Which Is The Best Description Of Authorized Shares

Holbox

Mar 17, 2025 · 7 min read

Table of Contents

Which is the Best Description of Authorized Shares?

Understanding authorized shares is crucial for anyone involved in the world of finance, investing, or corporate governance. This comprehensive guide delves deep into the definition, significance, and implications of authorized shares, offering a clear and concise explanation for both beginners and seasoned professionals. We'll explore various aspects, comparing and contrasting different perspectives to provide the most accurate and helpful description possible.

What are Authorized Shares?

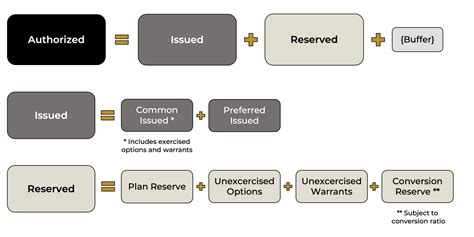

Authorized shares represent the maximum number of shares a company is legally permitted to issue, as outlined in its articles of incorporation or charter. This number is determined during the company's formation and serves as a fundamental component of its capital structure. It's a crucial figure that sets a hard limit on the total number of shares the company can ever create and offer to investors. Think of it as the company's "share issuance ceiling." This is distinct from the number of shares actually issued and outstanding, which we'll discuss later.

Key Characteristics of Authorized Shares:

- Legally Defined: The number is explicitly stated in the company's legal documents, providing a clear boundary for future share issuance.

- Fixed (Generally): While some companies might have mechanisms to increase authorized shares, this typically requires shareholder approval through a formal process. It's not something done lightly.

- Not Necessarily Issued: A company doesn't have to issue all of its authorized shares. It can choose to issue only a portion, reserving the remainder for future needs like expansion, acquisitions, or employee stock options.

- Foundation of Capital Structure: The authorized share figure acts as the foundational element of the company's capital structure, influencing its financial flexibility and future growth potential.

Authorized Shares vs. Issued Shares vs. Outstanding Shares: Clarifying the Differences

It's essential to distinguish between authorized shares and other related terms:

Issued Shares:

Issued shares represent the total number of shares that have actually been distributed to investors. These shares are actively traded in the market (if publicly traded) and represent ownership in the company. Issued shares are always less than or equal to the number of authorized shares.

Outstanding Shares:

Outstanding shares are the number of issued shares that are currently held by investors. This excludes treasury shares (shares repurchased by the company). Outstanding shares represent the actual number of shares actively participating in the market and influencing the company's market capitalization.

Example:

Imagine a company with authorized shares of 100 million. They might have issued 60 million shares, and currently have 58 million outstanding shares (meaning 2 million shares are held as treasury stock).

The Significance of Authorized Shares

Understanding authorized shares carries significant implications for various stakeholders:

For Investors:

- Potential for Future Dilution: Knowing the authorized share count helps investors assess the potential for future share dilution. If a company has a large number of authorized but unissued shares, it can issue more shares without shareholder approval, potentially diluting the ownership and earnings per share of existing investors.

- Valuation and Investment Decisions: The relationship between authorized shares, issued shares, and outstanding shares influences a company's valuation. A large discrepancy between authorized and issued shares can raise questions about the company's future plans and potentially impact investment decisions.

- Understanding Growth Potential: The authorized share count can provide clues about the company's growth plans. A company with significantly more authorized shares than issued shares may be planning for significant expansion or acquisitions in the future.

For Companies:

- Financial Flexibility: Having a sufficient number of authorized shares provides financial flexibility. It allows the company to raise capital quickly through issuing new shares without needing shareholder approval each time. This is crucial for funding expansion projects, acquisitions, or handling unexpected financial needs.

- Strategic Planning: The authorized share count is a part of a company's broader financial and strategic planning. It's a critical factor in determining the company's capital structure and its ability to pursue growth opportunities.

- Maintaining Control: Companies can use authorized shares strategically to maintain control. By carefully managing the issuance of new shares, they can prevent a hostile takeover or maintain their current shareholder structure.

