Which Of The Following Applies To Nonadmitted Insurance Companies

Holbox

Mar 28, 2025 · 7 min read

Table of Contents

- Which Of The Following Applies To Nonadmitted Insurance Companies

- Table of Contents

- Navigating the World of Non-Admitted Insurance Companies: A Comprehensive Guide

- What are Non-Admitted Insurance Companies?

- Key Characteristics of Non-Admitted Insurers:

- When Do You Need Non-Admitted Insurance?

- High-Risk or Unusual Coverage Needs:

- Geographical Limitations of Admitted Insurers:

- Regulatory Gaps:

- The Role of Surplus Lines Brokers:

- Functions of a Surplus Lines Broker:

- Legal and Regulatory Considerations:

- State Surplus Lines Laws:

- Compliance with State Laws and Regulations:

- Comparing Admitted vs. Non-Admitted Insurance: A Side-by-Side Comparison

- Potential Risks and Challenges:

- Higher Premiums and Costs:

- Limited Consumer Protections:

- Difficulty in Claims Handling:

- Choosing Wisely: Factors to Consider:

- Financial Strength of the Insurer:

- Reputation and Track Record:

- Broker Expertise:

- Policy Terms and Conditions:

- Conclusion:

- Latest Posts

- Latest Posts

- Related Post

Navigating the World of Non-Admitted Insurance Companies: A Comprehensive Guide

The insurance industry is a complex landscape, with a variety of companies offering diverse products and services. Understanding the distinctions between different types of insurance providers is crucial, especially when it comes to non-admitted insurance companies. This comprehensive guide will delve deep into the characteristics, implications, and considerations surrounding non-admitted insurers, offering a clear picture for both consumers and industry professionals.

What are Non-Admitted Insurance Companies?

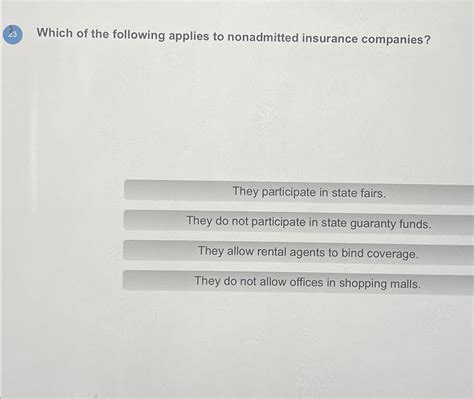

Unlike admitted insurance companies, which are licensed to operate within a specific state or jurisdiction, non-admitted insurance companies lack this authorization. They haven't met the regulatory requirements of the state where they're selling insurance. This doesn't necessarily mean they're illegitimate or unreliable; however, it does imply a different level of regulatory oversight and consumer protection. It's crucial to understand this fundamental distinction because it significantly impacts the policyholder's rights and recourse in case of disputes or claims.

Key Characteristics of Non-Admitted Insurers:

- Lack of State Licensing: This is the defining characteristic. They haven't gone through the licensing process in the state where they're offering insurance.

- Surplus Lines Market Operations: Non-admitted insurers often operate within the surplus lines market. This market caters to risks that are considered too high, unusual, or specialized for standard insurers to handle.

- Higher Premiums: Because of the higher risk involved and the lack of state regulation, premiums for non-admitted policies are often significantly higher than those from admitted insurers.

- Limited Consumer Protections: State-level consumer protection laws generally don't fully extend to policies from non-admitted insurers. This means fewer avenues for redress in case of disputes or claims denials.

- Specialized Coverage: They typically provide specialized insurance products, such as high-value homes, unique businesses, or unusual liability exposures, that standard insurers might not offer.

- Potential Insolvency Risk: While not inherently more risky than admitted insurers, the lack of stringent state regulation poses a potential increased risk in the event of insolvency.

When Do You Need Non-Admitted Insurance?

While admitted insurers represent the majority of the market, specific circumstances necessitate seeking coverage from non-admitted insurers:

High-Risk or Unusual Coverage Needs:

- High-Value Assets: Individuals or businesses with extremely valuable assets, like high-net-worth homes, valuable collections, or unique equipment, may find it difficult to obtain sufficient coverage from admitted insurers.

- Specialized Industries: Certain industries, such as mining, offshore energy, or specialized manufacturing, may require unique coverage tailored to their specific risks. Admitted insurers might not offer such niche products.

- Unusual Liability Exposures: Businesses with unusual liability exposures (e.g., environmental liability, professional liability for high-risk activities) may find it difficult to find adequate coverage from admitted insurers.

- Large Commercial Risks: Large commercial entities may require coverage exceeding the capacity of a single admitted insurer, leading them to seek coverage from multiple non-admitted insurers.

Geographical Limitations of Admitted Insurers:

In certain regions or for specific types of risks, admitted insurers might not offer coverage. In such cases, non-admitted insurers can bridge the gap. This is particularly relevant in areas with unique geographical challenges or where regulatory environments restrict the operation of admitted carriers.

