When A Bond Sells At A Premium

Holbox

Mar 17, 2025 · 7 min read

Table of Contents

When a Bond Sells at a Premium: A Comprehensive Guide

Investing in bonds can be a strategic move to diversify your portfolio and achieve financial stability. Understanding the nuances of bond pricing is crucial for making informed investment decisions. One such aspect is when a bond sells at a premium. This comprehensive guide will delve into the intricacies of premium bonds, explaining why they occur, their implications for investors, and how to navigate this aspect of the bond market.

Understanding Bond Basics: Par, Premium, and Discount

Before diving into premium bonds, let's establish a foundational understanding of bond pricing. Bonds are essentially loans you make to a corporation or government. In return for your investment, the issuer promises to pay you regular interest payments (coupons) and repay the principal (face value or par value) at maturity.

-

Par Value: This is the face value of the bond, typically $1,000, which the issuer will pay back at the bond's maturity date.

-

Premium: A bond sells at a premium when its market price is higher than its par value.

-

Discount: Conversely, a bond sells at a discount when its market price is lower than its par value.

Why Bonds Sell at a Premium: The Role of Interest Rates

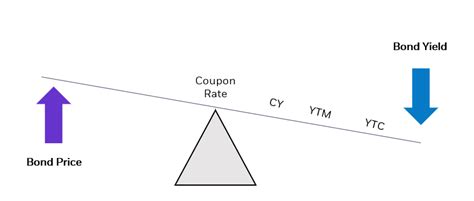

The primary driver behind a bond selling at a premium is the relationship between the bond's coupon rate and the prevailing market interest rates. Let's break this down:

-

Coupon Rate: This is the fixed interest rate stated on the bond, determining the periodic interest payments you'll receive.

-

Market Interest Rates: These are the prevailing interest rates in the broader economy. They fluctuate based on various economic factors, including inflation, central bank policies, and investor sentiment.

When market interest rates fall below a bond's coupon rate, the bond becomes more attractive to investors. Why? Because the bond offers a higher yield than newly issued bonds with lower coupon rates. This increased demand pushes the bond's price up above its par value, resulting in a premium. Investors are essentially willing to pay more to secure the higher yield offered by the existing bond.

Calculating the Premium

The premium amount is simply the difference between the bond's market price and its par value. For example:

- Par Value: $1,000

- Market Price: $1,050

- Premium: $50 ($1,050 - $1,000)

Implications of Buying a Premium Bond

Investing in a premium bond presents both advantages and disadvantages:

Advantages:

-

Higher Current Income: Premium bonds offer a higher coupon payment than bonds selling at par or discount, providing a greater stream of income.

-

Potential for Capital Appreciation (though less likely than with discount bonds): While less probable than with discount bonds, there's a possibility of capital appreciation depending on market fluctuations and changes in interest rates. This is particularly true if interest rates fall further after purchasing the bond.

Disadvantages:

-

Lower Yield to Maturity (YTM): While the coupon rate is higher, the YTM, which accounts for the premium paid, will be lower than the coupon rate. YTM represents the total return an investor can expect if they hold the bond until maturity.

-

Decreased Return Potential: If interest rates rise, the bond's price will likely fall, potentially resulting in a capital loss when the bond is sold before maturity. The premium paid initially reduces the potential for significant capital gains.

-

Duration Risk: Premium bonds generally have longer durations, meaning they are more sensitive to interest rate changes. A rise in interest rates could lead to a greater price decline compared to a bond with a shorter duration.

When to Consider Buying a Premium Bond

Buying a premium bond might be a suitable strategy under specific circumstances:

-

Stable Interest Rate Environment: If you anticipate relatively stable or slightly declining interest rates, a premium bond can provide consistent income with less risk of capital loss.

-

Strong Issuer Credit Rating: Investing in a premium bond from a financially sound issuer (e.g., a blue-chip corporation or government) mitigates the credit risk associated with the bond.

-

Long-Term Investment Horizon: Holding a premium bond until maturity minimizes the impact of potential price fluctuations and ensures receiving the full par value.

