Which Of The Following Is Not A Time Series Model

Holbox

Mar 16, 2025 · 6 min read

Table of Contents

Which of the following is not a time series model? Understanding Time Series Analysis and its Alternatives

Time series analysis is a powerful statistical technique used to analyze data points collected over time. It's crucial in diverse fields, from finance and economics to meteorology and healthcare, allowing us to understand patterns, trends, and seasonality within data. But not all models are suited for analyzing time-dependent data. This article delves deep into the world of time series models, highlighting which models are not designed for time series data and explaining why. We'll explore common time series models and contrast them with alternative techniques.

What is a Time Series Model?

A time series model is a statistical model that analyzes data points indexed in time order. The key characteristic is the dependence of observations on their past values. This dependence is often captured through concepts like autocorrelation, where observations at different time points are correlated. This inherent dependence differentiates time series analysis from other statistical techniques that assume independence of data points.

Common features of time series data include:

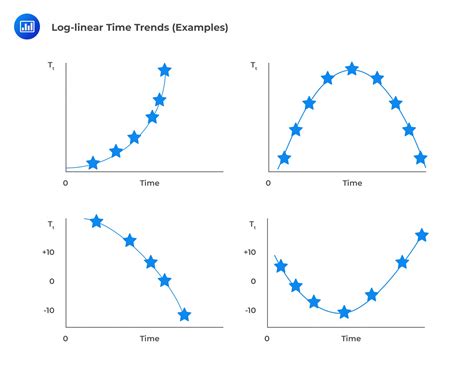

- Trend: A long-term upward or downward movement in the data.

- Seasonality: Regular fluctuations within a fixed time period (e.g., yearly, monthly, daily).

- Cyclicity: Less predictable fluctuations with periods longer than a season.

- Irregularity (Noise): Random variations not explained by trend, seasonality, or cyclicity.

Common Time Series Models

Several models are specifically designed to capture the temporal dependencies within time series data. Some of the most popular include:

- AR (Autoregressive) Models: These models assume that the current value is a linear function of past values. An AR(p) model uses the previous 'p' values to predict the current value.

- MA (Moving Average) Models: These models assume that the current value is a linear function of past forecast errors. An MA(q) model uses the previous 'q' forecast errors.

- ARMA (Autoregressive Moving Average) Models: This combines AR and MA models, capturing both past values and past forecast errors. An ARMA(p,q) model uses 'p' past values and 'q' past errors.

- ARIMA (Autoregressive Integrated Moving Average) Models: An extension of ARMA models, ARIMA incorporates differencing to make the time series stationary (meaning its statistical properties, like mean and variance, don't change over time). An ARIMA(p,d,q) model uses 'p' past values, 'd' levels of differencing, and 'q' past errors.

- SARIMA (Seasonal Autoregressive Integrated Moving Average) Models: This extends ARIMA to account for seasonality. It adds parameters to model seasonal patterns.

- Exponential Smoothing Models: These models assign exponentially decreasing weights to older observations, making them suitable for forecasting when recent data is more relevant. Variations include Simple Exponential Smoothing, Double Exponential Smoothing, and Triple Exponential Smoothing.

Models that are Not Time Series Models

Several statistical methods are not designed for time series data because they violate the core assumption of temporal dependence. Using these methods on time series data can lead to inaccurate results and flawed interpretations. Let's examine some examples:

-

Linear Regression (without time-specific features): While linear regression can model relationships between variables, a standard linear regression that doesn't explicitly account for time dependence is unsuitable for time series analysis. Ignoring the autocorrelation in the data can lead to inaccurate standard errors and unreliable hypothesis tests. To use regression effectively with time series data, you often need to include lagged variables (past values of the dependent or independent variables) or incorporate autocorrelation terms.

-

Independent Samples t-test: This test compares the means of two independent groups. It assumes that the observations within each group are independent, an assumption violated in time series data where observations are inherently correlated.

-

ANOVA (Analysis of Variance): Similar to the t-test, ANOVA assumes independence of observations. Applying ANOVA to time series data without accounting for autocorrelation can lead to inflated Type I error rates (incorrectly rejecting the null hypothesis).

