With Double Entry Accounting Each Transaction Requires

Holbox

Mar 17, 2025 · 6 min read

Table of Contents

With Double-Entry Accounting, Each Transaction Requires Two Entries: A Comprehensive Guide

Double-entry bookkeeping is the foundation of modern accounting. Unlike single-entry bookkeeping, which only records one side of a transaction (either a debit or a credit), double-entry bookkeeping demands that each transaction impacts at least two accounts. This seemingly simple rule is the cornerstone of a balanced and reliable financial record, ensuring that the accounting equation (Assets = Liabilities + Equity) always remains in balance. This comprehensive guide delves into the intricacies of this crucial accounting principle.

Understanding the Fundamental Accounting Equation

Before exploring the double-entry system, it's essential to grasp the accounting equation: Assets = Liabilities + Equity. This equation represents the fundamental relationship between a company's resources (assets), its obligations (liabilities), and the owners' stake (equity). Every transaction must maintain this balance. If one side of the equation increases, the other side must also increase by the same amount, or one side increases while the other side decreases in the same amount, to keep the equation in balance.

Assets: What a Business Owns

Assets are resources controlled by the business as a result of past events and from which future economic benefits are expected to flow to the entity. Examples include:

- Cash: Money in the bank and on hand.

- Accounts Receivable: Money owed to the business by customers.

- Inventory: Goods held for sale in the ordinary course of business.

- Equipment: Machinery, computers, and other tools used in operations.

- Buildings & Land: Property owned by the business.

Liabilities: What a Business Owes

Liabilities are present obligations of the business arising from past events, the settlement of which is expected to result in an outflow of resources embodying economic benefits. Examples include:

- Accounts Payable: Money owed to suppliers for goods or services.

- Loans Payable: Money borrowed from banks or other lenders.

- Salaries Payable: Wages owed to employees.

- Taxes Payable: Taxes owed to the government.

Equity: The Owners' Stake

Equity represents the residual interest in the assets of the entity after deducting all its liabilities. It reflects the owners' investment in the business, including:

- Owner's Capital: The initial investment made by the owner.

- Retained Earnings: Accumulated profits that have not been distributed to owners as dividends.

- Net Income/Loss: The difference between revenues and expenses during a specific period.

The Mechanics of Double-Entry Bookkeeping

The core principle of double-entry bookkeeping is that every transaction affects at least two accounts. One account will be debited, and at least one other account will be credited. The total debits must always equal the total credits for each transaction. This ensures that the accounting equation remains balanced.

Debits and Credits: The Heart of the System

- Debits (Dr.): Increases in assets, expenses, and dividend accounts are recorded as debits. Decreases in liabilities, equity (excluding owner contributions and net income), and revenue accounts are also recorded as debits.

- Credits (Cr.): Increases in liabilities, equity (excluding owner withdrawals and net loss), and revenue accounts are recorded as credits. Decreases in assets, expenses, and dividend accounts are also recorded as credits.

It’s helpful to remember the mnemonic device DEAD CLIC to help you remember which accounts increase with a debit and which increase with a credit.

- DEAD: Debits increase Expenses, Assets, and Dividends.

- CLIC: Credits increase Liabilities, Income, and Capital.

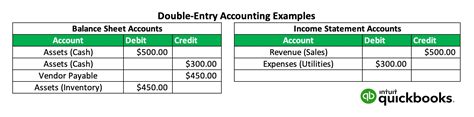

Illustrative Examples: Understanding Double-Entry in Action

Let's illustrate the double-entry system with several common business transactions:

1. Purchasing Equipment with Cash:

Imagine a business purchases equipment for $5,000 cash. This transaction involves two accounts:

- Debit: Equipment (Asset) increases by $5,000.

- Credit: Cash (Asset) decreases by $5,000.

The accounting equation remains balanced: the increase in one asset (Equipment) is offset by a decrease in another asset (Cash).

2. Providing Services and Receiving Cash:

A business provides services for $1,000 and receives cash immediately. This involves:

- Debit: Cash (Asset) increases by $1,000.

