When Treasury Stock Is Resold At A Price Above Cost

Holbox

Mar 29, 2025 · 6 min read

Table of Contents

- When Treasury Stock Is Resold At A Price Above Cost

- Table of Contents

- When Treasury Stock is Resold at a Price Above Cost

- Understanding Treasury Stock Acquisition and Resale

- Accounting for Resale Above Cost: The Gain on Resale

- Impact on Financial Statements

- Tax Implications of Resale Gain

- Different Scenarios and Considerations

- Strategic Implications of Treasury Stock Resales

- Reporting Requirements and Disclosure

- Advanced Considerations and Complexities

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

When Treasury Stock is Resold at a Price Above Cost

Treasury stock, also known as reacquired stock, represents shares of a company's own stock that it has repurchased from the open market. Repurchasing stock can be a strategic move for various reasons, including boosting earnings per share, signaling confidence in the company's future, or having shares available for employee stock option plans. However, the accounting treatment of treasury stock becomes more complex when the company later decides to resell these shares, particularly when the resale price exceeds the original cost. This article delves into the intricacies of this scenario, exploring its impact on the balance sheet, income statement, and overall financial reporting.

Understanding Treasury Stock Acquisition and Resale

Before diving into the complexities of reselling treasury stock above cost, let's establish a foundational understanding of the process. When a company buys back its own shares, it typically records this transaction by debiting the Treasury Stock account and crediting Cash. The Treasury Stock account is a contra-equity account, meaning it reduces the overall equity value. The cost of acquiring these shares is the crucial figure for later accounting entries.

The resale of treasury stock introduces a further layer of complexity. If the resale price is equal to or less than the original cost, the accounting treatment is relatively straightforward. However, when the resale price is higher than the original cost, the excess amount is treated as a gain, impacting the company's income statement.

Accounting for Resale Above Cost: The Gain on Resale

The key accounting principle guiding the resale of treasury stock above cost is the recognition of a gain. This gain represents the difference between the resale price and the original cost of the treasury stock. The gain is not considered a dividend distribution to shareholders; instead, it's a gain from a profitable investment in its own shares.

Let's illustrate this with an example:

Example:

ABC Company initially purchased 1,000 shares of its own stock at $10 per share, for a total cost of $10,000. Later, the company resells 500 of these shares at $15 per share, generating $7,500 in proceeds.

- Original Cost of 500 shares: $5,000 ($10/share * 500 shares)

- Resale Proceeds: $7,500 ($15/share * 500 shares)

- Gain on Resale: $2,500 ($7,500 - $5,000)

The accounting entries would be as follows:

- Debit: Cash $7,500

- Credit: Treasury Stock $5,000

- Credit: Gain on Resale of Treasury Stock $2,500

This entry removes the cost of the treasury stock from the balance sheet and recognizes the gain on the income statement, reflecting the improved financial position due to the profitable resale.

Impact on Financial Statements

The resale of treasury stock above cost has a direct impact on both the balance sheet and the income statement.

Balance Sheet Impact:

- Decrease in Treasury Stock: The balance sheet will show a reduction in the Treasury Stock account, reflecting the shares no longer held by the company.

- Increase in Cash: The cash balance will increase by the amount received from the resale.

- No Direct Impact on Retained Earnings (initially): The gain is not directly added to retained earnings until the end of the accounting period. Retained earnings are then increased after closing the gain account to the retained earnings account.

Income Statement Impact:

- Gain on Resale: The income statement will report a gain on the resale of treasury stock, boosting the company's net income for the period. This gain contributes to higher earnings per share (EPS).

Tax Implications of Resale Gain

The gain on the resale of treasury stock is generally subject to corporate income tax. The tax implications are not directly part of the accounting treatment, but they are a crucial financial consideration for the company. The tax rate applicable will depend on the company's overall tax bracket and the relevant tax laws in their jurisdiction.

Different Scenarios and Considerations

While the above example represents a common scenario, several other situations may arise:

- Partial Resale: If only a portion of the treasury stock is resold above cost, the gain is calculated proportionally.

- Multiple Resales at Different Prices: If the company resells treasury stock acquired at different costs and prices, the gain or loss needs to be calculated separately for each batch of shares.

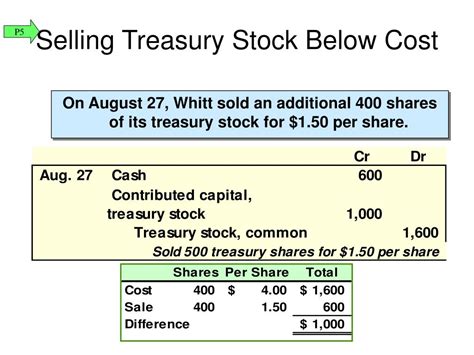

- Resale Below Cost: If the resale price is below the original cost, the difference is recorded as a loss on the income statement. This is typically unusual unless market conditions have significantly changed.

Strategic Implications of Treasury Stock Resales

The decision to repurchase and resell treasury stock is a significant financial strategy. Companies undertake these actions for multiple reasons, including:

- Increasing Earnings Per Share: By reducing the number of outstanding shares, the company can artificially increase EPS. A higher EPS can improve the company's market valuation.

- Signaling Confidence: Repurchasing stock can signal confidence to the market, suggesting that management believes the shares are undervalued.

- Funding Employee Stock Option Plans: Companies often maintain a treasury stock to fund employee stock options and avoid issuing new shares.

- Defending Against Takeovers: Repurchasing stock can make a hostile takeover more difficult and expensive.

Reporting Requirements and Disclosure

Companies are required to disclose information related to their treasury stock transactions in their financial statements. This typically includes details on the number of shares acquired, the cost of acquisition, the number of shares resold, and the proceeds received. Proper disclosure is crucial for transparency and helps investors assess the company's financial health and strategic direction.

Advanced Considerations and Complexities

The accounting for treasury stock can become significantly more complex in specific situations, particularly for companies with multiple classes of stock or those operating under different accounting standards. Furthermore, the impact on financial ratios and investor perception should be carefully considered.

Impact on Financial Ratios: The increase in net income from the gain on the resale of treasury stock impacts several key financial ratios, such as return on equity (ROE) and earnings per share (EPS). Understanding these effects is essential for accurate financial analysis.

Investor Perception: While a gain on the resale of treasury stock might seem positive, investors should also consider the underlying reasons behind the repurchase and resale actions. Sometimes, it reflects a lack of better investment opportunities, potentially signaling a lack of growth prospects.

Conclusion

The resale of treasury stock above cost is a nuanced aspect of corporate finance. Understanding the accounting treatment, including the recognition of a gain, its impact on the balance sheet and income statement, and the underlying strategic reasons, is vital for both corporate management and investors. This article aims to provide a comprehensive overview, but consulting with financial professionals is recommended for companies navigating complex treasury stock transactions. Accurate accounting and transparent reporting of these activities are crucial for maintaining investor confidence and ensuring the company's overall financial health. Always remember that the complexities of this accounting method can lead to significant adjustments and potentially necessitate consultation with qualified accountants or financial experts for accurate execution.

Latest Posts

Latest Posts

-

The Bureau Of Transportation Statistics Collects Analyzes And Disseminates

Apr 02, 2025

-

Stirring The Mixture Does Which Of The Following Select Two

Apr 02, 2025

-

Comity Is A Doctrine That Is Rooted In

Apr 02, 2025

-

What Material Makes Up Most Of The Structure At A

Apr 02, 2025

-

Selections Made With Replacement Are Considered To Be

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about When Treasury Stock Is Resold At A Price Above Cost . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.