A Comparison Of Bookkeeping And Accounting Indicates That

Holbox

Mar 16, 2025 · 6 min read

Table of Contents

A Comparison of Bookkeeping and Accounting Indicates That... They're Distinct Yet Interdependent

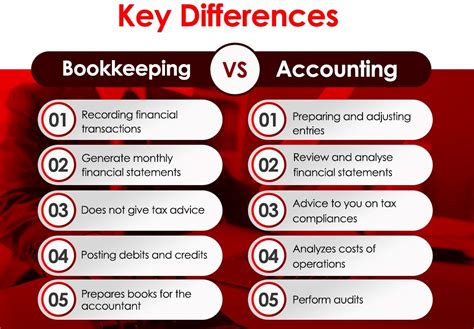

The terms "bookkeeping" and "accounting" are often used interchangeably, leading to confusion. While closely related, they represent distinct yet interdependent processes within a business's financial management system. A thorough comparison reveals their unique functions, skill sets required, and overall contribution to a company's financial health. Understanding these differences is crucial for both business owners and aspiring professionals in the finance field. This article delves deep into the nuances of bookkeeping and accounting, highlighting their similarities and differences, and ultimately demonstrating their symbiotic relationship.

Bookkeeping: The Foundation of Financial Records

Bookkeeping forms the bedrock of a company's financial record-keeping. It's a meticulous, detail-oriented process focused on the systematic recording of all financial transactions. Think of it as the raw data collection phase. Bookkeepers meticulously document every financial event, ensuring accuracy and consistency.

Key Functions of a Bookkeeper:

- Recording Transactions: This is the core function. Every sale, purchase, expense, and receipt is diligently recorded in a systematic manner, usually through software or a journal. This includes documenting dates, descriptions, and relevant account codes.

- Data Entry: Bookkeepers are responsible for entering this data into the chosen accounting system. This requires accuracy and attention to detail to avoid errors that can cascade throughout the financial reports.

- Maintaining Financial Records: Beyond simply recording, bookkeepers organize and maintain these records, ensuring they're readily accessible for auditing or reporting purposes. This includes filing documents and generating basic reports.

- Bank Reconciliation: Regularly comparing bank statements to the company's internal records to identify any discrepancies is a key bookkeeping task. This helps to identify potential errors and ensures financial accuracy.

- Generating Basic Reports: While not performing in-depth financial analysis, bookkeepers may generate simple reports like income statements or balance sheets, providing a snapshot of the company's financial standing.

Skills Required for Bookkeeping:

- Accuracy and Attention to Detail: This is paramount. Even minor errors can have significant consequences.

- Organizational Skills: Managing a large volume of financial data requires strong organizational skills to maintain order and efficiency.

- Proficiency in Accounting Software: Most bookkeeping is done using accounting software like QuickBooks, Xero, or FreshBooks. Familiarity with at least one of these is essential.

- Basic Accounting Knowledge: While not as extensive as an accountant's knowledge, a fundamental understanding of accounting principles is necessary.

- Data Entry Skills: Efficient and accurate data entry is crucial for timely and reliable reporting.

Accounting: Interpreting and Analyzing Financial Data

Accounting builds upon the foundation laid by bookkeeping. It goes beyond simple record-keeping to interpret, analyze, and utilize financial data for strategic decision-making. Accountants provide insights that help businesses make informed financial choices.

Key Functions of an Accountant:

- Financial Reporting: Accountants prepare comprehensive financial statements, including income statements, balance sheets, and cash flow statements, adhering to generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS).

- Financial Statement Analysis: They analyze these statements to identify trends, assess financial performance, and evaluate the financial health of the business. This involves using ratios, trend analysis, and other techniques.

- Tax Preparation and Planning: This involves preparing and filing tax returns, as well as developing strategies to minimize tax liabilities within legal frameworks. This can be quite complex, requiring a deep understanding of tax laws.

- Auditing: Accountants may conduct audits, both internal and external, to verify the accuracy and reliability of a company's financial records.

- Budgeting and Forecasting: They develop budgets and forecasts to project future financial performance and guide resource allocation.

- Cost Accounting: Analyzing the costs associated with different aspects of the business to identify areas for improvement and cost optimization.