- Credit: Service Revenue (Revenue) increases by $1,000.

Here, an asset (Cash) increases, and equity (through increased revenue) also increases, maintaining the balance.

3. Purchasing Supplies on Credit:

A business purchases supplies worth $200 on credit. This transaction involves:

- Debit: Supplies (Asset) increases by $200.

- Credit: Accounts Payable (Liability) increases by $200.

An asset (Supplies) increases, and a liability (Accounts Payable) also increases, keeping the equation balanced.

4. Paying Salaries:

A business pays its employees $3,000 in salaries. This impacts:

- Debit: Salaries Expense (Expense) increases by $3,000.

- Credit: Cash (Asset) decreases by $3,000.

An expense (Salaries Expense) increases, reducing equity, and an asset (Cash) decreases, maintaining the equation's balance.

5. Receiving Payment from a Customer:

A customer pays $500 for services previously rendered on credit. This involves:

- Debit: Cash (Asset) increases by $500.

- Credit: Accounts Receivable (Asset) decreases by $500.

One asset (Cash) increases while another asset (Accounts Receivable) decreases, keeping the equation balanced.

The Importance of Accurate Double-Entry Bookkeeping

Accurate double-entry bookkeeping is crucial for several reasons:

- Financial Statement Accuracy: It ensures the reliable generation of accurate financial statements, including the balance sheet, income statement, and cash flow statement. These statements are vital for making informed business decisions and attracting investors.

- Error Detection: The double-entry system acts as a built-in error-checking mechanism. If debits and credits don't match, it indicates an error somewhere in the accounting process, prompting investigation and correction.

- Fraud Prevention: The inherent checks and balances of double-entry bookkeeping make it more difficult to conceal fraudulent activities.

- Improved Financial Management: Accurate accounting provides valuable insights into the financial health of the business, allowing for better budgeting, forecasting, and financial planning.

- Compliance and Auditing: Double-entry bookkeeping is a fundamental requirement for complying with accounting standards and satisfying the needs of auditors.

Advanced Concepts in Double-Entry Bookkeeping

While the basic principles are relatively straightforward, double-entry bookkeeping involves several advanced concepts:

- Adjusting Entries: These entries are made at the end of an accounting period to update accounts for items that haven't been recorded during the period (e.g., depreciation, accruals, prepayments).

- Closing Entries: These entries are made at the end of the accounting period to transfer the balances of temporary accounts (revenues, expenses, and dividends) to retained earnings.

- Consolidation: In a multi-company environment, consolidation combines the financial statements of different entities into a single set of statements.

- Foreign Currency Transactions: These require special considerations for recording transactions in different currencies.

- Inventory Valuation: Different methods exist (FIFO, LIFO, weighted-average cost) for valuing inventory, impacting the cost of goods sold and the value of ending inventory.

Conclusion: Mastering Double-Entry for Financial Success

Double-entry bookkeeping, despite its seemingly complex nature, is a powerful tool for managing and understanding a business's finances. By consistently applying the principles of debits and credits and ensuring that each transaction impacts at least two accounts, businesses can create reliable financial records that provide valuable insights and support informed decision-making. Mastering this fundamental accounting principle is essential for achieving financial success and ensuring long-term sustainability. The benefits far outweigh the initial learning curve, laying a robust foundation for financial clarity and growth. Continuous practice and a strong grasp of the underlying principles are key to becoming proficient in double-entry bookkeeping, enabling businesses to navigate the complexities of financial management with confidence.

Latest Posts

Latest Posts

-

In Which Situations Can Simplifying Jobs Be Most Beneficial

Mar 17, 2025

-

For The Hr Planning Process How Should Goals Be Determined

Mar 17, 2025

-

How Does A Shortcut Link To Another File

Mar 17, 2025

-

Cash Flows From Financing Activities Do Not Include

Mar 17, 2025

-

A Positive Return On Investment For Education Happens When

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about With Double Entry Accounting Each Transaction Requires . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.