-

Cross-sectional Regression: This type of regression analyzes data collected at a single point in time across multiple subjects. It doesn't account for the time dimension inherent in time series data.

-

Clustering Algorithms (without time consideration): Clustering algorithms like K-means or hierarchical clustering group similar data points together. While these can be adapted to handle time series data (e.g., by using dynamic time warping), standard implementations ignore temporal dependencies.

Why Using Incorrect Models is Problematic

Using non-time series models on time series data can lead to several issues:

-

Incorrect Standard Errors and p-values: The assumptions of independence violated by using non-time series models result in inaccurate standard errors and p-values, potentially leading to false conclusions regarding statistical significance.

-

Biased Parameter Estimates: The model might produce inaccurate estimates of the relationships between variables due to the ignored temporal dependence.

-

Poor Forecasting Accuracy: Models that don't account for temporal patterns will generally have poor predictive accuracy compared to models explicitly designed for time series data.

-

Misinterpretation of Results: Ignoring the temporal nature of the data can lead to a misinterpretation of trends, seasonality, and other important features.

Addressing Temporal Dependence: Techniques and Considerations

To correctly analyze time series data, it's crucial to account for the temporal dependencies. Here are some key considerations:

-

Stationarity: Many time series models require the data to be stationary. This involves transforming the data to have a constant mean and variance over time. Techniques like differencing can induce stationarity.

-

Autocorrelation Analysis: Examining the autocorrelation function (ACF) and partial autocorrelation function (PACF) helps determine the appropriate order (p and q) for ARMA and ARIMA models.

-

Model Selection: Choosing the appropriate model involves considering the characteristics of the data (trend, seasonality, etc.) and evaluating the model's performance using metrics like AIC (Akaike Information Criterion) or BIC (Bayesian Information Criterion).

-

Model Diagnostics: After fitting a model, it's essential to check for model assumptions (e.g., normality of residuals, constant variance) and assess goodness of fit.

-

Forecasting: Once a model is validated, it can be used for forecasting future values.

Choosing the Right Model: A Step-by-Step Guide

The selection of the appropriate model is paramount for accurate analysis. This process typically involves these stages:

-

Data Exploration and Visualization: Begin by thoroughly examining your data. Plot the data to identify trends, seasonality, and outliers.

-

Stationarity Check: Test for stationarity using methods like the Augmented Dickey-Fuller test. If the data is non-stationary, use differencing to achieve stationarity.

-

ACF and PACF Analysis: Examine the autocorrelation and partial autocorrelation functions to identify potential model orders (p and q for ARMA models).

-

Model Selection: Based on ACF/PACF analysis and the characteristics of the data, choose a suitable model (AR, MA, ARMA, ARIMA, SARIMA, etc.).

-

Model Fitting and Validation: Fit the chosen model to your data and evaluate its performance using appropriate metrics (AIC, BIC, RMSE).

-

Diagnostic Checks: Conduct diagnostic tests to ensure the model assumptions are met and identify any potential problems.

-

Forecasting (If needed): Use the validated model to generate forecasts.

Conclusion

Understanding which models are not suitable for time series analysis is as important as knowing which models are. Failing to account for the inherent temporal dependence in time series data can lead to misleading results and inaccurate predictions. By understanding the properties of time series data and employing appropriate modeling techniques, you can effectively analyze temporal patterns, uncover valuable insights, and make informed decisions based on accurate analyses. Remember to always prioritize thorough data exploration, model selection based on data characteristics, and robust model validation to ensure the reliability of your findings. Proper application of time series models can unlock a deeper understanding of dynamic systems across numerous fields.

Latest Posts

Latest Posts

-

How Many Centimeters Is A Nickel

Mar 16, 2025

-

Label The Components Of A Synapse

Mar 16, 2025

-

Consider The Following Two Mutually Exclusive Projects

Mar 16, 2025

-

Transfer Prices Check All That Apply

Mar 16, 2025

-

Job A3b Was Ordered By A Customer On September 25

Mar 16, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Is Not A Time Series Model . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.