- Management Accounting: Providing financial information to managers to aid in decision-making within the business, such as pricing strategies or investment decisions.

Skills Required for Accounting:

- Advanced Accounting Knowledge: A thorough understanding of accounting principles, financial statements, and financial analysis techniques is essential.

- Analytical Skills: The ability to analyze financial data and draw meaningful conclusions is crucial.

- Problem-Solving Skills: Identifying and resolving financial issues requires strong problem-solving abilities.

- Communication Skills: Accountants need to clearly communicate complex financial information to both management and external stakeholders.

- Tax Law Knowledge: A strong understanding of tax laws and regulations is often required, especially for tax accountants.

- Software Proficiency: While accounting software is important, accountants often use advanced spreadsheet software (Excel) and specialized financial analysis tools.

The Interdependence of Bookkeeping and Accounting: A Symbiotic Relationship

While distinct, bookkeeping and accounting are inextricably linked. Accounting relies heavily on the accurate and complete data provided by bookkeeping. Without accurate bookkeeping, accounting becomes unreliable and potentially misleading.

Think of it this way: Bookkeeping provides the raw ingredients (the data), while accounting is the chef who transforms those ingredients into a delicious and informative meal (financial insights). The quality of the meal depends entirely on the quality of the ingredients.

Here's how they work together:

-

Data Flow: Bookkeeping provides the raw transaction data that feeds into the accounting process. Accurate and timely data entry ensures the reliability of accounting reports.

-

Financial Reporting: Bookkeeping provides the foundational data used to generate financial statements. Accountants then use these statements to conduct their analysis and provide valuable insights.

-

Auditing: Accurate bookkeeping records are essential for efficient and reliable audits. Without detailed and well-maintained records, auditing becomes a significantly more challenging and time-consuming process.

-

Tax Compliance: Accurate bookkeeping data is crucial for preparing tax returns. Incomplete or inaccurate data can lead to penalties and legal issues.

-

Financial Decision-Making: The accurate insights provided by accounting, based on the thorough records kept by bookkeepers, help businesses make informed decisions about investments, pricing, expansion, and other crucial aspects.

Choosing Between Bookkeeping and Accounting as a Career Path

The choice between pursuing a career in bookkeeping or accounting depends on your skills, interests, and career goals.

Bookkeeping: If you enjoy meticulous detail-oriented work, are comfortable with data entry, and prefer a more structured and routine job, bookkeeping might be a good fit. It's often an excellent entry point into the accounting field.

Accounting: If you possess strong analytical skills, enjoy problem-solving, and aspire to a more strategic role in financial management, accounting is a rewarding path. It typically requires further education and certification.

Beyond the Basics: Emerging Trends and Technologies

Both bookkeeping and accounting are rapidly evolving, embracing technological advancements to enhance efficiency and accuracy. Cloud-based accounting software, automation tools, and artificial intelligence are transforming the way financial data is managed and analyzed. These changes demand that professionals continuously upskill and adapt to remain relevant in the industry.

Conclusion: Two Sides of the Same Coin

The comparison of bookkeeping and accounting reveals a clear picture: while distinct in their functions and required skill sets, they are intrinsically linked and mutually dependent. Bookkeeping lays the groundwork for accurate and reliable financial information, while accounting interprets and leverages this data to provide valuable insights for strategic decision-making. Understanding this interdependence is crucial for businesses seeking to optimize their financial management processes and for individuals navigating career paths within the field of finance. The future of both fields hinges on embracing technological advancements and developing the necessary skills to thrive in a dynamic and evolving landscape.

Latest Posts

Latest Posts

-

Prepaid Accounts Also Called Prepaid Expenses Are

Mar 16, 2025

-

Fermentation In Yeast Can Occur Without

Mar 16, 2025

-

What Is Hootsuite Inbox Is Used For Pick Three

Mar 16, 2025

-

Which Distribution Channel Drives Results Fastest

Mar 16, 2025

-

A Constraint In A Decision Is A Restriction Placed On

Mar 16, 2025

Related Post

Thank you for visiting our website which covers about A Comparison Of Bookkeeping And Accounting Indicates That . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.