Aggregating Multiple Businesses For The Qbi Deduction Cannot Include

Holbox

Mar 28, 2025 · 6 min read

Table of Contents

- Aggregating Multiple Businesses For The Qbi Deduction Cannot Include

- Table of Contents

- Aggregating Multiple Businesses for the QBI Deduction: What You Can't Include

- Understanding the QBI Deduction and Aggregation

- Key Exclusions from QBI Aggregation

- 1. Businesses with Different Ownership Structures

- 2. Businesses with Different Trade or Businesses Activities

- 3. Rental Real Estate Activities

- 4. Capital Gains and Losses from Investments

- 5. Interest Income and Dividend Income

- 6. Wages Paid to Non-Qualified Individuals

- 7. Businesses Operated Under Different Tax Years

- 8. Businesses Subject to Different Tax Rules

- Practical Examples of Ineligible Aggregations

- Consequences of Incorrect Aggregation

- Seeking Professional Guidance

- Latest Posts

- Latest Posts

- Related Post

Aggregating Multiple Businesses for the QBI Deduction: What You Can't Include

The Qualified Business Income (QBI) deduction, introduced under Section 199A of the Internal Revenue Code, offers significant tax savings to eligible taxpayers. However, understanding the rules surrounding aggregation—combining multiple businesses for the purposes of calculating the deduction—is crucial to avoid costly errors. This article delves into the intricacies of aggregating businesses for the QBI deduction, focusing specifically on what cannot be included in the aggregation process. Failure to correctly identify these exclusions can lead to an inaccurate QBI calculation and potential penalties.

Understanding the QBI Deduction and Aggregation

Before exploring the exclusions, let's briefly recap the QBI deduction and its connection to aggregation. The QBI deduction allows eligible self-employed individuals, partners, S corporation shareholders, and other qualified individuals to deduct up to 20% of their qualified business income (QBI). This QBI is generally the net amount of income, gains, deductions, and losses from a qualified trade or business (QTB).

The rules surrounding aggregation become pertinent when a taxpayer owns multiple businesses. The IRS allows for the aggregation of multiple businesses if they meet specific criteria, allowing for a single QBI calculation. This can simplify the tax process, particularly for individuals with diverse business interests. However, the ability to aggregate is not unlimited. The IRS clearly outlines what constitutes a single business, and what cannot be included within an aggregated calculation.

Key Exclusions from QBI Aggregation

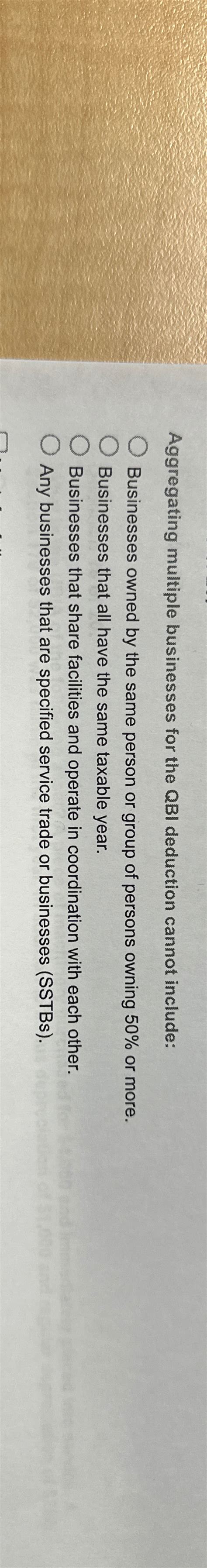

The IRS provides specific guidelines on what constitutes a separate trade or business, thus preventing the aggregation of entities that shouldn't be combined. Incorrect aggregation can result in penalties and tax underpayments. Here’s a breakdown of the key exclusions:

1. Businesses with Different Ownership Structures

One of the most fundamental exclusions from QBI aggregation involves differing ownership structures. You cannot aggregate businesses with different ownership arrangements. For example:

- Sole Proprietorship and Partnership: A taxpayer operating a sole proprietorship and a partnership cannot aggregate these businesses for QBI purposes. Each must be calculated separately.

- S Corporation and LLC: Similarly, an S corporation and an LLC, even if owned entirely by the same individual, cannot be aggregated for the QBI deduction. Each legal entity maintains its distinct identity for tax purposes.

- Multiple LLCs with Different Members: If multiple LLCs are structured as partnerships, they cannot be aggregated even if managed by the same individual or group of individuals. Different membership will render them separate entities for QBI calculation.

2. Businesses with Different Trade or Businesses Activities

Aggregation is not permissible if the businesses represent materially different trades or businesses. The IRS uses a holistic test to determine this, considering factors such as:

- Products or Services: A business selling handcrafted jewelry and another offering accounting services are considered materially different. They involve different skills, resources, and market segments.

