A Responsibility Accounting Performance Report Displays

Holbox

Mar 21, 2025 · 7 min read

Table of Contents

- A Responsibility Accounting Performance Report Displays

- Table of Contents

- A Responsibility Accounting Performance Report Displays: A Deep Dive into Effective Performance Measurement

- Understanding the Core Components of a Responsibility Accounting Performance Report

- 1. Header Information:

- 2. Budget vs. Actual Comparison:

- 3. Variance Analysis:

- 4. Graphical Representations:

- 5. Commentary and Explanations:

- 6. Performance Metrics:

- Types of Responsibility Accounting Performance Reports

- 1. Cost Center Reports:

- 2. Revenue Center Reports:

- 3. Profit Center Reports:

- 4. Investment Center Reports:

- Key Performance Indicators (KPIs) in Responsibility Accounting

- Effective Interpretation and Utilization of Responsibility Accounting Performance Reports

- Conclusion: Driving Organizational Success with Effective Responsibility Accounting

- Latest Posts

- Latest Posts

- Related Post

A Responsibility Accounting Performance Report Displays: A Deep Dive into Effective Performance Measurement

Responsibility accounting is a crucial management tool that helps organizations track performance at different levels. It assigns accountability for specific areas or segments to individual managers, empowering them to make decisions and own their outcomes. A key element of this system is the responsibility accounting performance report. These reports provide a detailed view of an individual's or department's performance against pre-set targets, allowing for both evaluation and improvement. This article explores the essential elements of these reports, their different types, the key performance indicators (KPIs) typically used, and how to effectively interpret and utilize this data for improved organizational performance.

Understanding the Core Components of a Responsibility Accounting Performance Report

A well-structured responsibility accounting performance report goes beyond simply presenting numbers. It aims to tell a story, providing a clear picture of performance against targets, highlighting variances, and offering insights into potential underlying causes. Key components often include:

1. Header Information:

- Reporting Period: Clearly specifies the timeframe covered by the report (e.g., month, quarter, year).

- Responsibility Center: Identifies the specific individual, department, or unit accountable for the performance results.

- Date of Report: Indicates when the report was generated.

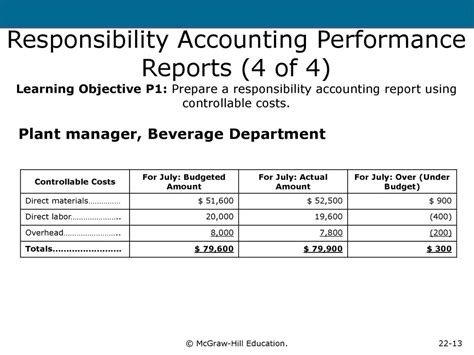

2. Budget vs. Actual Comparison:

This is the heart of the report. It presents a detailed comparison between the planned (budgeted) figures and the actual results achieved during the reporting period. The difference between the two reveals the variance, which is further analyzed to understand its root cause. This section typically includes:

- Revenue/Sales: Actual sales achieved compared to the budgeted sales. Variances should be analyzed to identify factors like pricing changes, sales volume fluctuations, and market conditions.

- Costs: A breakdown of actual costs compared to budgeted costs. This could include direct materials, direct labor, manufacturing overhead, selling expenses, administrative expenses, etc. Variances should highlight areas of overspending or underspending and potential efficiency gains.

- Profit/Loss: The overall profitability (or loss) of the responsibility center, comparing actual profit/loss to the budgeted profit/loss.

3. Variance Analysis:

This section is critical for understanding why the variances exist. A simple numerical comparison isn't enough; the report should delve into the reasons behind the discrepancies. Common causes of variances include:

- Price Variances: Differences between actual and budgeted prices of materials or products.

- Quantity Variances: Differences between the actual and budgeted quantities of materials used or products sold.

- Efficiency Variances: Differences in the efficiency of resource utilization (e.g., labor hours, machine hours).

- Spending Variances: Deviations from the budgeted expenditure in various expense categories.

- Sales Price Variances: Differences between actual and expected selling prices.

- Sales Volume Variances: Differences between actual and expected sales volumes.

4. Graphical Representations:

Visual aids like charts and graphs can significantly enhance the report's readability and impact. These can effectively highlight trends, patterns, and key variances. Examples include:

- Bar charts: Comparing budgeted vs. actual figures for various cost or revenue categories.

- Line graphs: Showing trends in sales, costs, or profits over time.

- Pie charts: Illustrating the proportion of costs allocated to different expense categories.

5. Commentary and Explanations:

The report should not simply present numbers; it should provide context and interpretation. This section should explain the significant variances, highlighting potential causes and suggesting corrective actions. It should also discuss any external factors that may have impacted performance.

