A Monopoly Can Earn Positive Profits Because It

Holbox

Mar 21, 2025 · 6 min read

Table of Contents

- A Monopoly Can Earn Positive Profits Because It

- Table of Contents

- A Monopoly Can Earn Positive Profits Because It… Controls the Market

- 1. Barriers to Entry: Keeping Competitors Out

- a) Legal Barriers:

- b) Natural Barriers:

- 2. Price Setting Above Marginal Cost: The Power of Monopoly Pricing

- 3. Profit Maximization: The Monopolist's Goal

- 4. Price Discrimination: Extracting Maximum Consumer Surplus

- 5. Lack of Competition: The Absence of Competitive Pressure

- 6. Innovation and R&D: A Double-Edged Sword

- 7. Regulation and Government Intervention: A Balancing Act

- 8. Long-Run Sustainability: The Threat of Erosion

- Conclusion: A Complex Relationship

- Latest Posts

- Latest Posts

- Related Post

A Monopoly Can Earn Positive Profits Because It… Controls the Market

A monopoly, by definition, is a market structure characterized by a single seller offering a unique product or service with no close substitutes. This singular position grants the monopolist significant market power, allowing them to influence both price and quantity supplied, ultimately leading to the potential for sustained positive economic profits. But why can a monopoly earn positive profits? It boils down to several key factors:

1. Barriers to Entry: Keeping Competitors Out

The foundation of a monopoly's ability to earn positive profits lies in the presence of high barriers to entry. These barriers prevent other firms from entering the market and competing away the monopolist's profits. These barriers can take many forms:

a) Legal Barriers:

- Patents and Copyrights: These grant exclusive rights to produce and sell a particular product or utilize a specific technology for a defined period. Pharmaceutical companies, for example, often enjoy substantial periods of monopoly power due to patent protection on their drugs.

- Government Licenses and Franchises: In some industries, governments grant exclusive licenses or franchises, effectively limiting the number of firms that can operate. This is common in utilities (like electricity or water provision) and public transportation.

- Regulation: Government regulations can inadvertently create monopolies by imposing stringent entry requirements or licensing fees that make it difficult for new businesses to compete.

b) Natural Barriers:

- High Start-up Costs: Some industries require massive initial investments in infrastructure or technology, making it prohibitively expensive for new firms to enter. Think of the telecommunications industry or the development of a nationwide railway system.

- Control of Essential Resources: A firm might control access to a crucial raw material or resource necessary for production, effectively blocking potential competitors. For instance, a company owning a unique mineral deposit enjoys a natural monopoly.

- Economies of Scale: In some industries, the cost of production falls significantly as the scale of operation increases. This allows large, established firms to produce at a lower average cost than smaller, newer entrants, making it challenging for them to compete on price. This is a significant barrier in industries like airline travel or automobile manufacturing.

- Network Effects: The value of a product or service often increases with the number of users. This network effect creates a powerful barrier to entry, as new entrants struggle to attract users away from an established network. Social media platforms exemplify this phenomenon.

2. Price Setting Above Marginal Cost: The Power of Monopoly Pricing

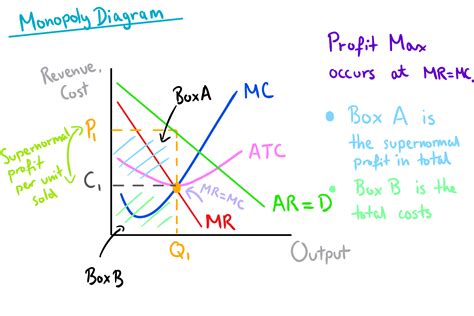

Unlike firms in perfectly competitive markets that are price takers, monopolies are price makers. This means they can choose the price at which they sell their product, subject to the market demand curve. The key to understanding their profit-making lies in the relationship between marginal cost (MC) and marginal revenue (MR).

A monopolist maximizes its profit by producing at the quantity where marginal revenue equals marginal cost (MR = MC). However, unlike perfect competition, the monopolist's marginal revenue is always less than the price (P). This is because to sell more units, the monopolist must lower the price on all units sold, not just the additional units. Therefore, the price charged by the monopolist will be higher than its marginal cost. This difference between price and marginal cost constitutes the monopolist's profit margin.

