Within The Relevant Range Of Activity Costs

Holbox

Mar 29, 2025 · 6 min read

Table of Contents

- Within The Relevant Range Of Activity Costs

- Table of Contents

- Understanding and Managing Activity Costs Within the Relevant Range

- What is the Relevant Range?

- Why is Understanding the Relevant Range Crucial?

- Identifying the Relevant Range for Different Costs

- Practical Strategies for Managing Activity Costs Within the Relevant Range

- Analyzing Cost Behavior Outside the Relevant Range

- The Impact of Technological Advancements

- Conclusion: The Importance of Continuous Monitoring

- Frequently Asked Questions (FAQs)

- Latest Posts

- Latest Posts

- Related Post

Understanding and Managing Activity Costs Within the Relevant Range

Activity-based costing (ABC) is a powerful tool for managing costs, but its effectiveness hinges on understanding and operating within the relevant range of activity. This crucial concept determines the accuracy and reliability of cost estimations and predictions. Stepping outside this range can lead to inaccurate cost allocations, flawed decision-making, and ultimately, financial difficulties. This article delves deep into the concept of the relevant range within activity costs, exploring its implications and providing practical strategies for effective cost management.

What is the Relevant Range?

The relevant range refers to the bandwidth of activity levels where the assumed cost behavior remains valid. Within this range, the relationship between the cost driver (e.g., machine hours, production volume) and the total cost remains relatively consistent and predictable. For example, if a company's relevant range for production is between 10,000 and 20,000 units, cost estimations based on activity within this range will be more accurate than those made outside of it. Outside the relevant range, the relationship between cost and activity can change significantly.

Why is Understanding the Relevant Range Crucial?

Understanding the relevant range is crucial for several reasons:

-

Accurate Cost Estimation: Within the relevant range, cost functions (like linear equations used in cost accounting) provide reliable estimations of costs. Outside this range, cost behavior might become non-linear, rendering these estimations inaccurate. For example, increasing production beyond the relevant range might necessitate purchasing new equipment, leading to a sudden jump in fixed costs and altering the overall cost structure.

-

Effective Decision-Making: Accurate cost information is fundamental for informed decision-making. Whether it's pricing strategies, make-or-buy decisions, or capacity planning, decisions based on cost estimations outside the relevant range are prone to errors.

-

Performance Evaluation: Cost variances and performance evaluations rely on accurate cost predictions. If the actual activity level falls outside the relevant range, the standard costs used for comparison become unreliable, making performance evaluation meaningless.

-

Budgeting and Forecasting: Budgets and forecasts rely heavily on cost estimations. Operating outside the relevant range introduces significant uncertainty and reduces the reliability of these crucial financial planning tools.

Identifying the Relevant Range for Different Costs

Identifying the relevant range requires careful analysis of historical data and a thorough understanding of the company's operations. The process varies slightly depending on the type of cost:

1. Variable Costs: The relevant range for variable costs is generally wider than for fixed costs. These costs fluctuate directly with the level of activity. However, even variable costs can exhibit non-linear behavior at extremely high or low activity levels. For example, bulk discounts on raw materials might kick in at very high production volumes, making the cost per unit lower than the initially projected linear relationship would suggest.

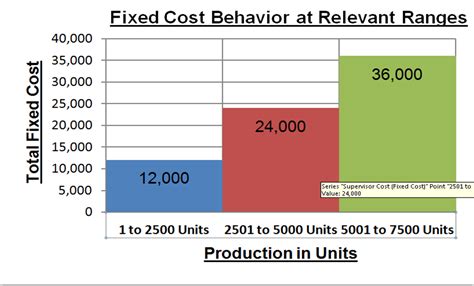

2. Fixed Costs: Fixed costs are more susceptible to changes outside the relevant range. These costs remain relatively constant within a specific activity level but can increase dramatically if the activity level surpasses the relevant range. For example, renting an additional factory space would be a significant jump in fixed costs if the production volume necessitates it.

3. Semi-Variable Costs: These costs comprise both fixed and variable elements. Identifying their relevant range requires separating the fixed and variable components and determining the relevant ranges for each separately.

