Which Of The Following Is Not An Advantage Of Budgeting

Holbox

Mar 28, 2025 · 6 min read

Table of Contents

- Which Of The Following Is Not An Advantage Of Budgeting

- Table of Contents

- Which of the Following is NOT an Advantage of Budgeting? Debunking the Myths Around Financial Planning

- Understanding the Core Advantages of Budgeting

- 1. Improved Financial Clarity and Control:

- 2. Goal Setting and Achievement:

- 3. Reduced Financial Stress and Anxiety:

- 4. Enhanced Savings Potential:

- 5. Debt Management and Reduction:

- 6. Informed Financial Decision-Making:

- The Potential Pitfalls: Where Budgeting Might Fall Short

- 1. Rigid Budgeting and Lack of Flexibility:

- 2. Time Commitment and Effort:

- 3. Psychological Impact: Restriction and Deprivation:

- 4. Inaccurate Forecasting and Unexpected Expenses:

- 5. Focus on Restriction Rather Than Opportunity:

- 6. Lack of Personalization and Adaptability:

- Conclusion: Budgeting - A Powerful Tool, Not a Guaranteed Solution

- Latest Posts

- Latest Posts

- Related Post

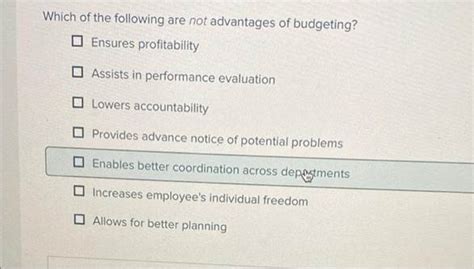

Which of the Following is NOT an Advantage of Budgeting? Debunking the Myths Around Financial Planning

Budgeting. The word itself can conjure up images of spreadsheets, restrictions, and a generally joyless existence. However, the truth is far removed from this negative perception. Effective budgeting is a powerful tool for achieving financial goals, from saving for a down payment on a house to securing a comfortable retirement. While the advantages are numerous and well-documented, it's crucial to address the misconception that budgeting is universally beneficial without caveat. Therefore, the question we'll explore in detail is: Which of the following is NOT an advantage of budgeting? We'll dissect common arguments surrounding budgeting and pinpoint the areas where it might fall short.

Understanding the Core Advantages of Budgeting

Before we delve into the potential drawbacks, let's establish a clear understanding of the significant benefits of budgeting. These include:

1. Improved Financial Clarity and Control:

A well-structured budget provides a clear picture of your income and expenses, revealing spending patterns you may not have noticed otherwise. This enhanced awareness empowers you to make informed financial decisions, leading to greater control over your finances. You can identify areas where you're overspending and strategically adjust your habits to align with your financial goals.

2. Goal Setting and Achievement:

Budgeting facilitates the process of setting and achieving both short-term and long-term financial goals. Whether it's saving for a vacation, paying off debt, or investing for retirement, a budget provides a roadmap and the necessary discipline to stay on track. By allocating funds specifically towards these goals, you increase the likelihood of their successful completion.

3. Reduced Financial Stress and Anxiety:

Knowing where your money is going and having a plan in place can significantly alleviate financial stress and anxiety. The feeling of being in control of your finances can have a profound impact on your overall well-being. Knowing you're on track to meet your financial obligations reduces the worry associated with unexpected expenses.

4. Enhanced Savings Potential:

By tracking your spending and identifying areas for reduction, budgeting creates opportunities to increase your savings. This extra money can then be allocated to investment opportunities, emergency funds, or paying down debt faster. The snowball effect of savings can lead to significant financial growth over time.

5. Debt Management and Reduction:

A budget is an invaluable tool for managing and reducing debt. By prioritizing debt repayment within your budget, you can strategically allocate funds to pay down high-interest debt more quickly, saving money on interest payments in the long run. This approach contributes to improved credit scores and overall financial health.

6. Informed Financial Decision-Making:

A budget empowers you to make more informed decisions regarding significant purchases. By analyzing your spending patterns and assessing the impact of a potential purchase on your overall budget, you can avoid impulsive buys and make responsible spending choices. This leads to better long-term financial stability.

