What Is A Classified Balance Sheet

Holbox

Mar 09, 2025 · 6 min read

Table of Contents

What is a Classified Balance Sheet? A Comprehensive Guide

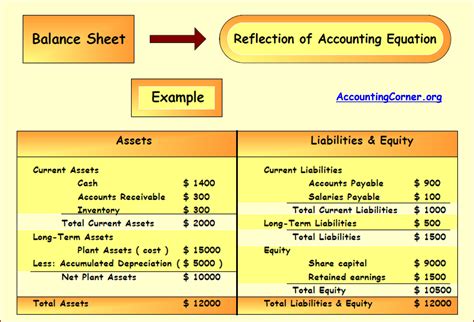

The balance sheet, a cornerstone of financial statements, provides a snapshot of a company's financial position at a specific point in time. However, a standard balance sheet, simply listing assets, liabilities, and equity, can be overwhelming and difficult to interpret. This is where the classified balance sheet comes in. It's a more organized and insightful version, categorizing assets and liabilities to offer a clearer understanding of a company's financial health and structure. This comprehensive guide will delve into the intricacies of a classified balance sheet, explaining its components, benefits, and limitations.

Understanding the Structure of a Classified Balance Sheet

Unlike a simple balance sheet, a classified balance sheet groups similar items together, enhancing readability and analysis. The basic structure follows a consistent format:

- Assets: These are what a company owns, categorized by liquidity (how quickly they can be converted to cash).

- Liabilities: These are what a company owes to others. They are also categorized by maturity (when they are due).

- Equity: This represents the owners' stake in the company.

Let's examine each section in more detail:

Assets: A Closer Look

Assets are categorized into several sub-categories based on their liquidity:

-

Current Assets: These are assets expected to be converted into cash, sold, or used up within one year or the company's operating cycle, whichever is longer. Common current assets include:

- Cash and Cash Equivalents: This includes readily available cash, bank balances, and short-term, highly liquid investments.

- Accounts Receivable: Money owed to the company by customers for goods or services sold on credit.

- Inventory: Goods held for sale in the ordinary course of business. This can include raw materials, work-in-progress, and finished goods.

- Prepaid Expenses: Expenses paid in advance, such as insurance premiums or rent.

-

Non-Current Assets (Long-term Assets): These assets are expected to provide economic benefits for more than one year. These typically include:

- Property, Plant, and Equipment (PP&E): Tangible assets used in the company's operations, such as land, buildings, machinery, and equipment. These are usually depreciated over their useful lives.

- Intangible Assets: Non-physical assets with economic value, such as patents, copyrights, trademarks, and goodwill. These are often amortized over their useful lives.

- Long-term Investments: Investments in other companies or securities that are not expected to be liquidated within the next year.

Liabilities: Understanding Obligations

Liabilities are also categorized based on their maturity:

-

Current Liabilities: These are obligations that are expected to be settled within one year or the operating cycle. Examples include:

- Accounts Payable: Money owed to suppliers for goods or services purchased on credit.

- Salaries Payable: Wages owed to employees.

- Interest Payable: Interest owed on loans or other debt instruments.

- Short-term Loans Payable: Loans that are due within one year.

- Current Portion of Long-term Debt: The portion of long-term debt that is due within the next year.

-

Non-Current Liabilities (Long-term Liabilities): These are obligations that are due beyond one year. Examples include:

- Long-term Loans Payable: Loans with a maturity date beyond one year.

- Bonds Payable: Debt securities issued by the company.

- Deferred Revenue: Revenue received in advance for goods or services yet to be delivered.

Equity: The Owners' Stake

Equity represents the residual interest in the assets of a company after deducting its liabilities. For corporations, this typically includes:

- Common Stock: Represents the ownership shares held by the company's shareholders.

- Retained Earnings: Accumulated profits that have not been distributed as dividends.

- Treasury Stock: Company's own stock that has been repurchased.

- Other Comprehensive Income: Gains and losses that are not included in net income, such as unrealized gains or losses on investments.

