Why Does Cmg Have A Higher Wacc Than Sbux

Holbox

Mar 19, 2025 · 5 min read

Table of Contents

Why Does CMG Have a Higher WACC Than SBUX? A Deep Dive into Weighted Average Cost of Capital

The Weighted Average Cost of Capital (WACC) is a crucial metric for evaluating a company's cost of financing. It represents the average rate a company expects to pay to finance its assets. A higher WACC generally indicates higher risk and a lower valuation. This article delves into the reasons why Chipotle Mexican Grill (CMG) consistently exhibits a higher WACC than Starbucks Corporation (SBUX), exploring factors related to their capital structure, risk profiles, and market perception.

Understanding WACC: A Recap

Before we compare CMG and SBUX, let's briefly review the WACC formula:

WACC = (E/V) * Re + (D/V) * Rd * (1 - Tc)

Where:

- E: Market value of equity

- D: Market value of debt

- V: Total value of the firm (E + D)

- Re: Cost of equity

- Rd: Cost of debt

- Tc: Corporate tax rate

A higher WACC can result from higher costs of equity and/or debt, or a higher proportion of equity financing (which is generally more expensive than debt).

CMG vs. SBUX: A Comparative Analysis

Chipotle and Starbucks, while both in the restaurant industry, operate under vastly different business models and face distinct challenges. This leads to significant differences in their WACC.

1. Cost of Equity (Re): The Risk Premium

The cost of equity reflects the return investors expect for taking on the risk of investing in a company's stock. Several factors influence the cost of equity:

-

Company-Specific Risk: CMG operates in a fast-casual segment known for its volatile nature. Food safety concerns, ingredient cost fluctuations, and competition can significantly impact profitability. Starbucks, while not immune to these issues, benefits from a more diversified portfolio including beverages, baked goods, and merchandise, offering a degree of operational resilience. This inherent higher operational risk for CMG translates into a higher cost of equity.

-

Growth Expectations: While both companies have experienced growth, investor sentiment towards CMG's future growth might be more volatile due to its dependence on a relatively narrow menu and a less established international presence compared to Starbucks. Higher growth expectations typically lead to a higher cost of equity. However, if this growth is not consistently met, the cost of equity may increase even further.

-

Market Sentiment & Beta: Beta, a measure of a stock's volatility relative to the overall market, plays a significant role in calculating the cost of equity using the Capital Asset Pricing Model (CAPM). A higher beta, reflecting greater volatility, leads to a higher cost of equity. CMG typically exhibits a higher beta than SBUX, indicating investors perceive a higher level of risk.

2. Cost of Debt (Rd): Financing Strategies

The cost of debt represents the interest rate a company pays on its borrowed capital.

-

Credit Ratings: A company's credit rating significantly influences its cost of debt. Companies with higher credit ratings (like AAA or AA) enjoy lower borrowing costs. While both CMG and SBUX maintain relatively strong credit ratings, any differences in their ratings, or perceived creditworthiness, could impact their respective costs of debt. Changes in macroeconomic conditions can also affect credit ratings, and thus, the cost of debt.

-

Debt Levels: The amount of debt a company carries relative to its equity (leverage) also influences its cost of debt. Higher leverage typically results in a higher cost of debt due to increased risk for lenders. A comparative analysis of the debt-to-equity ratios of CMG and SBUX would reveal insights into the influence of leverage on their WACC.

-

Debt Maturity: The maturity of debt influences the cost. Short-term debt typically carries a lower cost than long-term debt, as it involves less risk for lenders. An analysis of the debt maturity profiles of both companies could help explain differences in their cost of debt.

3. Capital Structure (E/V & D/V): The Weight of Financing

The weights of equity (E/V) and debt (D/V) in the WACC formula reflect the proportion of each financing source used by a company.

-

Financial Strategies: CMG and SBUX may have different financial strategies regarding their capital structures. CMG might historically have opted for a higher proportion of equity financing, potentially resulting in a higher WACC. Conversely, SBUX might have utilized a more balanced approach, or leveraged debt more efficiently, leading to a lower WACC.

