A Job Cost Sheet Contains Blank______ The Job.

Holbox

Mar 18, 2025 · 7 min read

Table of Contents

A Job Cost Sheet Contains Blank __: Mastering Job Costing for Profitability

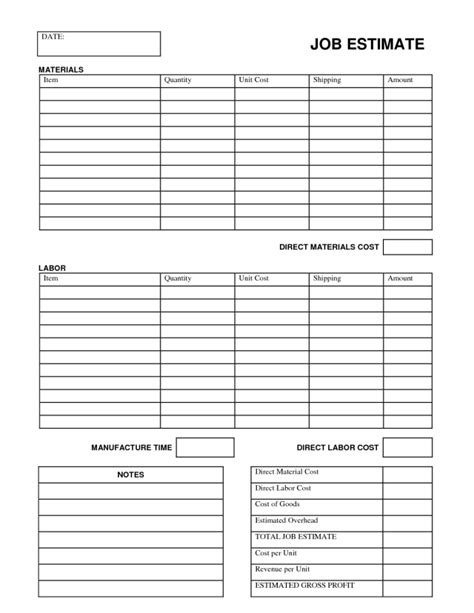

A job cost sheet is the bedrock of accurate project costing. It's a crucial document that meticulously tracks all expenses associated with a specific job, from the initial planning phase to final completion. The blank spaces on a job cost sheet are intentionally left open to allow for the detailed recording of every cost element related to the project. Understanding what information belongs in those blanks is essential for businesses to accurately price projects, control costs, and ultimately, maximize profitability. This comprehensive guide will delve into the key components of a job cost sheet, explain what information fills those blanks, and demonstrate how effective job costing can significantly improve your business's bottom line.

Understanding the Purpose of a Job Cost Sheet

Before jumping into the specifics of what fills those blanks, let's understand the overarching purpose of a job cost sheet. It serves as a centralized repository for all direct and indirect costs associated with a particular project. This detailed record allows businesses to:

- Accurately Determine Project Profitability: By meticulously tracking all expenses, businesses can calculate the actual profit (or loss) on each job, revealing areas for improvement and future pricing strategies.

- Improve Cost Control and Budgeting: Analyzing job cost sheets helps identify inefficiencies and potential cost overruns, enabling proactive measures to improve future project management and resource allocation.

- Make Informed Pricing Decisions: Historical cost data from previous job cost sheets informs realistic pricing for new projects, minimizing the risk of underbidding or overcharging.

- Enhance Project Management: Real-time tracking of costs allows project managers to monitor progress, identify potential delays, and make informed decisions regarding resource allocation.

- Simplify Financial Reporting: Consolidated data from job cost sheets simplifies the preparation of financial statements, providing clear insights into business performance.

The Essential Components of a Job Cost Sheet: Filling the Blanks

A typical job cost sheet is designed with specific sections to capture all relevant cost information. While the exact format might vary depending on the industry and the specific software used, the following elements are consistently found:

1. Job Identification & Details

- Job Number: A unique identifier for each job, crucial for tracking and organization. This is one of the most important blanks to fill.

- Client Name: Clearly identifies the customer for whom the work is being performed.

- Job Description: A concise summary of the work being undertaken. This blank needs a thorough description to avoid ambiguity.

- Project Start and Completion Dates: Essential for tracking project timelines and duration.

- Project Manager: Identifies the individual responsible for overseeing the project.

2. Direct Costs: The Core Expenses

Direct costs are expenses that can be directly attributed to a specific job. These are often the largest part of the cost and include:

- Direct Materials: The cost of all raw materials, components, and supplies used directly in the project. This blank requires detailed itemization – quantity, unit cost, and total cost for each item. For example, if you're building a house, this would include lumber, cement, bricks, etc.

- Direct Labor: The wages, salaries, and benefits paid to employees who directly work on the job. This blank should specify the employee's name, hours worked, hourly rate, and total labor cost. Overtime costs should be separately identified.

- Subcontractor Costs: If subcontractors are involved, their costs are categorized as direct costs. This blank should include the subcontractor's name, the work performed, and the total cost incurred.

3. Indirect Costs: The Often-Overlooked Expenses

Indirect costs are expenses that are not directly attributable to a specific job but are necessary for the overall operation of the business. These are often overlooked but significantly impact profitability. Accurate accounting for these costs is crucial.