Benefits of Using a Classified Balance Sheet

The classified balance sheet offers several key advantages over a simple balance sheet:

-

Improved Readability and Understanding: The categorization of assets and liabilities makes the balance sheet easier to read and understand, even for those without extensive accounting knowledge.

-

Enhanced Financial Analysis: The classified format facilitates financial ratio analysis. By grouping similar items, analysts can easily calculate key ratios like the current ratio, quick ratio, and debt-to-equity ratio, providing insights into liquidity, solvency, and financial leverage.

-

Better Decision Making: The improved understanding of a company's financial position enables better decision-making by investors, creditors, and management. Investors can assess the company's risk profile, while creditors can evaluate its creditworthiness. Management can use the information to identify areas for improvement and strategic planning.

-

Comparative Analysis: Classifying balance sheets allows for easier comparison of financial performance over time or across different companies in the same industry. This comparative analysis provides valuable insights into trends and potential issues.

-

Compliance and Reporting: Many regulatory bodies require companies to present classified balance sheets in their financial reports, ensuring transparency and consistency in financial reporting practices.

Limitations of a Classified Balance Sheet

While the classified balance sheet offers many benefits, it does have some limitations:

-

Subjectivity in Classification: Some items may not fit neatly into a specific category, leading to some subjectivity in classification. For instance, certain assets might have characteristics of both current and non-current assets.

-

Historical Information: The balance sheet provides a snapshot of a company's financial position at a specific point in time. It does not reflect the dynamic nature of a business's financial activities throughout the entire reporting period.

-

Lack of Qualitative Information: The balance sheet primarily presents quantitative data. It does not capture important qualitative factors, such as management quality, employee morale, and brand reputation, which can significantly impact a company's performance.

-

Potential for Manipulation: While accounting standards aim to minimize manipulation, there's always a possibility that companies might use accounting techniques to present a more favorable picture of their financial position. This requires careful scrutiny of the financial statements and potentially an audit.

Analyzing a Classified Balance Sheet: Key Ratios

Analyzing a classified balance sheet involves calculating various financial ratios to gain a deeper understanding of a company's financial health. Some key ratios include:

-

Current Ratio: (Current Assets / Current Liabilities) - Measures a company's ability to pay its short-term obligations. A higher ratio indicates better liquidity.

-

Quick Ratio (Acid-Test Ratio): ((Current Assets - Inventory) / Current Liabilities) - A more stringent measure of liquidity, excluding inventory which may not be easily converted to cash.

-

Debt-to-Equity Ratio: (Total Debt / Total Equity) - Measures the proportion of a company's financing from debt versus equity. A higher ratio indicates greater financial risk.

-

Working Capital: (Current Assets - Current Liabilities) - Represents the difference between current assets and current liabilities. Positive working capital suggests the company has sufficient resources to meet its short-term obligations.

Conclusion: The Importance of the Classified Balance Sheet

The classified balance sheet is a crucial tool for understanding a company's financial position. Its structured format enhances readability, facilitates financial analysis, and supports better decision-making. By categorizing assets and liabilities, it offers a clearer and more insightful picture than a simple balance sheet. While it has limitations, such as subjectivity and the absence of qualitative information, its advantages significantly outweigh its drawbacks. Understanding the classified balance sheet and its associated ratios is essential for investors, creditors, and management alike, allowing them to make informed decisions based on a comprehensive understanding of a company's financial health. The ability to interpret this vital financial statement is a key skill in navigating the complex world of finance. Remember to always consider the balance sheet in conjunction with other financial statements, such as the income statement and cash flow statement, for a truly comprehensive view of a company's financial performance.

Latest Posts

Latest Posts

-

What Is 2 And 1 2 As A Decimal

Mar 10, 2025

-

What Is 58 Degrees Fahrenheit In Celsius

Mar 10, 2025

-

How Many Inches Are In 6 Feet

Mar 10, 2025

-

How Many Valence Electrons Does Zn Have

Mar 10, 2025

-

How Do You Say Go To In Spanish

Mar 10, 2025

Related Post

Thank you for visiting our website which covers about What Is A Classified Balance Sheet . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.