- Customer Base: If the businesses cater to completely different customer bases, this might also indicate distinct trade or businesses. A business providing services to corporations versus a business serving individual customers is unlikely to qualify for aggregation.

- Operational Processes: Distinct operational processes and procedures further suggest separate trades or businesses. A manufacturing business is different from a retail business, even if they sell related products.

- Capital Investments: Significantly different capital investments suggest separate entities. A business requiring specialized equipment versus a business with minimal capital investment points towards separate trades or businesses.

3. Rental Real Estate Activities

Rental real estate activities are specifically excluded from aggregation with other trades or businesses. This applies regardless of the ownership structure or level of management involvement. Rental income from real estate will always be treated as a separate trade or business and cannot be combined with any other business for the QBI deduction.

4. Capital Gains and Losses from Investments

Capital gains and losses derived from investments are not considered QBI and are, therefore, not eligible for inclusion in the aggregation process. This includes income from stocks, bonds, mutual funds, and other investment vehicles. While such investment income is taxable, it's separate from income generated through active trade or business activities.

5. Interest Income and Dividend Income

Similar to capital gains and losses, interest and dividend income are unrelated to active business operations and are not included in the QBI calculation. These passive income streams must be considered separately from any QBI generated by a trade or business.

6. Wages Paid to Non-Qualified Individuals

While wages are usually a deductible business expense, in the context of aggregation for the QBI deduction, the nature of the employee is important. Wages paid to individuals who are not qualified for the QBI deduction, such as non-resident aliens in certain circumstances, can not be included in the aggregated calculation. This aspect can become complicated depending on the specifics of the employee’s tax status and residency.

7. Businesses Operated Under Different Tax Years

If businesses operate under different tax years, aggregation isn't allowed. The QBI calculation requires aligning the income and expenses over a consistent period, which is impossible when businesses operate on different tax years. This restriction is in place to maintain accurate and comparable data for the deduction.

8. Businesses Subject to Different Tax Rules

If one of the businesses falls under a unique tax regime or regulation, that might preclude aggregation with other businesses. Examples include certain industries subject to specific tax codes or regulations, which can impact the eligibility for the QBI deduction itself. It's crucial to consult with a tax professional to assess such situations.

Practical Examples of Ineligible Aggregations

Let's illustrate some practical examples of businesses that cannot be aggregated for the QBI deduction:

- Example 1: Sarah owns a bakery (sole proprietorship) and a separate clothing boutique (S corporation). These businesses cannot be aggregated due to the differing ownership structures.

- Example 2: John operates a landscaping business and an online stock trading account. The landscaping income is QBI, but the stock trading income is investment income and therefore excluded from aggregation.

- Example 3: Maria owns a small restaurant and several rental properties. While both generate income, the rental properties' income is specifically excluded from QBI aggregation. Each must be treated as a separate entity for tax purposes.

- Example 4: David owns two distinct businesses operating under different tax years (one operates on a calendar year, the other on a fiscal year). Due to the differing tax years, aggregation is not permitted.

Consequences of Incorrect Aggregation

Incorrectly aggregating businesses for the QBI deduction can have serious consequences:

- Underpayment of Taxes: An inaccurate QBI calculation due to improper aggregation will likely result in an underpayment of taxes, leading to penalties and interest charges.

- IRS Audits: The IRS scrutinizes QBI deductions closely. Incorrect aggregation significantly increases the risk of an audit, which can be time-consuming and costly.

- Amended Tax Returns: Correcting an incorrect QBI calculation necessitates filing an amended tax return, adding complexity and potentially delaying tax refunds.

Seeking Professional Guidance

The rules surrounding QBI aggregation are complex. Navigating these intricacies requires careful attention to detail and a thorough understanding of the IRS guidelines. If you operate multiple businesses, it is strongly recommended to seek professional tax advice from a qualified tax advisor or CPA. They can help you determine which businesses can be aggregated, accurately calculate your QBI, and ensure compliance with all relevant tax regulations. This proactive approach will help avoid potential penalties and ensure you maximize your tax savings under the QBI deduction. Remember, careful planning and professional guidance are crucial for effectively leveraging this valuable tax benefit.

Latest Posts

Latest Posts

-

A Companys Rites And Rituals Might Include

Apr 01, 2025

-

Drag The Labels To Steps And Products In Spermatogenesis

Apr 01, 2025

-

What Is The Voltage Across A Membrane Called

Apr 01, 2025

-

Fundamentals Of Anatomy And Physiology 11th Edition

Apr 01, 2025

-

We Represent Declarative Sentences In Sentential Logic Using

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Aggregating Multiple Businesses For The Qbi Deduction Cannot Include . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.