Which Of The Following Would Be Considered A Long-term Liability

Holbox

Mar 28, 2025 · 6 min read

Table of Contents

- Which Of The Following Would Be Considered A Long-term Liability

- Table of Contents

- Which of the Following Would Be Considered a Long-Term Liability? A Comprehensive Guide

- Defining Long-Term Liabilities

- Key Characteristics of Long-Term Liabilities

- Common Examples of Long-Term Liabilities

- 1. Long-Term Debt

- 2. Deferred Tax Liabilities

- 3. Pension Obligations

- 4. Post-Retirement Benefits Other Than Pensions (OPEB)

- 5. Long-Term Lease Obligations

- Distinguishing Long-Term Liabilities from Other Items

- Impact of Long-Term Liabilities on Financial Statements

- Importance of Proper Accounting for Long-Term Liabilities

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

Which of the Following Would Be Considered a Long-Term Liability? A Comprehensive Guide

Understanding long-term liabilities is crucial for businesses of all sizes. These are obligations that extend beyond one year, impacting financial planning, creditworthiness, and overall financial health. This comprehensive guide will delve into the specifics of long-term liabilities, exploring various examples and providing clear definitions to help you confidently identify them.

Defining Long-Term Liabilities

A long-term liability is a financial obligation a company expects to settle beyond its current operating cycle (typically, more than one year). These are not short-term debts payable within the next 12 months, but instead represent longer-term commitments. They are reported on the balance sheet, providing a snapshot of a company's financial obligations and their potential impact on future cash flows. Accurate identification and reporting of long-term liabilities are vital for investors, creditors, and regulatory compliance.

Key Characteristics of Long-Term Liabilities

Several key characteristics distinguish long-term liabilities from short-term ones:

-

Maturity Date: The most defining feature is the maturity date—the date the liability is due. Long-term liabilities have maturity dates exceeding one year.

-

Non-Current Obligation: They represent non-current obligations, meaning they won't be settled through the normal course of business within a year.

-

Impact on Cash Flow: These liabilities significantly affect future cash flows, as they require substantial outlays to meet repayment obligations.

-

Financial Reporting: They are reported separately from short-term liabilities on the balance sheet, providing a clear picture of a company's long-term financial structure.

Common Examples of Long-Term Liabilities

Numerous types of obligations qualify as long-term liabilities. Let's explore some of the most common:

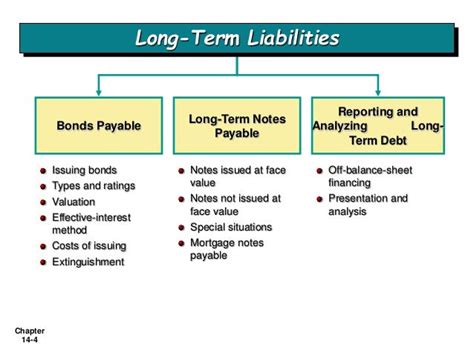

1. Long-Term Debt

This is perhaps the most recognizable type of long-term liability. It includes:

-

Bonds Payable: These are debt securities issued by companies to raise capital. Bondholders are creditors who lend money to the company in exchange for periodic interest payments and the eventual repayment of the principal. Bonds typically have maturity dates ranging from several years to decades.

-

Notes Payable: These are formal written promises to repay a debt, often issued to banks or other lending institutions. Like bonds, they usually have maturity dates exceeding one year.

-

Mortgages Payable: These are loans secured by real estate. The property serves as collateral for the loan, and the repayment schedule extends over several years.

-

Capital Leases: These are lease agreements where the lessee (the company renting the asset) essentially assumes ownership of the asset by the end of the lease term. The lease payments are treated as a long-term liability on the lessee's balance sheet.

2. Deferred Tax Liabilities

These arise when a company pays less in taxes to the government than it reports as income tax expense on its income statement. This difference typically occurs due to temporary differences in how income is recognized for tax purposes versus financial reporting purposes. The deferred tax liability represents the future tax payments the company anticipates making to reconcile this difference.

