Which One Of The Following Is An Agency Cost

Holbox

Mar 18, 2025 · 5 min read

Table of Contents

Which One of the Following is an Agency Cost? Deconstructing Corporate Governance

The question, "Which one of the following is an agency cost?" points to a fundamental concept in corporate finance: the agency problem. This problem arises when there's a separation of ownership and control within a company. Shareholders (the principals) delegate decision-making authority to managers (the agents), creating a potential conflict of interest. Agency costs are the expenses incurred to monitor and mitigate this conflict, ensuring that managers act in the best interests of the shareholders. Understanding agency costs is crucial for investors, managers, and anyone involved in corporate governance. This in-depth article will explore various aspects of agency costs, offering clear examples and practical applications.

Understanding the Agency Problem: A Foundation for Agency Costs

At the heart of agency costs lies the agency problem. This arises because managers, who control the day-to-day operations of the firm, may pursue their own self-interest rather than maximizing shareholder wealth. This self-interest could manifest in many ways, including:

- Excessive compensation: Managers may prioritize high salaries, bonuses, and perks over long-term profitability.

- Empire building: Managers might pursue mergers and acquisitions that increase the size of the company but don't necessarily enhance shareholder value.

- Shirking: Managers might not exert their best efforts, leading to suboptimal performance.

- Risk aversion: Managers may prefer less risky projects, even if higher-risk, higher-return opportunities exist. This is because their job security might be threatened by a failed high-risk venture.

- Personal Preferences: Managers might invest in projects that align with their personal interests, even if they are not financially beneficial to the company.

These actions erode shareholder value, leading to a need for mechanisms to control and minimize these agency costs. These mechanisms, which themselves cost money, become part of the agency cost framework.

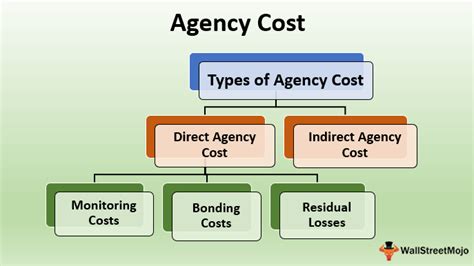

Types of Agency Costs: A Detailed Examination

Agency costs fall into two main categories:

1. Monitoring Costs: These are the expenses incurred by shareholders to monitor the actions of managers. Examples include:

- Auditing costs: The expense of hiring independent auditors to verify the accuracy of financial statements. This helps ensure transparency and prevents fraudulent activities.

- Board of directors fees: Paying directors to oversee management and provide oversight. Effective board members provide independent judgment, challenging management decisions and ensuring accountability.

- Analyst reports: The cost of obtaining and analyzing financial reports and industry analyses from independent sources to gain insights into company performance and management decisions. This helps shareholders form an independent assessment.

- Legal fees: Costs associated with legal action to address breaches of fiduciary duty or other mismanagement.

- Management Consulting Fees: Engaging external consultants to review management practices and strategy.

2. Bonding Costs: These are the expenses incurred by managers to assure shareholders that they will act in their best interests. Examples include:

- Performance-based compensation: Aligning management compensation with shareholder value creation through stock options, bonuses tied to performance metrics, and profit sharing schemes. This incentivizes managers to focus on maximizing shareholder returns.

- Restrictive covenants: Contracts that limit managerial actions, such as preventing managers from competing with the firm after leaving or engaging in insider trading. These aim to protect shareholder interests.

- Insurance: Management liability insurance helps protect managers from financial losses stemming from lawsuits related to mismanagement. Although this seemingly protects managers, it mitigates potential bonding costs by minimizing the risk of large financial repercussions which could lead to excessively cautious behaviour.

- Reputation costs: Managers who consistently demonstrate ethical and shareholder-focused behavior build a reputation that reduces the need for extensive monitoring and bonding. This is a subtle but significant factor.

- Debt financing: Employing debt financing can incentivize managers to perform well as they must meet the debt obligations. This helps mitigate shirking and inefficient decision-making.

Examples of Agency Costs in Action

Let's illustrate with practical scenarios:

-

Scenario 1: Excessive Executive Compensation: A company pays its CEO a multi-million dollar salary and bonus, significantly exceeding industry norms, even though the company's performance is mediocre. This is a direct agency cost, representing a transfer of wealth from shareholders to the manager.

-

Scenario 2: Failed Acquisition: A company undertakes a large acquisition that proves to be financially disastrous, wiping out significant shareholder value. The cost of the acquisition (including due diligence, legal fees, and integration costs) is an indirect agency cost, reflecting poor managerial decision-making.

-

Scenario 3: Lack of Transparency: A company refuses to provide detailed financial information to shareholders, making it difficult for them to monitor the management's actions. The cost of hiring external analysts or engaging in legal action to obtain information represents a monitoring cost.

-

Scenario 4: Stock Options Backfire: A company grants its executives stock options as an incentive. However, the executives manipulate financial reports to boost the stock price, leading to short-term gains and long-term losses for shareholders. The cost of the stock manipulation investigation and the subsequent drop in share price represent agency costs related to ineffective bonding mechanisms.

Mitigating Agency Costs: Strategies for Effective Corporate Governance

Several strategies can help mitigate agency costs:

-

Strong corporate governance: Establishing an independent board of directors, implementing effective audit committees, and fostering a culture of transparency and accountability.

-

Effective compensation plans: Designing compensation packages that align managerial incentives with shareholder interests. This often includes long-term performance-based incentives.

-

Active shareholder engagement: Encouraging shareholders to actively monitor management and participate in corporate decision-making.

-

Transparency and disclosure: Providing clear and timely financial information to shareholders.

-

Market for corporate control: The threat of hostile takeovers can discipline managers and encourage them to act in the best interests of shareholders.

The Importance of Identifying and Managing Agency Costs

Effective management of agency costs is crucial for long-term shareholder value creation. By understanding the various types of agency costs and implementing appropriate mitigation strategies, companies can create a more efficient and productive organizational structure, leading to improved financial performance and enhanced shareholder trust.

Conclusion: Navigating the Complexities of Agency Costs

The concept of agency costs is complex and multifaceted. Understanding the interplay between monitoring costs and bonding costs, and the various strategies to mitigate them, is essential for navigating the complexities of corporate governance. By prioritizing transparency, accountability, and alignment of interests, companies can reduce agency costs, unlock greater shareholder value, and build a strong foundation for long-term success. Ignoring agency costs can lead to significant financial losses, erosion of shareholder confidence, and ultimately, corporate failure. Therefore, a proactive and comprehensive approach to managing these costs is vital for any organization seeking sustainable growth and prosperity.

Latest Posts

Latest Posts

-

Which Point Would Be Located In Quadrant 3

Mar 18, 2025

-

Identify The Differential Equation Solved By

Mar 18, 2025

-

Radiolucent Lesion Apical To Tooth 30

Mar 18, 2025

-

A Legally Acceptable Id Has Which Characteristic

Mar 18, 2025

-

Ready To Eat Foods Are Defined As

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about Which One Of The Following Is An Agency Cost . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.