A Post Closing Trial Balance Will Show

Holbox

Mar 20, 2025 · 6 min read

Table of Contents

A Post-Closing Trial Balance: What It Shows and Why It Matters

A post-closing trial balance is a crucial step in the accounting cycle, serving as a final check to ensure the accuracy and completeness of your financial records. Understanding what it shows and why it's important is key to maintaining accurate financial statements and avoiding costly errors. This comprehensive guide will delve into the intricacies of a post-closing trial balance, explaining its purpose, how it's created, what it should show, and its significance in financial reporting.

Understanding the Accounting Cycle and its Stages

Before diving into the post-closing trial balance, it's essential to understand its place within the larger accounting cycle. The accounting cycle is a series of steps followed to record, classify, summarize, and interpret financial transactions. Key stages include:

- Journalizing: Recording transactions in a journal.

- Posting: Transferring journal entries to the general ledger.

- Trial Balance: Preparing a trial balance to verify the equality of debits and credits. This is typically done before closing entries are made (pre-closing trial balance).

- Adjusting Entries: Making adjustments for accruals, deferrals, and other necessary corrections.

- Adjusted Trial Balance: Preparing a trial balance after making adjusting entries.

- Closing Entries: Closing temporary accounts (revenue, expense, and dividends) to transfer their balances to retained earnings. This is a critical step that prepares the books for the next accounting period.

- Post-Closing Trial Balance: Preparing a trial balance after closing entries have been made. This is the focus of this article.

- Preparing Financial Statements: Creating the income statement, balance sheet, and statement of cash flows using the information from the post-closing trial balance.

What a Post-Closing Trial Balance Shows

The post-closing trial balance differs significantly from the pre-closing trial balance. The key difference lies in the accounts included. While the pre-closing trial balance includes all accounts – permanent and temporary – the post-closing trial balance only shows permanent accounts.

A post-closing trial balance will typically display the following:

- Assets: These represent what a company owns, including cash, accounts receivable, inventory, equipment, and property, plant, and equipment (PP&E).

- Liabilities: These are a company's obligations to others, such as accounts payable, salaries payable, loans payable, and deferred revenue.

- Equity: This represents the owners' stake in the company. For a corporation, this includes retained earnings (the accumulated profits less dividends) and contributed capital (amounts invested by shareholders). For sole proprietorships and partnerships, this section will reflect the owner's capital account.

Crucially, a post-closing trial balance will not show:

- Revenue Accounts: These accounts are closed at the end of the accounting period.

- Expense Accounts: These accounts are also closed at the end of the accounting period.

- Dividend Accounts: Dividends paid during the period are closed out to retained earnings.

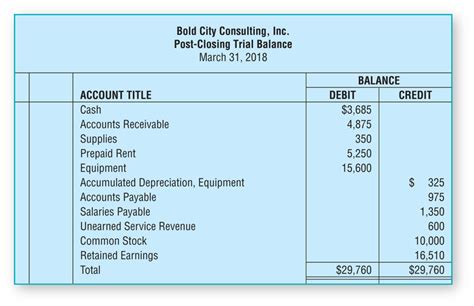

Example of a Post-Closing Trial Balance

Let's illustrate with a simplified example:

| Account Name | Debit | Credit |

|---|---|---|

| Cash | $10,000 | |

| Accounts Receivable | $5,000 | |

| Inventory | $2,000 | |

| Equipment | $20,000 | |

| Accumulated Depreciation | $2,000 | |

| Accounts Payable | $3,000 | |

| Salaries Payable | $1,000 | |

| Retained Earnings | $26,000 | |

| Total | $37,000 | $37,000 |

This example demonstrates a balanced post-closing trial balance. Notice that only permanent accounts are included. All temporary accounts (revenue, expenses, dividends) have been closed out.

The Purpose and Importance of a Post-Closing Trial Balance

The primary purpose of a post-closing trial balance is to verify the accuracy of the closing entries and ensure that the accounting equation (Assets = Liabilities + Equity) remains balanced after the closing process. It serves as a final checkpoint before preparing the financial statements for the next accounting period.

