A Monopolist Is Able To Maximize Its Profits By

Holbox

Mar 21, 2025 · 5 min read

Table of Contents

- A Monopolist Is Able To Maximize Its Profits By

- Table of Contents

- A Monopolist's Pursuit of Maximum Profit: Strategies and Limitations

- Understanding the Monopolist's Problem

- The Role of Marginal Revenue and Marginal Cost

- Strategies for Profit Maximization

- 1. Price Discrimination

- 2. Product Differentiation

- 3. Advertising and Branding

- 4. Control of Inputs

- 5. Lobbying and Rent-Seeking Behavior

- Limitations on Profit Maximization

- 1. Government Regulation

- 2. Potential Entry

- 3. Demand Elasticity

- 4. Cost Structures

- 5. Consumer Preferences and Technological Change

- Conclusion: A Balancing Act

- Latest Posts

- Latest Posts

- Related Post

A Monopolist's Pursuit of Maximum Profit: Strategies and Limitations

A monopolist, by definition, holds exclusive control over a market, facing no direct competition. This unique position allows them significant power in setting prices and quantities, but maximizing profit isn't simply a matter of charging exorbitant prices. Understanding the intricacies of demand elasticity, cost structures, and potential government regulation is crucial for a monopolist seeking to achieve maximum profitability. This article delves into the strategies a monopolist employs to maximize profit, exploring the economic principles involved and the inherent limitations they face.

Understanding the Monopolist's Problem

Unlike firms in perfectly competitive markets, which are price takers, a monopolist is a price maker. They have the power to influence the market price by adjusting the quantity supplied. However, this power isn't absolute. The monopolist must still consider the demand curve, which shows the relationship between price and quantity demanded. A higher price generally leads to lower demand, while a lower price attracts more buyers. The challenge lies in finding the optimal price-quantity combination that yields the highest possible profit.

The Role of Marginal Revenue and Marginal Cost

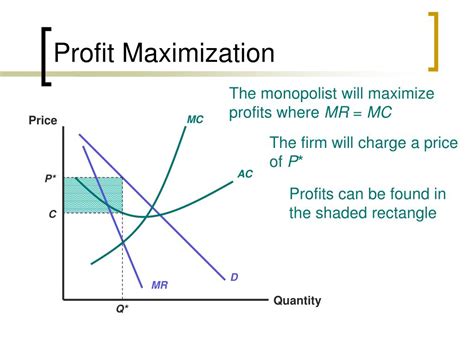

The key to profit maximization for any firm, including a monopolist, lies in understanding the concepts of marginal revenue (MR) and marginal cost (MC).

-

Marginal Revenue (MR): This represents the additional revenue generated by selling one more unit of output. For a monopolist, the MR curve lies below the demand curve because to sell more units, they must lower the price on all units sold, not just the additional one.

-

Marginal Cost (MC): This represents the additional cost of producing one more unit of output. This concept is similar across all market structures.

Profit maximization occurs where Marginal Revenue (MR) equals Marginal Cost (MC). This point represents the optimal output level where the additional revenue from selling one more unit exactly offsets the additional cost of producing it. Producing beyond this point would lead to diminishing returns, while producing less would leave potential profits unrealized.

Strategies for Profit Maximization

Several strategies contribute to a monopolist's ability to maximize profits:

1. Price Discrimination

This involves charging different prices to different groups of consumers based on their willingness to pay. There are three main degrees of price discrimination:

-

First-degree (perfect) price discrimination: The monopolist charges each consumer the maximum price they are willing to pay. This extracts all consumer surplus, maximizing the monopolist's profit. However, it is rarely achievable in practice due to the difficulty in perfectly assessing each consumer's willingness to pay.

-

Second-degree price discrimination: The monopolist charges different prices based on the quantity consumed. Examples include bulk discounts or tiered pricing plans. This strategy allows the monopolist to capture more consumer surplus from higher-volume consumers.

-

Third-degree price discrimination: The monopolist divides the market into distinct segments (e.g., students, seniors, adults) and charges different prices to each segment. This requires the ability to effectively segment the market and prevent arbitrage (consumers reselling products at a lower price).

2. Product Differentiation

Even though a monopolist has no direct competitors, they can still strive to improve their product offerings to maintain market dominance. This could involve creating new features, improving quality, or developing complementary goods and services. This strengthens their market position and increases consumer loyalty, allowing them to potentially charge higher prices.

3. Advertising and Branding

Effective marketing and branding are crucial for maintaining consumer demand and loyalty. A strong brand can create a perception of higher value, justifying a higher price point. Advertising helps to increase brand awareness and drive sales, contributing to overall profitability.

4. Control of Inputs

Monopolists often seek to control key inputs in the production process to limit competition. This can involve vertical integration, where the monopolist owns or controls suppliers, or strategic partnerships to secure vital resources. This strengthens their market control and reduces production costs.

5. Lobbying and Rent-Seeking Behavior

Monopolists might engage in lobbying efforts to influence government regulations and policies in their favor. This could involve seeking protection from new entrants through regulations or advocating for policies that benefit their industry. This is often referred to as rent-seeking behavior, where resources are expended to gain economic rents rather than create value.

Limitations on Profit Maximization

While monopolists have considerable power, several factors can limit their ability to maximize profits:

1. Government Regulation

Governments often intervene in monopolistic markets to protect consumers from exploitative pricing practices. This can include price controls, antitrust laws, and the promotion of competition. These regulations can significantly constrain a monopolist's ability to charge high prices and maximize profits.

2. Potential Entry

Even with high barriers to entry, the threat of new entrants can limit a monopolist's power. Technological advancements or changes in market conditions could create opportunities for new competitors to emerge, challenging the monopolist's dominance and reducing their ability to maximize profits.

3. Demand Elasticity

The responsiveness of demand to price changes plays a crucial role. If demand is highly elastic (small price changes lead to large quantity changes), the monopolist must be cautious in raising prices. Conversely, if demand is inelastic (small price changes have little effect on quantity), the monopolist has more leeway to increase prices and profits.

4. Cost Structures

A monopolist's profit is also affected by its cost structure. High production costs can limit the potential for profit maximization, even with market power. Efficient production techniques and cost management are crucial for maximizing profits.

5. Consumer Preferences and Technological Change

Shifting consumer preferences and rapid technological change can impact a monopolist's market position. If consumers shift away from the monopolist's product or if a disruptive technology emerges, profits can be significantly affected.

Conclusion: A Balancing Act

Maximizing profit for a monopolist is a complex balancing act. While their market power offers opportunities to set prices and quantities, they must consider the constraints imposed by demand elasticity, cost structures, potential competition, and government regulation. Effective strategies, such as price discrimination, product differentiation, and strong branding, can help a monopolist achieve higher profits. However, understanding the limitations and adapting to evolving market conditions are crucial for long-term success. The monopolist’s ultimate goal isn’t simply to charge the highest possible price, but rather to find the optimal price-quantity combination that maximizes their long-term profitability, considering all the internal and external factors at play. Ignoring any of these aspects can lead to missed opportunities or even the erosion of market share and eventual decline.

Latest Posts

Latest Posts

-

Eurail And Swiss Rail Are Hypothetical Railways

Mar 29, 2025

-

According To Federal Regulations The Expedited Review Process

Mar 29, 2025

-

Which Of The Following Is True About Database Rows

Mar 29, 2025

-

Steam Flows Steadily Through An Adiabatic Turbine

Mar 29, 2025

-

Which Statement Correctly Describes The Initiative Versus Guilt Stage

Mar 29, 2025

Related Post

Thank you for visiting our website which covers about A Monopolist Is Able To Maximize Its Profits By . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.