Which Of The Following Is Related To Market Values

Holbox

Mar 16, 2025 · 7 min read

Table of Contents

Decoding Market Values: A Deep Dive into Related Concepts

Understanding market values is crucial for anyone involved in finance, investing, or business. While the term itself seems straightforward, its implications are far-reaching and encompass a web of interconnected concepts. This article will explore various elements related to market values, examining their nuances and practical applications.

What are Market Values?

Before delving into related concepts, let's establish a solid foundation. Market value, in its simplest form, represents the price at which an asset would trade in a competitive, open market. This isn't simply a guess; it's a reflection of supply and demand dynamics, influenced by numerous factors. For instance, the market value of a publicly traded stock is the price at which it's currently being bought and sold on a stock exchange. Similarly, the market value of a house is the estimated price it would fetch if sold under normal market conditions. This implies a willing buyer and a willing seller, both acting without undue pressure.

The key characteristic differentiating market value from other valuation methods is its reliance on current market transactions. It's a forward-looking metric, constantly adjusting to reflect changing market sentiments, economic conditions, and investor expectations.

Factors Influencing Market Value:

Numerous interconnected elements contribute to an asset's market value. Understanding these factors is crucial for accurate valuation and informed decision-making. Let's explore some key influences:

1. Supply and Demand: The Fundamental Driver

The most fundamental principle governing market values is the interplay of supply and demand. High demand coupled with limited supply pushes prices upwards, increasing market value. Conversely, abundant supply and weak demand lead to lower prices and reduced market value. This dynamic applies to a broad range of assets, from commodities like gold to stocks and real estate.

2. Economic Conditions: The Macro Perspective

Broader economic trends significantly impact market values. Factors such as interest rates, inflation, economic growth, and unemployment rates influence investor sentiment and purchasing power. During periods of economic expansion, market values tend to rise, while economic downturns often result in decreased values.

3. Investor Sentiment: The Psychological Element

Market values are not solely determined by objective data; investor psychology plays a significant role. Fear, greed, speculation, and market confidence all influence trading activity and price fluctuations. Market sentiment can amplify or dampen the impact of other factors, leading to periods of irrational exuberance or panic selling.

4. Industry Trends and Technological Advancements: The Sectoral Influence

Specific industries and sectors experience cyclical trends and technological disruptions that impact their constituent companies' market values. Innovation, competition, and regulatory changes can all reshape market dynamics. For example, the rise of e-commerce significantly impacted the market values of traditional brick-and-mortar retailers.

5. Company Performance and Financial Health: The Micro Perspective (For Stocks)**

For publicly traded companies, their financial performance – including revenue growth, profitability, and debt levels – directly influences their market value. Strong earnings, innovative products, and efficient management generally lead to higher market valuations. Conversely, poor performance, financial instability, and scandals can severely depress market value.

6. Geopolitical Events: The Global Context

Global events, such as political instability, wars, and trade disputes, create uncertainty and volatility in financial markets. These events can significantly impact market values, depending on their severity and the extent of their impact on the global economy.

Concepts Closely Related to Market Value:

Several concepts are intrinsically linked to market values, offering complementary perspectives on asset valuation and investment analysis:

1. Intrinsic Value: The Underlying Worth

Intrinsic value represents the underlying worth of an asset, based on its fundamental characteristics and future potential. Unlike market value, which fluctuates with market sentiment, intrinsic value is a more stable estimate, reflecting the asset's long-term worth. Investors often seek assets trading below their intrinsic value, aiming to profit from the eventual convergence of market value and intrinsic value.

2. Book Value: The Accounting Perspective

Book value represents the net asset value of a company, based on its accounting records. It's the difference between a company's assets and liabilities. While book value offers a useful benchmark, it often differs significantly from market value, especially for growth companies with substantial intangible assets.