Key Benefits of a Post-Closing Trial Balance:

- Error Detection: It helps identify errors made during the closing process. If the debits and credits don't match, it indicates an error that needs to be corrected before proceeding.

- Accuracy Verification: It confirms that the permanent accounts are correctly balanced and ready for the start of the next accounting period.

- Financial Statement Preparation: It provides the necessary data to prepare the balance sheet, which shows the financial position of the business at the end of the accounting period.

- Auditing Purposes: It serves as a valuable document for auditors to verify the accuracy and completeness of the financial records.

- Smooth Transition to Next Period: A correctly prepared post-closing trial balance ensures a clean start to the next accounting period, minimizing errors and improving efficiency.

How to Prepare a Post-Closing Trial Balance

Preparing a post-closing trial balance is relatively straightforward. It follows these steps:

- Ensure Closing Entries are Complete: Verify that all temporary accounts (revenue, expenses, and dividends) have been properly closed.

- Gather Account Balances: Obtain the ending balances of all permanent accounts from the general ledger.

- Prepare a Worksheet: Create a worksheet with columns for account names, debit balances, and credit balances.

- List Permanent Accounts: List all permanent accounts (assets, liabilities, and equity) on the worksheet.

- Enter Account Balances: Enter the debit or credit balance of each account in the appropriate column.

- Total Debits and Credits: Calculate the total of the debit and credit columns.

- Verify Equality: Ensure that the total debits equal the total credits. If they don't, it indicates an error that needs immediate investigation and correction.

Troubleshooting a Post-Closing Trial Balance

If the debit and credit columns of your post-closing trial balance do not match, it means there's an error somewhere in the accounting process. Here are some common causes and troubleshooting steps:

- Incorrect Closing Entries: Review all closing entries for accuracy. A common mistake is incorrectly debiting or crediting accounts.

- Mathematical Errors: Double-check all calculations during the closing process and the preparation of the trial balance.

- Omitted Accounts: Ensure that all permanent accounts have been included in the trial balance.

- Errors in the General Ledger: Review the general ledger for any errors in posting or calculations. Incorrect postings will skew the account balances.

- Errors in the Adjusting Entries (if applicable): Incorrect adjusting entries can affect the final balances of accounts used in the closing entries.

If you identify an error, correct it in the general ledger and then prepare a revised post-closing trial balance.

The Post-Closing Trial Balance and Financial Statement Preparation

The post-closing trial balance is the foundation for preparing the balance sheet. The balances from the post-closing trial balance are directly used to populate the balance sheet's asset, liability, and equity sections. The balance sheet, in turn, is a crucial component of the complete set of financial statements, alongside the income statement and statement of cash flows. Without an accurate post-closing trial balance, preparing reliable and accurate financial statements becomes impossible.

Conclusion

The post-closing trial balance is a critical step in the accounting cycle, serving as a vital check on the accuracy and completeness of your financial records. By understanding what it shows, why it's important, and how to prepare it correctly, businesses can ensure the integrity of their financial statements, facilitate a smooth transition to the next accounting period, and make informed business decisions based on reliable financial information. The time and effort invested in mastering this process is invaluable for the overall financial health and stability of any organization. Regularly reviewing and understanding your post-closing trial balance will help you proactively identify and address potential issues, safeguarding your business's financial well-being.

Latest Posts

Latest Posts

-

Human Anatomy And Physiology Lab Manual

Mar 21, 2025

-

Sophia Operates Her Own Accounting Practice

Mar 21, 2025

-

How Many Different Kinds Of 13c Peaks Will Be Seen

Mar 21, 2025

-

Which Of The Following Accurately Describes A Supply Chain Map

Mar 21, 2025

-

One Shot Prompting Refer To In The Context Of Llms

Mar 21, 2025

Related Post

Thank you for visiting our website which covers about A Post Closing Trial Balance Will Show . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.