Which Of The Following Costs Is Inventories Whehn Using

Holbox

Mar 17, 2025 · 6 min read

Table of Contents

Which of the Following Costs is Included in Inventories? A Comprehensive Guide

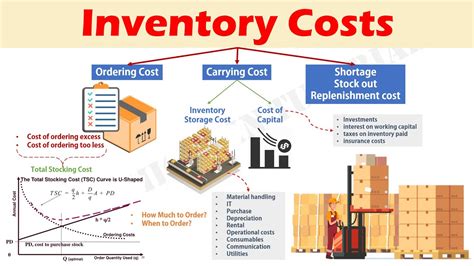

Determining which costs are included in inventories is crucial for accurate financial reporting and effective inventory management. Understanding the principles behind inventory costing ensures compliance with accounting standards and provides valuable insights into profitability and operational efficiency. This article will delve into the complexities of inventory costing, clarifying which costs are included and which are excluded, offering a comprehensive guide for businesses of all sizes.

What are Inventories?

Before we explore which costs constitute inventories, let's define the term itself. Inventories represent the goods held for sale in the ordinary course of business. These goods can be finished goods ready for sale, work-in-progress (WIP) undergoing production, or raw materials used in the production process. Accurate valuation of inventories is essential because it directly impacts a company's financial statements, specifically the balance sheet and income statement.

Key Accounting Standards: A Foundation for Inventory Costing

Several accounting standards govern how inventories are valued and reported. The most prominent is IAS 2 (International Accounting Standard 2) Inventories, which provides a framework for accounting for inventories under International Financial Reporting Standards (IFRS). Similar principles are applied under US Generally Accepted Accounting Principles (GAAP). These standards emphasize the principle of lower of cost and net realizable value (LCNRV). This means inventories should be reported at the lower of their cost or their net realizable value (estimated selling price less selling costs).

Costs Included in Inventories: A Detailed Breakdown

The cost of inventories includes all costs of purchase, costs of conversion, and other costs incurred in bringing the inventories to their present location and condition. Let's examine each component in detail:

1. Costs of Purchase: These are the costs directly attributable to the acquisition of goods. They include:

- Purchase Price: This is the amount paid to the supplier for the goods, excluding any trade discounts, rebates, or volume discounts that are consistently applied.

- Import Duties and Taxes: All import duties, taxes, and other levies payable on the purchase of goods are included in the cost of inventories.

- Freight In: Transportation costs incurred to bring the goods to the business's premises are also part of the cost.

- Handling Costs: Costs directly attributable to handling goods, such as unloading and storage in a warehouse, are considered inventory costs.

- Less: Trade Discounts and Rebates: While the gross invoice price is the starting point, any significant trade discounts or rebates that are consistently received should be deducted.

2. Costs of Conversion: These are costs incurred in transforming raw materials into finished goods. They encompass:

- Direct Labor: Wages and salaries of production workers directly involved in manufacturing the goods.

- Factory Overhead: Indirect costs related to production, including:

- Rent and Utilities: Costs associated with the factory space.

- Depreciation of Factory Equipment: Allocation of the cost of factory equipment over its useful life.

- Factory Supervision Costs: Salaries of factory supervisors.

- Manufacturing Supplies: Consumable materials used in the production process.

- Insurance and Property Taxes: Insurance premiums and property taxes related to the factory.

3. Other Costs: In addition to the costs of purchase and conversion, certain other costs can be included if they are directly attributable to bringing the inventories to their present location and condition. These include:

- Design Costs: If design costs are specifically related to a particular inventory item and are directly attributable to it, they can be included.

- Testing Costs: Testing costs incurred to ensure the quality of finished goods are often included.

- Storage Costs (Specific): While general storage costs are usually expensed, storage costs related to specific inventory items (e.g., holding specialized items needing special conditions) can be capitalized.