3. Fair Market Value: A Legal Definition

Fair market value is a legal term used to determine the value of an asset for tax purposes, estate settlements, or legal disputes. It's generally defined as the price an asset would fetch in an arm's-length transaction between a willing buyer and a willing seller, both acting under no compulsion. It often aligns closely with market value, but the legal context necessitates a more precise definition.

4. Market Capitalization: Total Market Value of a Company

Market capitalization represents the total market value of a publicly traded company. It's calculated by multiplying the company's outstanding shares by its current market price. Market capitalization is a widely used metric to assess a company's size and overall value within the stock market.

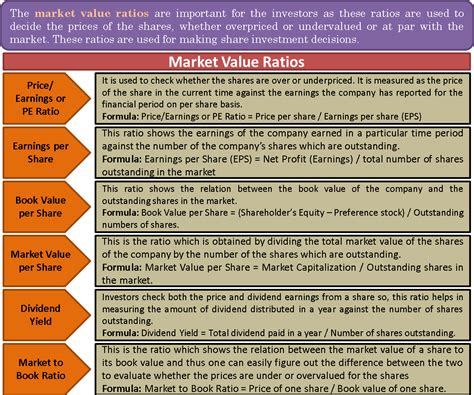

5. Price-to-Earnings Ratio (P/E Ratio): A Valuation Metric

The P/E ratio is a common valuation metric that compares a company's stock price to its earnings per share (EPS). It reflects the market's expectations for future earnings growth. A high P/E ratio suggests that investors anticipate strong future growth, while a low P/E ratio may indicate undervaluation or concerns about future performance. It helps investors evaluate whether a stock's current market price is justified by its earnings.

6. Dividend Yield: Return on Investment from Dividends

Dividend yield is the annual dividend payment per share, expressed as a percentage of the stock's market price. It offers insight into the return an investor can expect from dividends alone. High dividend yields can be attractive to income-seeking investors, but a high yield might also reflect concerns about the company's future growth prospects.

7. Price-to-Book Ratio (P/B Ratio): Comparing Market Value to Book Value

The P/B ratio compares a company's market value to its book value. A P/B ratio above 1 indicates that the market values the company's assets at a premium to their book value, suggesting strong growth prospects or intangible assets not reflected in the book value. A P/B ratio below 1 may suggest undervaluation, but could also indicate underlying financial challenges.

Practical Applications of Understanding Market Values:

Understanding market values is vital for various applications:

- Investment Decisions: Investors use market values to assess the attractiveness of different investment opportunities. They compare market values to intrinsic values, analyzing potential returns and risks.

- Financial Reporting: Companies use market values to report their assets and liabilities in financial statements. Market values offer a current assessment of the value of their assets.

- Mergers and Acquisitions: Market values play a pivotal role in determining the price in mergers and acquisitions. Acquiring companies assess the target company's market value to decide on a fair purchase price.

- Real Estate Transactions: Market values are essential for determining the price of real estate properties. Real estate appraisers use market data to estimate the fair market value of properties.

- Tax Assessments: Governments use market values to assess property taxes. This ensures that property taxes are based on a fair reflection of property values.

- Portfolio Management: Market values are crucial for tracking the performance of investment portfolios. Changes in market values directly affect portfolio valuations.

Conclusion:

Market value is a dynamic and multifaceted concept, deeply intertwined with a network of other valuation methods and market forces. Understanding these interconnected elements is essential for making informed investment decisions, conducting effective financial analysis, and navigating the complexities of the financial world. While market value provides a snapshot of an asset's current worth, it's crucial to remember that it's influenced by a range of factors and can be subject to significant fluctuations. By analyzing these factors and considering alternative valuation metrics, investors and business professionals can gain a more comprehensive understanding of an asset's true value and make better decisions. The constant evolution of market dynamics necessitates ongoing learning and adaptation to stay informed and effective in the ever-changing world of finance.

Latest Posts

Related Post

Thank you for visiting our website which covers about Which Of The Following Is Related To Market Values . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.