A Bank Reconciliation Should Be Prepared Periodically Because

Holbox

Mar 15, 2025 · 5 min read

Table of Contents

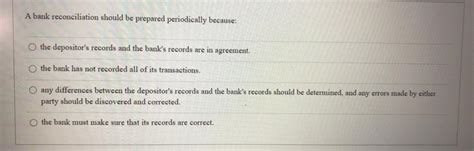

A Bank Reconciliation Should Be Prepared Periodically Because…

Bank reconciliations are a crucial part of any sound financial management system. They aren't just a tedious bookkeeping task; they're a vital control mechanism that safeguards your business's financial health. Preparing a bank reconciliation periodically is not merely a best practice; it's a necessity for maintaining accurate financial records and detecting potential problems early. This article will delve into the reasons why regular bank reconciliations are indispensable, exploring the benefits, the process, and the potential consequences of neglecting this important procedure.

Why Perform Bank Reconciliations Regularly?

The core reason behind the periodic preparation of bank reconciliations is simple: to ensure the accuracy of your financial records. Discrepancies between your internal accounting records and your bank statement can arise from various sources, and identifying these inconsistencies promptly is critical for maintaining the integrity of your financial data. Ignoring this process can lead to inaccurate financial reporting, impacting your business decisions and even attracting unwanted attention from regulatory bodies.

Here's a deeper look into the benefits:

1. Early Detection of Errors:

This is arguably the most significant benefit. Bank reconciliations help you identify errors in both your accounting records and your bank statement before they escalate into more substantial problems. These errors could include:

- Data entry mistakes: Simple typos or incorrect amounts entered into your accounting software.

- Timing differences: Transactions recorded in your books but not yet reflected in the bank statement (e.g., outstanding checks, deposits in transit).

- Bank errors: Mistakes made by the bank itself, such as incorrect charges or credits.

- Fraudulent activities: Reconciliations can uncover unauthorized transactions or other signs of fraud.

2. Improved Financial Accuracy:

By regularly comparing your books to your bank statement, you can ensure that your financial statements accurately reflect your financial position. This improved accuracy is fundamental for:

- Accurate financial reporting: This is vital for making informed business decisions, attracting investors, and satisfying regulatory requirements.

- Reliable financial analysis: Accurate financial data is essential for effective financial planning, budgeting, and forecasting.

- Enhanced credibility: Accurate financial records build trust with stakeholders, including investors, lenders, and government agencies.

3. Enhanced Internal Controls:

A regular bank reconciliation process strengthens your internal controls, making your business less susceptible to fraud and error. By establishing a system of checks and balances, you minimize the risk of unauthorized transactions or misappropriation of funds. This contributes to:

- Fraud prevention: Regularly reviewing your bank statements can help detect fraudulent activity early on.

- Improved accountability: A clear reconciliation process assigns responsibility for financial transactions, reducing the chances of errors going unnoticed.

- Strengthened security: A robust reconciliation process is a key element of a strong internal control system, protecting your business from financial losses.

4. Better Cash Management:

Knowing your exact cash balance at all times is crucial for effective cash management. Bank reconciliations provide a clear and accurate picture of your available funds, allowing you to:

- Optimize cash flow: Accurate cash flow information helps you make better decisions about investments, expenses, and debt management.

- Improve budgeting: Precise cash balance data improves the accuracy of your budget and forecasts.

- Avoid overdrafts: By knowing your true balance, you can avoid costly overdraft fees.

5. Regulatory Compliance:

Many industries are subject to stringent regulatory requirements regarding financial record-keeping. Regular bank reconciliations demonstrate compliance with these regulations, reducing the risk of penalties or legal action. This is particularly important for:

- Publicly traded companies: These companies face rigorous scrutiny and are required to maintain meticulous financial records.

- Banks and financial institutions: These institutions are subject to strict regulatory oversight and must demonstrate impeccable financial controls.

- Government agencies: Government entities are held to high standards of financial accountability and transparency.

The Bank Reconciliation Process: A Step-by-Step Guide

The process of preparing a bank reconciliation involves several key steps:

-

Gather necessary documents: You'll need your bank statement, your company's cash account ledger, and any supporting documents such as canceled checks, deposit slips, and credit card statements.

-

Compare the bank statement balance to the book balance: This is the starting point. Note any differences between the two balances.

-

Identify and classify outstanding checks: These are checks you've written but haven't yet cleared the bank. Subtract these from the bank statement balance.

-

Identify and classify deposits in transit: These are deposits you've made but haven't yet appeared on the bank statement. Add these to the bank statement balance.

-

Identify and classify bank errors: These could include incorrect charges or credits made by the bank. Adjust the bank statement balance accordingly.

-

Identify and classify book errors: These could include errors in recording transactions in your accounting software. Adjust the book balance accordingly.

-

Reconcile the adjusted bank balance and adjusted book balance: After making all the necessary adjustments, the adjusted bank balance and the adjusted book balance should match. If they don't, carefully review your work to identify any remaining errors.

-

Document the reconciliation: Prepare a formal bank reconciliation statement showing all adjustments and the final reconciled balance. This documentation is crucial for auditing purposes.

Consequences of Neglecting Bank Reconciliations

Failing to prepare bank reconciliations regularly can have serious consequences, including:

- Inaccurate financial reporting: Leading to flawed business decisions.

- Missed opportunities: Inability to identify trends and optimize cash flow.

- Increased risk of fraud: Unnoticed fraudulent activities can cause significant financial losses.

- Regulatory non-compliance: Resulting in penalties and legal action.

- Erosion of trust: Inaccurate financial records damage your credibility with stakeholders.

- Difficulty obtaining financing: Lenders are hesitant to work with companies that have poor financial record-keeping practices.

Frequency of Bank Reconciliations: Best Practices

While the exact frequency depends on factors such as business size and transaction volume, most businesses benefit from performing bank reconciliations at least monthly. Smaller businesses with fewer transactions might be able to reconcile less frequently, while larger businesses with high transaction volumes should consider reconciling more frequently – perhaps even weekly.

Conclusion: The Indispensable Role of Bank Reconciliations

Regular bank reconciliations are not merely a compliance requirement; they are a critical component of a robust financial management system. The benefits—from early error detection and fraud prevention to improved cash management and regulatory compliance—significantly outweigh the effort involved. By making bank reconciliation a regular part of your financial routine, you protect your business's financial health, ensuring accuracy, accountability, and peace of mind. Ignoring this fundamental process exposes your business to unnecessary risks and potential financial setbacks. Therefore, prioritize regular bank reconciliations to safeguard your financial future.

Latest Posts

Latest Posts

-

If A Company Recognizes Accrued Salary Expense

Mar 17, 2025

-

Utma Accounts Are Opened Under The Tax Id Of The

Mar 17, 2025

-

In Which Situations Can Simplifying Jobs Be Most Beneficial

Mar 17, 2025

-

For The Hr Planning Process How Should Goals Be Determined

Mar 17, 2025

-

How Does A Shortcut Link To Another File

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about A Bank Reconciliation Should Be Prepared Periodically Because . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.