Which Of The Following Does The Federal Reserve Not Do

Holbox

Mar 21, 2025 · 7 min read

Table of Contents

- Which Of The Following Does The Federal Reserve Not Do

- Table of Contents

- Which of the following does the Federal Reserve not do? A Deep Dive into the Fed's Responsibilities and Limitations

- What the Federal Reserve DOES Do: Core Functions and Responsibilities

- 1. Conducting Monetary Policy: The Foundation of the Fed's Work

- 2. Supervising and Regulating Banks and Other Financial Institutions: Ensuring Stability

- 3. Maintaining the Stability of the Financial System: Responding to Crises

- 4. Processing Payments: The Backbone of the Financial System

- What the Federal Reserve DOES NOT Do: Important Limitations and Misconceptions

- 1. The Fed Does NOT Directly Control Inflation or Unemployment: Indirect Influence Only

- 2. The Fed Does NOT Set Interest Rates Directly on All Loans: Market Forces Play a Role

- 3. The Fed Does NOT Guarantee Individual Bank Solvency: A Safety Net, Not a Guarantee

- 4. The Fed Does NOT Directly Control the Stock Market: Indirect Influence Through Monetary Policy

- 5. The Fed Does NOT Directly Manage the National Debt: Fiscal Policy's Domain

- 6. The Fed Does NOT Control Exchange Rates: Global Market Forces Prevail

- 7. The Fed Does NOT Guarantee Economic Growth: Facilitates, Does Not Guarantee

- 8. The Fed Does NOT Directly Address Income Inequality: Indirect Effects Only

- 9. The Fed Does NOT Control Commodity Prices: Global Market Driven

- 10. The Fed Does NOT Make Laws or Enforce Regulations: Independent but Works Within Existing Frameworks

- Conclusion: Understanding the Fed's Limits for a More Realistic Perspective

- Latest Posts

- Latest Posts

- Related Post

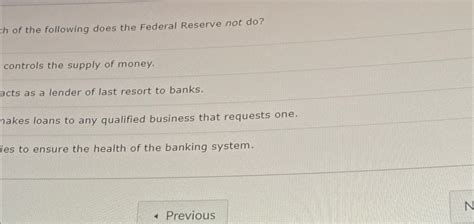

Which of the following does the Federal Reserve not do? A Deep Dive into the Fed's Responsibilities and Limitations

The Federal Reserve (often called the Fed) is a powerful institution, playing a central role in the U.S. economy. Understanding its functions is crucial for anyone interested in finance, economics, or simply staying informed about current events. While many associate the Fed with controlling interest rates and influencing the money supply, its role is multifaceted and contains several key limitations. This article explores what the Federal Reserve does and, more importantly, what it does not do.

What the Federal Reserve DOES Do: Core Functions and Responsibilities

Before examining the Fed's limitations, it's vital to understand its core responsibilities. These include:

1. Conducting Monetary Policy: The Foundation of the Fed's Work

This is arguably the Fed's most well-known function. Monetary policy involves influencing the money supply and credit conditions to promote maximum employment, stable prices, and moderate long-term interest rates. The Fed achieves this primarily through:

-

Setting the federal funds rate: This is the target rate that banks charge each other for overnight loans. By adjusting this rate, the Fed influences other interest rates throughout the economy. A higher federal funds rate generally leads to higher borrowing costs, slowing economic growth, and combating inflation. Conversely, a lower rate stimulates economic activity.

-

Open market operations: This involves buying and selling U.S. Treasury securities and other government-backed securities. Buying securities injects money into the banking system, increasing the money supply, while selling securities reduces the money supply.

-

Reserve requirements: The Fed sets the minimum amount of reserves banks must hold against deposits. Changes to reserve requirements can influence the amount of money banks can lend, affecting the money supply.

-

Discount rate: This is the interest rate at which commercial banks can borrow money directly from the Fed. Adjustments to the discount rate can signal the Fed's monetary policy stance and influence banks' borrowing behavior.

2. Supervising and Regulating Banks and Other Financial Institutions: Ensuring Stability

The Fed plays a crucial role in maintaining the stability of the U.S. financial system by:

-

Supervising bank holding companies: This ensures banks operate safely and soundly, mitigating the risk of financial crises.

-

Setting capital requirements: This dictates the amount of capital banks must hold as a buffer against potential losses. Higher capital requirements increase bank stability but can limit lending.

-

Regulating financial institutions: The Fed's regulatory powers extend beyond banks to include other financial institutions, promoting overall financial system stability.

3. Maintaining the Stability of the Financial System: Responding to Crises

The Fed acts as a lender of last resort during financial crises, providing liquidity to struggling institutions to prevent widespread panic and systemic collapse. This involves:

-

Providing emergency loans: This helps institutions meet their short-term funding needs during times of stress.

-

Implementing unconventional monetary policies: During severe crises, the Fed may use unconventional tools such as quantitative easing (QE) – large-scale purchases of long-term securities – to inject liquidity into the market.