6. Performance Metrics:

Beyond financial data, the report may include other relevant performance indicators, depending on the nature of the responsibility center. Examples include:

- Customer satisfaction scores: For sales and marketing departments.

- Employee turnover rates: For human resources departments.

- Defect rates: For production departments.

- On-time delivery rates: For logistics and operations.

Types of Responsibility Accounting Performance Reports

The structure and content of a responsibility accounting performance report will vary depending on the type of responsibility center it covers. Common types include:

1. Cost Center Reports:

These reports focus on controlling costs. They compare actual costs to budgeted costs and analyze variances, highlighting areas where cost reduction efforts are needed. KPIs often include cost per unit, overhead rates, and variance percentages.

2. Revenue Center Reports:

These reports concentrate on generating revenue. They compare actual revenue to budgeted revenue, analyze sales volume and pricing variances, and assess the effectiveness of sales and marketing strategies. KPIs typically include sales volume, revenue growth, customer acquisition cost, and market share.

3. Profit Center Reports:

These reports combine aspects of cost and revenue centers, focusing on profitability. They analyze both revenue and cost variances to determine the overall profit generated by a specific unit. Key KPIs include gross profit margin, net profit margin, return on investment (ROI), and contribution margin.

4. Investment Center Reports:

These reports assess the performance of responsibility centers that have significant investment decisions. They evaluate profitability while considering the amount of capital invested. Key KPIs include ROI, residual income, economic value added (EVA), and return on assets (ROA).

Key Performance Indicators (KPIs) in Responsibility Accounting

The specific KPIs included in a responsibility accounting performance report will depend on the nature of the responsibility center and organizational goals. However, some common KPIs across various responsibility centers include:

- Net Income: The overall profit generated after deducting all expenses.

- Gross Profit Margin: The percentage of revenue remaining after deducting the cost of goods sold.

- Operating Income: Profit before interest and taxes.

- Return on Investment (ROI): A measure of profitability relative to the investment made.

- Return on Assets (ROA): A measure of how efficiently a company is using its assets to generate earnings.

- Sales Growth: The percentage increase in sales revenue over a period.

- Market Share: The percentage of the total market controlled by a company or unit.

- Customer Satisfaction: Measured through surveys or feedback mechanisms.

- Employee Turnover: The rate at which employees leave the organization.

- Defect Rate: The percentage of defective products or services produced.

- On-Time Delivery Rate: The percentage of orders delivered on time.

- Inventory Turnover: The number of times inventory is sold and replaced over a period.

- Days Sales Outstanding (DSO): The average number of days it takes to collect payment after a sale.

Effective Interpretation and Utilization of Responsibility Accounting Performance Reports

The true value of a responsibility accounting performance report lies in its effective interpretation and utilization. This requires:

- Understanding the Context: Analyze the report considering external factors that may have impacted performance (e.g., economic downturns, changes in competition, natural disasters).

- Identifying Key Trends: Look for patterns and trends in the data over time. This helps predict future performance and identify potential problems early.

- Focusing on Significant Variances: Don't get bogged down in small, insignificant variances. Concentrate on the major discrepancies that have a substantial impact on performance.

- Investigating Root Causes: Drill down into the reasons behind significant variances. This may involve conducting interviews, analyzing data in more detail, and investigating operational processes.

- Developing Corrective Actions: Based on the variance analysis, develop and implement corrective actions to address performance issues.

- Regular Review and Monitoring: Regularly review the performance reports to track progress and make necessary adjustments.

- Using the Data for Improvement: Use the data in the reports to inform strategic decisions, improve operational efficiency, and enhance overall organizational performance.

Conclusion: Driving Organizational Success with Effective Responsibility Accounting

Responsibility accounting, with its reliance on detailed performance reports, provides a robust framework for monitoring and improving organizational performance. By clearly defining responsibilities, setting realistic targets, and regularly reviewing performance against those targets, organizations can enhance accountability, empower managers, and drive continuous improvement. The key lies in creating comprehensive reports that go beyond simple numerical comparisons, providing insightful analysis, contextual information, and actionable recommendations. By leveraging these reports effectively, organizations can foster a culture of accountability, drive operational efficiency, and ultimately achieve greater success. Remember that the report is a tool; its effectiveness depends on how it’s used to inform decision-making and drive positive change.

Latest Posts

Latest Posts

-

Genes Turn On Or Off To Regulate The Activity Of

Mar 29, 2025

-

Effective Promotion Enhances A Product Or Services

Mar 29, 2025

-

Which Of The Following Is True Of A Nights Sleep

Mar 29, 2025

-

A Fox Locates Rodents Under The Snow

Mar 29, 2025

-

Click On All The Electrophiles Then Check Your Answer

Mar 29, 2025

Related Post

Thank you for visiting our website which covers about A Responsibility Accounting Performance Report Displays . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.