-

Industry Norms: It's essential to consider industry norms for capital structure. The fast-casual restaurant industry might favor equity financing more than the broader beverage and food service industry. This industry-specific preference would further influence the weight of equity and debt in the WACC calculation for both companies.

4. Corporate Tax Rate (Tc): The Tax Shield

The corporate tax rate affects the after-tax cost of debt. Interest payments on debt are tax-deductible, reducing the effective cost of debt. Slight differences in the effective tax rates between CMG and SBUX could marginally contribute to differences in their WACC. However, this factor is typically less influential than the cost of equity and debt.

5. Market Conditions & Macroeconomic Factors

External factors, such as prevailing interest rates, market risk premiums, and overall economic conditions, influence the WACC of both companies. Periods of high interest rates or increased market volatility will generally lead to higher WACCs for both CMG and SBUX, but the impact might be disproportionately larger on CMG due to its higher inherent risk.

Conclusion: Unpacking the WACC Discrepancy

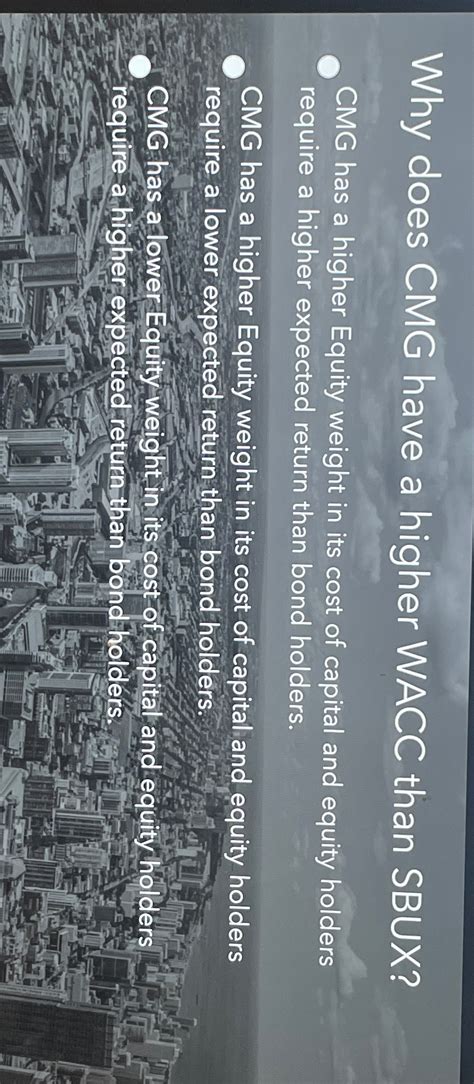

The higher WACC for CMG compared to SBUX is likely a multifaceted issue stemming from a combination of factors:

-

Higher Cost of Equity: CMG's higher operational risk, growth volatility, and higher beta contribute to a significantly higher cost of equity.

-

Capital Structure: While a detailed analysis of their financial statements is required, CMG might have historically relied more on equity financing, increasing the weight of equity in their WACC calculation.

-

Market Perception: Investors may perceive CMG as a riskier investment, demanding a higher return, consequently leading to a higher cost of equity.

To definitively determine why CMG's WACC is higher than SBUX's, a comprehensive financial analysis is necessary, including an in-depth examination of their financial statements, capital structures, and risk profiles. However, the factors discussed above provide a robust framework for understanding the likely contributors to this difference. Furthermore, regularly monitoring these factors and their evolution is crucial for investors and analysts to effectively assess and compare the financial health and risk profiles of these two prominent companies within the restaurant sector. The inherent differences in their business models, operational strategies, and market positioning significantly influence their respective cost of capital.

Latest Posts

Latest Posts

-

Which Of The Following Is A Current Asset

Mar 19, 2025

-

Important Characteristics Of Antimicrobic Drugs Include

Mar 19, 2025

-

All Amino Acids Have Two Ionizable Functional Groups

Mar 19, 2025

-

A Suggested Active Reading Strategy Is To

Mar 19, 2025

-

The Goal Of Any Marketing Communication Is To

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about Why Does Cmg Have A Higher Wacc Than Sbux . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.