Regulatory Gaps:

Certain gaps in state-level insurance regulation could leave businesses or individuals without access to necessary coverage from admitted insurers. Non-admitted insurance can then be a solution to fill this gap.

The Role of Surplus Lines Brokers:

Navigating the complexities of the non-admitted insurance market is often best done with the help of a licensed surplus lines broker. These brokers specialize in placing insurance with non-admitted insurers, assisting clients in finding appropriate coverage and ensuring compliance with state regulations.

Functions of a Surplus Lines Broker:

- Identifying Appropriate Coverage: Brokers leverage their expertise to find suitable coverage from non-admitted insurers.

- Negotiating Terms and Conditions: They negotiate policies to secure the best possible terms and conditions for clients.

- Ensuring Regulatory Compliance: Surplus lines brokers understand and comply with all state regulations concerning non-admitted insurance.

- Managing the Claims Process: Should a claim arise, they assist policyholders in navigating the claims process with the non-admitted insurer.

Choosing a reputable surplus lines broker is critical for ensuring a smooth and compliant experience. Thorough research and due diligence are crucial to selecting a broker with a proven track record of success.

Legal and Regulatory Considerations:

While non-admitted insurers are not subject to the same level of state regulation as admitted insurers, they are still subject to certain legal and regulatory frameworks:

State Surplus Lines Laws:

Each state has its own laws and regulations governing surplus lines insurance. These laws outline the requirements for surplus lines brokers, the types of risks that can be insured through the surplus lines market, and the conditions under which non-admitted insurance can be purchased. Understanding these state-specific laws is critical for both insurers and policyholders.

Compliance with State Laws and Regulations:

Non-admitted insurers, even though not directly licensed in a state, must still comply with specific state laws and regulations relating to their operations within that state. This compliance often involves maintaining records, filing reports, and adhering to specific conditions set forth by state regulators.

Comparing Admitted vs. Non-Admitted Insurance: A Side-by-Side Comparison

| Feature | Admitted Insurance | Non-Admitted Insurance |

|---|---|---|

| Licensing | Licensed by the state | Not licensed by the state |

| Regulation | Heavily regulated by state insurance departments | Less regulated, operates in the surplus lines market |

| Consumer Protection | Strong consumer protection laws | Limited consumer protection |

| Premiums | Generally lower | Generally higher |

| Availability | Wide range of products and coverage | Specialized products, often for high-risk exposures |

| Claims Handling | Established procedures and consumer protections | Potential complexities in claims handling |

| Insolvency | State guaranty associations provide protection | Limited or no protection from state guaranty funds |

Potential Risks and Challenges:

While non-admitted insurance can be a necessary solution in certain situations, it's essential to acknowledge the potential risks and challenges:

Higher Premiums and Costs:

The lack of state regulation often translates into higher premiums compared to admitted insurance. Additionally, the complexities involved in placing coverage with non-admitted insurers might lead to higher brokerage fees.

Limited Consumer Protections:

The absence of strong consumer protection laws can make recourse more difficult in case of disputes or claim denials. State guaranty associations, which provide a safety net for policyholders in case of admitted insurer insolvency, typically don't extend coverage to non-admitted insurers.

Difficulty in Claims Handling:

Navigating the claims process with a non-admitted insurer might present greater challenges than with an admitted insurer. This necessitates careful consideration of the insurer's financial stability and claims-handling reputation.

Choosing Wisely: Factors to Consider:

Before opting for non-admitted insurance, it's crucial to carefully assess several factors:

Financial Strength of the Insurer:

Research the insurer's financial stability thoroughly. Seek independent ratings from reputable financial rating agencies to gauge the insurer's ability to pay claims.

Reputation and Track Record:

Investigate the insurer's reputation and track record in claims handling. Look for reviews and testimonials from other policyholders to assess their experiences.

Broker Expertise:

Choose a reputable and experienced surplus lines broker. A skilled broker can navigate the complexities of the surplus lines market and ensure compliance with state regulations.

Policy Terms and Conditions:

Carefully review the policy's terms and conditions, paying particular attention to exclusions, limitations, and dispute resolution processes. Seek clarity on any ambiguous clauses.

Conclusion:

Non-admitted insurance companies play a vital role in filling coverage gaps for high-risk or specialized exposures. While offering solutions for those unable to obtain coverage from admitted insurers, they necessitate a thorough understanding of the associated risks and implications. Careful due diligence, selection of a reputable surplus lines broker, and awareness of state-specific regulations are crucial for making informed decisions and mitigating potential challenges. By weighing the benefits and drawbacks carefully, individuals and businesses can navigate this niche sector of the insurance market effectively and securely.

Latest Posts

Latest Posts

-

Label The Images To Review The Spectrum Of Cutaneous Mycoses

Apr 01, 2025

-

Martys Email To Their College Professor

Apr 01, 2025

-

The Cost Of Land Does Not Include

Apr 01, 2025

-

The Term Xenophobia Can Best Be Defined As

Apr 01, 2025

-

Which Of The Following Is Not A Fixed Cost

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Applies To Nonadmitted Insurance Companies . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.