

-

How Does A Shortcut Link To Another File

Mar 17, 2025

-

Cash Flows From Financing Activities Do Not Include

Mar 17, 2025

-

A Positive Return On Investment For Education Happens When

Mar 17, 2025

-

What Is The Value Of I

Mar 17, 2025

-

The Accounts In The Ledger Of Monroe Entertainment Co

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about Accounts Recievalb. Eare Normally Reported At The . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.