By restricting output and charging a higher price, the monopolist creates a deadweight loss – a reduction in overall economic efficiency. This is because some mutually beneficial transactions do not occur due to the high price.

3. Profit Maximization: The Monopolist's Goal

The monopolist's primary goal is profit maximization. They analyze the market demand to determine the price and quantity that will generate the highest possible profit. This involves carefully considering the trade-off between higher prices (generating greater profit per unit) and lower quantity sold (reducing total revenue). They use various techniques, including price discrimination, to extract maximum profit from the market.

4. Price Discrimination: Extracting Maximum Consumer Surplus

Monopoly power allows firms to engage in price discrimination, charging different prices to different consumers for the same product or service. This is only feasible if the monopolist can segment the market and prevent arbitrage (consumers buying at a low price and reselling at a higher price).

There are three degrees of price discrimination:

- First-degree price discrimination (perfect price discrimination): The monopolist charges each consumer the maximum price they are willing to pay. This extracts all consumer surplus, maximizing the monopolist's profit. It's a theoretical ideal rarely achieved in practice.

- Second-degree price discrimination: The monopolist charges different prices based on the quantity consumed. Bulk discounts are a common example.

- Third-degree price discrimination: The monopolist divides the market into distinct segments (e.g., student discounts, senior citizen discounts) and charges different prices to each segment.

5. Lack of Competition: The Absence of Competitive Pressure

The absence of meaningful competition is crucial to a monopoly's ability to sustain positive profits. In competitive markets, firms are constantly pressured to reduce prices and improve efficiency to survive. The lack of this competitive pressure allows monopolies to operate with less urgency to innovate or improve their offerings. This can lead to x-inefficiency, where costs are higher than they would be in a competitive environment.

6. Innovation and R&D: A Double-Edged Sword

While monopolies often lack the pressure to innovate from competition, they may also invest in research and development (R&D) to improve their products or create new ones. The protection afforded by barriers to entry gives them the incentive to invest in long-term projects that may not be profitable for firms facing intense competition. However, the lack of competitive pressure can also lead to complacency and reduced innovation. The extent of R&D investment depends on the specific characteristics of the industry and the monopolist's management.

7. Regulation and Government Intervention: A Balancing Act

Governments often intervene in monopolies to mitigate the negative consequences of market power, such as high prices and reduced output. This intervention can take the form of antitrust laws aimed at breaking up monopolies, or regulations that control prices or limit profits. The optimal level of government intervention is a complex issue, balancing the potential benefits of monopoly innovation with the need to protect consumers from exploitation.

8. Long-Run Sustainability: The Threat of Erosion

While a monopoly can earn positive profits, this is not guaranteed indefinitely. Over time, technological advancements, changes in consumer preferences, or successful challenges to barriers to entry can erode the monopolist's market power. Even strong monopolies face the potential for disruption and the eventual erosion of their profit streams. Their sustained positive profits depend on their ability to adapt and maintain their dominant position.

Conclusion: A Complex Relationship

The ability of a monopoly to earn positive profits is a multifaceted issue influenced by barriers to entry, pricing power, profit maximization strategies, and the dynamics of competition and regulation. While the potential for substantial profits exists, it's crucial to acknowledge the negative consequences of monopoly power, such as reduced efficiency, innovation stagnation, and potential consumer exploitation. Understanding these aspects is vital for policymakers, businesses, and consumers alike. The sustainability of positive profits for a monopoly is not guaranteed, and the market constantly evolves, presenting both opportunities and threats to firms controlling a significant market share.

Latest Posts

Latest Posts

-

Aggregating Multiple Businesses For The Qbi Deduction Cannot Include

Mar 28, 2025

-

Consider The Market For Coal With Quantities In Tons

Mar 28, 2025

-

Which Of The Following Would Be Considered A Long Term Liability

Mar 28, 2025

-

The Belmont Principle Of Beneficence Requires That

Mar 28, 2025

-

Robin Would Like To Shoot An Orange

Mar 28, 2025

Related Post

Thank you for visiting our website which covers about A Monopoly Can Earn Positive Profits Because It . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.