For Regulators:

- Corporate Governance: Regulators use information about authorized shares to oversee a company's financial transparency and corporate governance practices.

- Preventing Fraud: Regulators monitor authorized share counts to help prevent fraud and ensure compliance with securities regulations.

- Investor Protection: Clear information about authorized shares helps protect investors by providing transparency and preventing potential manipulation of the market.

Increasing Authorized Shares: The Process and Implications

While the authorized share count is typically fixed at the time of incorporation, companies may sometimes need to increase it. This process generally involves:

- Board of Directors Recommendation: The board of directors proposes an increase in the authorized share count.

- Shareholder Approval: Shareholders must vote to approve the increase. This typically requires a majority vote.

- Filing Amendments: The company must file amended articles of incorporation or other relevant documents with the appropriate regulatory authorities to reflect the increase in authorized shares.

Implications of Increasing Authorized Shares:

- Potential for Dilution: Increasing authorized shares increases the potential for future dilution, as it expands the pool of shares available for issuance. This is a significant consideration for existing shareholders.

- Market Perception: The market may react negatively to a significant increase in authorized shares, particularly if investors perceive it as a sign of poor management or a lack of confidence in the company's future prospects.

- Cost and Time: Increasing authorized shares involves a formal process that can be costly and time-consuming.

The Best Description of Authorized Shares: A Synthesis

The best description of authorized shares is that they represent the maximum number of shares a company can legally issue as specified in its founding documents, providing a foundational limit on its capital structure and impacting financial flexibility, growth potential, and investor perception. This concise definition encapsulates the key aspects: the legal limit, its role in the capital structure, and its influence on various stakeholders. It highlights the importance of understanding the relationship between authorized shares, issued shares, and outstanding shares for a comprehensive understanding of a company's financial health and future prospects. Ignoring or misunderstanding this crucial aspect can lead to poor investment decisions, misinterpretations of financial statements, and even legal issues. Therefore, a thorough grasp of authorized shares is fundamental for anyone navigating the complexities of the corporate world.

Frequently Asked Questions (FAQs)

Q: What happens if a company issues more shares than authorized?

A: A company cannot legally issue more shares than it has authorized. Attempting to do so would be a violation of its corporate charter and relevant securities laws.

Q: Can a company decrease its authorized shares?

A: Generally, decreasing the authorized share count is more complex than increasing it and often requires shareholder approval. The process may vary by jurisdiction.

Q: Why would a company choose to have a large number of authorized shares?

A: Companies might opt for a large number of authorized shares to provide flexibility for future growth, acquisitions, employee stock option plans, or to avoid the need for repeated shareholder approvals for share issuances. However, this comes with the risk of potential dilution for existing shareholders.

Q: How do I find the authorized share count for a publicly traded company?

A: The authorized share count is typically disclosed in a company's annual reports, quarterly filings, or other publicly available documentation. These documents are often accessible through the company's investor relations section or through regulatory filings databases.

Q: What is the impact of authorized shares on a company's market capitalization?

A: The authorized share count itself doesn't directly determine market capitalization. However, it influences market capitalization indirectly by impacting the number of outstanding shares and the potential for future dilution. A high authorized share count relative to issued shares might be viewed negatively by some investors.

This in-depth exploration provides a comprehensive understanding of authorized shares, their significance, and their implications for investors, companies, and regulators alike. By understanding this critical aspect of corporate finance, individuals can make informed decisions and navigate the complexities of the financial markets with greater confidence.

Latest Posts

Latest Posts

-

When Direct Labor Costs Are Recorded

Mar 17, 2025

-

In Prompt Engineering Why It Is Important To Specify

Mar 17, 2025

-

Identify The Function Represented By The Following Power Series

Mar 17, 2025

-

Predict The Product For The Reaction Shown

Mar 17, 2025

-

Which Of The Following Is Not A Stimulant

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about Which Is The Best Description Of Authorized Shares . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.