-

Income Focus: If your primary investment objective is generating regular income, the higher coupon payments offered by premium bonds can be attractive.

Premium Bonds vs. Discount Bonds: A Comparison

Understanding the differences between premium and discount bonds is essential for strategic portfolio management.

| Feature | Premium Bond | Discount Bond |

|---|---|---|

| Market Price | Higher than par value | Lower than par value |

| Coupon Rate | Higher than market rate | Lower than market rate |

| Yield to Maturity (YTM) | Lower than coupon rate | Higher than coupon rate |

| Capital Appreciation Potential | Lower | Higher |

| Interest Rate Sensitivity | Higher | Lower |

| Income Generation | Higher | Lower |

Analyzing Bond Yields: Understanding YTM and Current Yield

To fully grasp the implications of buying a premium bond, it's crucial to understand the key yield metrics:

-

Current Yield: This is the annual coupon payment divided by the bond's current market price. It provides a snapshot of the bond's income potential. For premium bonds, the current yield will be lower than the coupon rate.

-

Yield to Maturity (YTM): YTM is a more comprehensive measure of a bond's total return, considering the current market price, coupon payments, and the par value received at maturity. For premium bonds, the YTM will be lower than the coupon rate, reflecting the premium already paid.

Factors Influencing Bond Prices Beyond Interest Rates

While interest rate changes are the dominant force driving bond prices, other factors can influence whether a bond trades at a premium, par, or discount:

-

Credit Rating: Bonds issued by companies with higher credit ratings are generally less risky and tend to trade at higher prices, potentially including a premium.

-

Call Provisions: Callable bonds, which can be redeemed by the issuer before maturity, may trade at a premium to reflect the potential for early repayment. However, this also carries the risk of early redemption if interest rates decline.

-

Maturity Date: Bonds with longer maturities are generally more sensitive to interest rate changes and may trade at premiums or discounts based on interest rate expectations.

-

Tax Implications: Tax-exempt municipal bonds may trade at premiums relative to comparable taxable corporate bonds due to their tax advantages.

-

Market Sentiment: General market conditions and investor sentiment can affect bond prices, irrespective of interest rates and other fundamental factors.

Strategies for Managing Premium Bond Investments

Investors holding premium bonds should consider several strategies to manage their investment effectively:

-

Hold to Maturity: The simplest strategy is to hold the bond until its maturity date, guaranteeing repayment of the par value. This minimizes the risk of capital loss due to price fluctuations.

-

Laddered Portfolio: Diversifying investments across bonds with varying maturities (a laddered portfolio) can reduce the overall interest rate risk.

-

Rebalancing: Regularly reviewing and rebalancing your bond portfolio can help maintain the desired asset allocation and risk profile, especially in a changing interest rate environment.

-

Consider Reinvestment: Upon maturity, consider reinvesting the proceeds in other bonds or assets aligned with your investment goals.

Conclusion: Navigating the Premium Bond Market

Understanding when a bond sells at a premium requires a comprehensive grasp of bond pricing mechanics and market dynamics. While premium bonds offer higher current income, they come with lower YTM and increased sensitivity to interest rate fluctuations. Investors should carefully consider their investment goals, risk tolerance, and the prevailing economic environment before investing in premium bonds. By carefully analyzing bond yields, assessing issuer creditworthiness, and employing effective portfolio management strategies, investors can navigate the premium bond market effectively and achieve their desired financial outcomes. Remember, this information is for educational purposes and should not be considered financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Latest Posts

Latest Posts

-

When Using A Self Managed Team A Manager Should

Mar 17, 2025

-

Match Each Definition To The Level Of Protein Structure

Mar 17, 2025

-

A Fixed Position Production Layout Would Be Particularly Recommended If

Mar 17, 2025

-

When Direct Labor Costs Are Recorded

Mar 17, 2025

-

In Prompt Engineering Why It Is Important To Specify

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about When A Bond Sells At A Premium . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.