3. Pension Obligations

Companies with defined benefit pension plans have obligations to pay retirement benefits to their employees. These obligations are typically significant and extend far into the future, making them a substantial long-term liability. Actuarial calculations are used to estimate the present value of these future pension payments.

4. Post-Retirement Benefits Other Than Pensions (OPEB)

Similar to pension obligations, OPEB liabilities relate to healthcare and other post-retirement benefits provided to employees. These benefits also require significant future cash outflows and are considered long-term liabilities. The accounting for OPEB is complex and requires actuarial expertise.

5. Long-Term Lease Obligations

Long-term lease obligations, as discussed earlier, represent future lease payments for assets leased under operating leases (as opposed to capital leases). While the lease is for a period beyond one year, the payments are spread over several years and therefore must be reflected as a long-term liability.

Distinguishing Long-Term Liabilities from Other Items

It's crucial to understand the difference between long-term liabilities and other items on the balance sheet to avoid misclassification:

-

Equity: Equity represents ownership in the company, whereas liabilities represent obligations. They are fundamentally different and should not be confused.

-

Short-Term Liabilities: These are obligations due within one year, such as accounts payable, salaries payable, and short-term loans. These are distinct from long-term liabilities due to their shorter maturity.

-

Contingent Liabilities: These are potential obligations that may or may not occur depending on future events. While they are disclosed in the notes to the financial statements, they are not recorded as liabilities until the event making them certain occurs.

Impact of Long-Term Liabilities on Financial Statements

Long-term liabilities significantly influence a company's financial statements:

-

Balance Sheet: They appear as a major component of the liabilities section, providing insights into the company's overall financial structure and its ability to meet its long-term obligations.

-

Income Statement: Interest expense related to long-term debt is reported on the income statement, impacting net income. Furthermore, the amortization of certain long-term liabilities may also be reflected in the income statement.

-

Cash Flow Statement: Repayments of long-term debt and interest payments are recorded in the cash flow statement's financing activities section.

Importance of Proper Accounting for Long-Term Liabilities

Accurate accounting for long-term liabilities is vital for several reasons:

-

Financial Reporting: Compliance with accounting standards (like GAAP or IFRS) necessitates accurate recording and disclosure of these liabilities.

-

Creditworthiness: Creditors assess a company's creditworthiness based on its financial statements, including its long-term liabilities. A high level of long-term debt relative to equity can negatively affect credit ratings.

-

Investment Decisions: Investors use information about long-term liabilities to evaluate a company's financial risk and potential returns. Understanding a company's long-term debt obligations helps assess its ability to meet its commitments and generate profits.

-

Financial Planning: Proper accounting for long-term liabilities is essential for effective financial planning and forecasting. Accurate identification and analysis allow businesses to plan for future cash outflows and manage their debt burden effectively.

Conclusion

Understanding long-term liabilities is a fundamental aspect of financial literacy, especially for businesses. This comprehensive guide has highlighted the key characteristics, common examples, and the significance of these obligations in financial reporting and decision-making. By accurately identifying and managing long-term liabilities, companies can improve their financial health, attract investors, and ensure long-term sustainability. Remember that seeking professional advice from accountants or financial advisors is always recommended for complex financial matters. Properly accounting for these long-term commitments is crucial for maintaining financial stability and achieving sustainable growth.

Latest Posts

Latest Posts

-

A Batch Level Activity Will Vary With The

Apr 01, 2025

-

You Market Many Different Types Of Insurance

Apr 01, 2025

-

Posterosuperior Boundary Of The Oral Cavity

Apr 01, 2025

-

Which Is True Concerning A Variable Universal Life Policy

Apr 01, 2025

-

The Self Management Dimension Of Emotional Intelligence Is Described As

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Would Be Considered A Long-term Liability . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.