4. Processing Payments: The Backbone of the Financial System

The Fed operates the Fedwire Funds Service, a real-time gross settlement system that facilitates large-value electronic payments between banks and financial institutions. This ensures the smooth functioning of the U.S. payments system.

What the Federal Reserve DOES NOT Do: Important Limitations and Misconceptions

Despite its extensive powers, the Federal Reserve has several important limitations. Understanding these limitations is critical to having a realistic understanding of its role in the economy:

1. The Fed Does NOT Directly Control Inflation or Unemployment: Indirect Influence Only

While the Fed's monetary policy actions significantly influence inflation and unemployment, it cannot directly control them. These are complex macroeconomic phenomena affected by a multitude of factors beyond the Fed's control, including:

-

Global economic conditions: International events, such as commodity price shocks or geopolitical instability, can dramatically impact inflation and employment.

-

Government fiscal policy: Government spending and taxation policies can significantly influence economic growth, inflation, and employment.

-

Consumer and business confidence: These psychological factors significantly impact spending and investment decisions, influencing economic activity.

-

Technological innovation: Technological advancements can drive productivity and affect both inflation and employment.

2. The Fed Does NOT Set Interest Rates Directly on All Loans: Market Forces Play a Role

While the Fed sets the federal funds rate, it doesn't directly control all interest rates in the economy. Interest rates on mortgages, auto loans, and other consumer and business loans are influenced by a combination of factors, including the federal funds rate, market conditions, and the creditworthiness of the borrower.

3. The Fed Does NOT Guarantee Individual Bank Solvency: A Safety Net, Not a Guarantee

The Fed's supervisory and regulatory actions aim to prevent bank failures, but it doesn't guarantee the solvency of individual banks. Banks can still fail if they engage in excessively risky behavior or experience significant losses. The FDIC (Federal Deposit Insurance Corporation) provides deposit insurance, but this does not protect against all losses.

4. The Fed Does NOT Directly Control the Stock Market: Indirect Influence Through Monetary Policy

While the Fed's monetary policy actions can indirectly influence stock prices, it doesn't directly control the stock market. Stock prices are driven by investor sentiment, company performance, and various other market forces.

5. The Fed Does NOT Directly Manage the National Debt: Fiscal Policy's Domain

The Fed's actions can indirectly affect the national debt through their influence on interest rates and economic growth. However, the management of the national debt is primarily the responsibility of Congress and the Treasury Department through fiscal policy. The Fed's role is limited to managing the government's borrowing needs through its operations in the Treasury market.

6. The Fed Does NOT Control Exchange Rates: Global Market Forces Prevail

The value of the U.S. dollar relative to other currencies is determined by supply and demand in the foreign exchange market. While the Fed's monetary policy actions can have an indirect influence on exchange rates, it does not directly control them. Global economic conditions, trade balances, and investor sentiment all play a significant role.

7. The Fed Does NOT Guarantee Economic Growth: Facilitates, Does Not Guarantee

The Fed's actions aim to foster sustainable economic growth, but it cannot guarantee it. Economic growth is a complex process influenced by numerous factors beyond the Fed's control, including technological change, productivity, and global economic conditions.

8. The Fed Does NOT Directly Address Income Inequality: Indirect Effects Only

While the Fed's monetary policy actions can have an indirect effect on income inequality through their impact on employment and economic growth, it doesn't directly address income inequality. Addressing income inequality requires broader economic and social policies beyond the Fed's mandate.

9. The Fed Does NOT Control Commodity Prices: Global Market Driven

The prices of commodities such as oil, gold, and agricultural products are primarily determined by global supply and demand. While the Fed's monetary policy can have an indirect influence on commodity prices through its impact on the dollar and economic growth, it does not directly control them.

10. The Fed Does NOT Make Laws or Enforce Regulations: Independent but Works Within Existing Frameworks

The Fed is an independent central bank, but it operates within the framework of existing laws and regulations established by Congress. It does not create or enforce laws; it implements the policies and regulations set forth by the legislative branch.

Conclusion: Understanding the Fed's Limits for a More Realistic Perspective

The Federal Reserve plays a vital role in the U.S. economy, influencing inflation, employment, and financial stability. However, it's crucial to understand its limitations. The Fed does not have direct control over many aspects of the economy, and its actions are often indirect and influenced by a multitude of other factors. By understanding both the capabilities and limitations of the Federal Reserve, we can gain a more realistic and nuanced understanding of the complexities of the U.S. economic landscape and the role of monetary policy within it.

Latest Posts

Latest Posts

-

Del Gato Clinics Cash Account Shows

Mar 28, 2025

-

A Little Added Challenge Answer Key

Mar 28, 2025

-

Two Of The Characteristics Of Useful Information Are

Mar 28, 2025

-

There Are Almost 500 Naturally Occurring

Mar 28, 2025

-

Process Capability Compares Process Variability To The Tolerances

Mar 28, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Does The Federal Reserve Not Do . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.