- Overhead Costs: These include general administrative expenses, rent, utilities, insurance, and depreciation of equipment. These costs are allocated to each job based on a predetermined method, such as a percentage of direct labor costs or a predetermined overhead rate. This is a key area where the blank spaces on the job cost sheet play a crucial role. It's not simply a matter of entering a single number; a breakdown of the different overhead components allocated to the job will provide deeper insights.

- Equipment Rental Costs: If specialized equipment is rented for the job, the rental costs are added here. The blank should clearly indicate the equipment rented, the rental period, and the total rental cost.

- Travel Expenses: Travel expenses incurred by employees while working on the project, including mileage, airfare, and accommodation, are recorded here. A detailed breakdown of each travel expense is essential.

- Permits and Licenses: Costs associated with obtaining necessary permits and licenses for the project are included. This blank should specify the type of permit, issuing authority, and total cost.

4. Profit & Loss Calculation: The Bottom Line

This section summarizes all costs and calculates the project's profitability.

- Total Direct Costs: The sum of all direct material, direct labor, and subcontractor costs.

- Total Indirect Costs: The sum of all allocated indirect costs.

- Total Costs: The sum of total direct and indirect costs.

- Revenue: The total amount billed to the client for the completed job.

- Gross Profit: The difference between revenue and total costs (Revenue – Total Costs).

- Net Profit: Gross profit minus any additional expenses not included in direct or indirect costs.

Best Practices for Accurate Job Costing

Accurate job costing is critical for long-term success. Here are some best practices:

- Establish a Clear and Consistent Costing System: Develop a standardized job cost sheet and ensure all employees understand how to use it accurately.

- Implement a Robust Time Tracking System: Accurate time tracking is essential for calculating direct labor costs. Consider using time tracking software or apps to streamline this process.

- Regularly Review and Update Cost Data: Periodically review your cost data to identify areas for improvement and adjust your pricing strategies accordingly.

- Utilize Job Costing Software: Software solutions can automate many aspects of job costing, reducing manual effort and improving accuracy.

- Conduct Regular Reconciliation: Compare the actual costs with the budgeted costs to identify discrepancies and take corrective actions.

The Importance of Detail: Why Those Blanks Matter

The blanks on a job cost sheet are not mere placeholders; they are crucial for capturing the granular detail necessary for accurate cost analysis. Failing to fill these blanks thoroughly can lead to inaccurate cost estimations, flawed pricing decisions, and ultimately, reduced profitability. The seemingly small details, such as specifying the exact type of material used or detailing individual travel expenses, contribute significantly to the overall accuracy of the job cost sheet.

Ignoring these details can create a cascading effect, leading to miscalculations that snowball into significant financial losses over time. Imagine, for example, overlooking the cost of a specialized tool rented for a short period – that seemingly minor expense can drastically skew the overall cost analysis if not accurately captured. The same applies to accurate time tracking; discrepancies in labor hours can have a major impact on the project's profitability.

Therefore, the emphasis on detail is paramount. The blanks on a job cost sheet are designed not just for numerical data entry, but for a complete, auditable record of every expenditure involved in the project. This level of detail ensures that any financial discrepancy can be traced back to its source, enabling businesses to make data-driven decisions and refine their operational efficiencies.

Conclusion: Job Costing as a Strategic Tool

A job cost sheet, with its numerous blanks meticulously filled with accurate data, is more than just a record-keeping document; it’s a strategic tool for maximizing profitability. By understanding the significance of each component and adhering to best practices, businesses can gain valuable insights into their operational costs, improve pricing strategies, and make informed decisions that lead to sustainable growth. The seemingly simple act of diligently filling those blanks is, in essence, an investment in the future financial health of your business. Investing time and effort in accurate and thorough job costing is a cornerstone of sound financial management and a key differentiator for businesses aiming for long-term success.

Latest Posts

Latest Posts

-

Draw The Product Of The Reaction Shown Below

Mar 18, 2025

-

Use Retrosynthetic Analysis To Suggest A Way

Mar 18, 2025

-

Notch Is A Receptor Protein Displayed On The Surface

Mar 18, 2025

-

Which Of The Following Applies To The Electron

Mar 18, 2025

-

Electrolytes In Body Fluids Report Sheet

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about A Job Cost Sheet Contains Blank______ The Job. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.