The Potential Pitfalls: Where Budgeting Might Fall Short

While budgeting offers considerable advantages, it’s crucial to acknowledge its limitations. The assertion that budgeting is always an advantage is a misconception. The following represent areas where budgeting might not be entirely beneficial:

1. Rigid Budgeting and Lack of Flexibility:

This is a key area where budgeting can be detrimental. An overly rigid budget that doesn't account for unexpected expenses or life changes can lead to frustration and even financial setbacks. Life throws curveballs. Job loss, medical emergencies, or unexpected home repairs can derail even the most meticulously planned budget if it lacks flexibility. Sticking to a budget too rigidly, without allowing for occasional deviations, can be counterproductive and increase stress. A better approach is a flexible budgeting system that allows for adjustments based on unforeseen circumstances.

2. Time Commitment and Effort:

Creating and maintaining a budget requires time and effort. This can be a significant hurdle for individuals with busy schedules or limited financial literacy. While budgeting apps and software can streamline the process, it still necessitates consistent monitoring and updating. For some, the time investment might outweigh the perceived benefits, especially if they already feel overwhelmed with their daily commitments. This is particularly true for those lacking basic financial skills; the learning curve can be steep.

3. Psychological Impact: Restriction and Deprivation:

For some individuals, the restrictive nature of a budget can lead to feelings of deprivation and resentment. Constantly monitoring spending and limiting purchases can create negative psychological impacts, especially if the budget feels too austere or unrealistic. This can lead to a sense of unhappiness and ultimately undermine the long-term sustainability of the budget. It’s crucial to create a budget that aligns with your lifestyle and aspirations, rather than imposing unrealistic restrictions.

4. Inaccurate Forecasting and Unexpected Expenses:

Accurately forecasting income and expenses can be challenging. Unexpected expenses, such as car repairs or medical bills, can easily derail a budget if not properly accounted for. Life is unpredictable, and rigid adherence to a budget that doesn't factor in unforeseen circumstances can lead to financial stress and a sense of failure. Contingency planning and emergency funds are essential components of a robust financial strategy, which complements—but doesn't negate—the value of budgeting.

5. Focus on Restriction Rather Than Opportunity:

Some individuals view budgeting solely as a system of restriction, focusing solely on what they cannot spend, rather than viewing it as a tool to achieve their financial goals. This negative framing can create resistance and ultimately hinder the success of the budgeting process. A more positive approach focuses on the opportunities budgeting unlocks: saving for a dream vacation, investing in education, or achieving financial independence.

6. Lack of Personalization and Adaptability:

A "one-size-fits-all" approach to budgeting is ineffective. What works for one individual might not work for another. A successful budget must be personalized to reflect individual circumstances, financial goals, and spending habits. Failing to adapt the budget to changing needs and circumstances can lead to disillusionment and abandonment. A budget isn't a static document; it's a living, breathing tool that requires regular review and adjustments.

Conclusion: Budgeting - A Powerful Tool, Not a Guaranteed Solution

In conclusion, while budgeting offers significant advantages in achieving financial clarity, managing debt, and achieving financial goals, it's not a panacea. The assertion that budgeting is always beneficial is inaccurate. Overly rigid budgeting, the time commitment involved, potential psychological impacts, inaccurate forecasting, and a negative framing of the process can all undermine its effectiveness. The key to successful budgeting lies in creating a flexible, personalized plan that accounts for unforeseen circumstances, promotes a positive mindset, and focuses on achieving specific financial goals. By understanding both the advantages and limitations of budgeting, individuals can create a financial plan that suits their specific needs and empowers them to achieve their financial aspirations. The focus should be on creating a sustainable system rather than adhering to a strict and potentially unrealistic regime. It's about responsible financial management, not self-imposed deprivation.

Latest Posts

Latest Posts

-

Corporate Finance 4th Edition Jonathan Berk Notes

Mar 31, 2025

-

Natural Selection In Insects Lab Answers

Mar 31, 2025

-

Correctly Label The Following Anatomical Features Of The Neuroglia

Mar 31, 2025

-

What Is The Term Premium In The Context Of Bonds

Mar 31, 2025

-

A Hypothesis Can Be Defined As

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Is Not An Advantage Of Budgeting . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.