Costs Excluded from Inventories: Clear Distinctions

It is just as important to understand which costs are excluded from inventory valuation as it is to know which are included. These costs are typically expensed in the period they are incurred. Examples include:

- Administrative Overhead: General administrative costs not directly related to production (e.g., salaries of administrative staff, rent of office space).

- Selling and Marketing Expenses: Costs associated with selling and marketing goods (e.g., advertising, sales commissions, shipping costs to customers).

- Research and Development (R&D) Costs: Costs incurred in developing new products or improving existing ones.

- General Storage Costs: Routine storage costs of finished goods awaiting sale are typically expensed, not capitalized.

- Abnormal Waste: Losses due to abnormal waste or spoilage should be expensed rather than included in inventory costs.

- Finance Costs: Interest costs on loans used to finance inventory purchases are generally expensed.

- Storage Costs (General): Unless it pertains to specialized, high-value items, general warehousing costs are expensed.

Inventory Costing Methods: Choosing the Right Approach

Once the costs included in inventories are determined, businesses must choose an appropriate costing method to assign costs to the goods. Common methods include:

- First-In, First-Out (FIFO): Assumes that the oldest goods are sold first.

- Last-In, First-Out (LIFO): Assumes that the newest goods are sold first (LIFO is less common under IFRS).

- Weighted-Average Cost: Assigns a weighted-average cost to all units of inventory.

The choice of inventory costing method can significantly impact the cost of goods sold and the value of ending inventory, influencing the company's profitability and financial position. The selection should be consistent and appropriate for the specific business and its inventory characteristics.

Practical Examples: Illustrating the Principles

Let's illustrate with some examples:

Example 1: Costs Included

A company manufactures widgets. The costs included in the cost of widgets would be:

- The cost of raw materials (plastic, metal, etc.).

- Direct labor costs of assembly line workers.

- Factory rent, utilities, and depreciation.

- Transportation costs of bringing raw materials to the factory.

Example 2: Costs Excluded

The same company's costs for advertising the widgets, salaries of the sales team, and general administrative expenses are not included in the cost of the widgets. These are period expenses that are reported on the income statement.

Example 3: Determining the Cost of a Specific Item

Imagine a company purchases a batch of luxury watches for resale. The cost of each watch would include:

- The purchase price from the supplier.

- Import duties and taxes.

- Insurance costs during transit.

- Costs of specialized secure storage (due to the high value).

The Importance of Accurate Inventory Costing

Accurate inventory costing is crucial for several reasons:

- Accurate Financial Reporting: Correctly valued inventories ensure reliable financial statements, providing a true picture of the company's financial health.

- Effective Inventory Management: Understanding inventory costs helps optimize inventory levels, minimizing storage costs and reducing the risk of obsolescence or spoilage.

- Profitability Analysis: Accurate cost of goods sold calculations are essential for determining gross profit margins and overall profitability.

- Compliance with Accounting Standards: Adherence to accounting standards ensures transparency and credibility in financial reporting.

- Tax Implications: Inventory valuation affects the calculation of taxable income.

Conclusion: A Holistic Perspective on Inventory Costing

Determining which costs are included in inventories requires a careful and systematic approach. By understanding the principles outlined in accounting standards and applying them consistently, businesses can ensure accurate inventory valuation and reliable financial reporting. This understanding allows for better inventory management, improved profitability analysis, and enhanced compliance with regulatory requirements. Remember to regularly review and update your inventory costing methods to reflect changes in business operations and market conditions. This holistic perspective on inventory costing will contribute significantly to the overall financial health and success of any business.

Latest Posts

Latest Posts

-

How To Cite The Bible In Apa

Mar 18, 2025

-

Which Of The Following Statements Is Most Accurate

Mar 18, 2025

-

The Heart Is Medial To The Lungs

Mar 18, 2025

-

Which Statement Summarizes The Main Idea Of Reciprocal Determinism

Mar 18, 2025

-

Chegg Press And Hold Not Working

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Costs Is Inventories Whehn Using . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.