Practical Strategies for Managing Activity Costs Within the Relevant Range

Several strategies can help businesses stay within the relevant range and effectively manage activity costs:

-

Capacity Planning: Accurate capacity planning is vital. It involves forecasting future demand and ensuring the company has the right resources (equipment, personnel, space) to meet that demand within the defined relevant range. Overestimating capacity can lead to unnecessary fixed costs, while underestimating it can result in bottlenecks and lost opportunities.

-

Production Smoothing: Techniques like production smoothing help maintain a consistent level of activity, minimizing fluctuations and preventing the company from operating outside the relevant range. This can involve techniques such as inventory management and adjusting production schedules based on forecasted demand.

-

Outsourcing: Outsourcing non-core activities can help manage costs and prevent the need to expand capacity beyond the relevant range. This can free up resources and prevent unnecessary investments in equipment or personnel.

-

Technology Adoption: Automating processes and implementing new technologies can enhance efficiency and reduce the overall activity level needed to produce the same output, potentially expanding the relevant range.

Analyzing Cost Behavior Outside the Relevant Range

While operating within the relevant range is ideal, situations might arise where the company must operate outside it. In such cases, a more sophisticated approach to cost analysis is necessary. This may involve:

-

Non-linear Cost Functions: Instead of relying on simple linear relationships, more complex cost functions should be developed to accurately capture the cost behavior outside the relevant range. This often involves using statistical methods to analyze historical data and identify the appropriate cost function.

-

Step-Cost Functions: These functions acknowledge that fixed costs can change in discrete steps as the activity level increases. For example, adding another machine to the production line represents a step increase in fixed costs.

-

Qualitative Factors: Purely quantitative analysis might be insufficient. Qualitative factors, like the impact on employee morale or product quality, should also be considered when operating outside the relevant range.

The Impact of Technological Advancements

Technological advancements play a significant role in shaping the relevant range. Automation, improved machinery, and advanced software can significantly increase the efficiency of operations, thereby extending the relevant range. For example, the introduction of a highly efficient machine might allow a company to produce a much larger volume of goods before reaching the upper limit of its relevant range.

Conclusion: The Importance of Continuous Monitoring

The relevant range isn't a static concept. It's dynamic and influenced by various factors, including technological advancements, changes in demand, and operational improvements. Continuous monitoring and regular review of the relevant range are essential for accurate cost estimations, effective decision-making, and optimal resource allocation. By diligently tracking activity levels, analyzing cost behavior, and adapting strategies as needed, companies can leverage the power of ABC costing and maintain a strong financial position.

Frequently Asked Questions (FAQs)

Q: How do I determine the relevant range for my business?

A: Analyzing historical data on cost and activity levels is crucial. Plot this data on a graph to identify the range where the cost behavior is relatively consistent and linear. Consider factors like capacity limitations, equipment capabilities, and organizational structure. Expert consultation from a management accountant can provide valuable insights.

Q: What happens if I operate outside the relevant range?

A: Cost estimations become less accurate, leading to flawed decisions regarding pricing, resource allocation, and capacity planning. Profitability can be negatively impacted, and the accuracy of performance evaluations diminishes.

Q: Can the relevant range change over time?

A: Yes, the relevant range is dynamic. Changes in technology, market demand, and company strategy can significantly alter the range. Regular review and adjustment are necessary.

Q: How does the relevant range relate to break-even analysis?

A: The relevant range is crucial for accurate break-even analysis. The break-even point, calculated using cost functions, is only valid within the relevant range. Outside this range, the break-even point calculation becomes unreliable.

Q: What are the consequences of ignoring the relevant range?

A: Ignoring the relevant range can lead to inaccurate budgeting and forecasting, inefficient resource allocation, and ultimately, poor financial performance. It can also lead to misinformed strategic decisions that hinder long-term growth.

This comprehensive exploration of the relevant range in activity-based costing highlights its critical role in effective cost management. By understanding and actively managing operations within this crucial range, businesses can enhance their financial performance, make well-informed decisions, and achieve sustainable growth.

Latest Posts

Latest Posts

-

Correctly Label The Posterior Muscles Of The Thigh

Apr 01, 2025

-

A Processing Department Is An Organization Unit

Apr 01, 2025

-

Which Phenomenon Is Reduced By Oil Immersion Microscopy

Apr 01, 2025

-

A Liability For Cash Dividends Is Recorded

Apr 01, 2025

-

You Can Recognize The Process Of Pinocytosis When

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Within The Relevant Range Of Activity Costs . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.