What Determines Market Price And Equilibrium Output In A Market

Holbox

Mar 29, 2025 · 6 min read

Table of Contents

- What Determines Market Price And Equilibrium Output In A Market

- Table of Contents

- What Determines Market Price and Equilibrium Output in a Market?

- The Foundation: Supply and Demand

- Demand: The Consumer's Perspective

- Supply: The Producer's Perspective

- Equilibrium: Where Supply Meets Demand

- Achieving Equilibrium

- Market Structures and Their Impact

- Perfect Competition

- Monopoly

- Monopolistic Competition

- Oligopoly

- External Factors: Shifting the Curves

- Conclusion: A Dynamic System

- Latest Posts

- Latest Posts

- Related Post

What Determines Market Price and Equilibrium Output in a Market?

Understanding how market prices and equilibrium outputs are determined is fundamental to economics. It's the bedrock upon which many economic theories and models are built. This comprehensive guide delves deep into the intricate interplay of supply and demand, exploring the factors that influence these forces and ultimately shape the market outcome. We'll examine various market structures and consider the impact of external factors, ultimately providing a robust understanding of this critical economic concept.

The Foundation: Supply and Demand

The cornerstone of market price and equilibrium output determination is the interaction of supply and demand.

Demand: The Consumer's Perspective

Demand reflects the consumer's desire and ability to purchase a good or service at a given price. Several factors influence the demand curve:

-

Price of the good: This is the most crucial factor. As the price of a good decreases, the quantity demanded generally increases (and vice versa), demonstrating the law of demand. This inverse relationship is depicted as a downward-sloping demand curve.

-

Price of related goods: The demand for a good can be affected by the prices of related goods. Substitute goods are those that can be used in place of one another (e.g., Coke and Pepsi). If the price of a substitute rises, the demand for the original good increases. Complementary goods are those that are consumed together (e.g., cars and gasoline). If the price of a complement rises, the demand for the original good falls.

-

Consumer income: The demand for most goods is positively related to consumer income. As income rises, consumers can afford to buy more (normal goods). However, for some goods (inferior goods), demand falls as income rises (e.g., instant noodles).

-

Consumer tastes and preferences: Changes in consumer preferences, influenced by trends, advertising, or cultural shifts, can significantly affect demand. A popular new product will see a surge in demand, while a product falling out of favor will experience a decline.

-

Consumer expectations: Anticipations about future prices or availability can impact current demand. If consumers expect prices to rise, they may buy more now, leading to increased current demand.

Supply: The Producer's Perspective

Supply represents the producer's willingness and ability to offer a good or service at a given price. Factors influencing the supply curve include:

-

Price of the good: Like demand, price is the most significant factor influencing supply. As the price of a good rises, producers are incentivized to offer more (and vice versa), illustrating the law of supply. This positive relationship is depicted by an upward-sloping supply curve.

-

Price of inputs: The cost of production, including raw materials, labor, and capital, directly impacts the supply. Higher input prices increase production costs, leading to a decrease in supply at any given price.

-

Technology: Technological advancements can enhance production efficiency, lowering costs and increasing supply. Improved technology allows producers to create more output with the same or fewer resources.

-

Government policies: Taxes, subsidies, and regulations influence the supply. Taxes increase production costs, reducing supply. Subsidies lower production costs, increasing supply. Regulations can either increase or decrease supply depending on their nature.

-

Producer expectations: Similar to consumer expectations, producer expectations regarding future prices can influence current supply. If producers anticipate higher future prices, they may withhold some of their current supply, hoping to sell at a higher price later.

Equilibrium: Where Supply Meets Demand

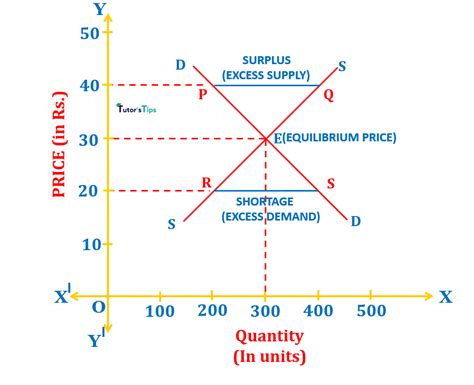

The market equilibrium is the point where the supply and demand curves intersect. At this point, the quantity supplied equals the quantity demanded. This intersection determines the equilibrium price (the market-clearing price) and the equilibrium quantity (the market-clearing quantity).

Achieving Equilibrium

The market mechanism, driven by price adjustments, facilitates the movement towards equilibrium. If the price is above the equilibrium price (a surplus exists), there's more supply than demand. Producers will lower prices to sell their excess inventory, bringing the market closer to equilibrium. Conversely, if the price is below the equilibrium price (a shortage exists), demand exceeds supply. Producers will raise prices to capitalize on high demand, moving the market towards equilibrium.

Market Structures and Their Impact

The market structure significantly impacts price and output determination. Different structures exhibit varying degrees of competition and seller control:

Perfect Competition

Characterized by many buyers and sellers, homogeneous products, free entry and exit, and perfect information, perfect competition results in the most efficient allocation of resources. The market price is determined solely by the interaction of supply and demand; individual firms have no power to influence the price. Equilibrium output is determined at the point where marginal cost equals marginal revenue (which equals price).

Monopoly

A monopoly exists when a single firm dominates the market, possessing significant control over price and output. Monopolies restrict output to maximize profits, resulting in higher prices and lower quantities compared to perfect competition. The equilibrium price and quantity are determined by the monopolist's cost structure and demand curve, often resulting in a socially inefficient outcome (deadweight loss).

Monopolistic Competition

This market structure features many firms selling differentiated products. Firms have some degree of control over price, but less than in a monopoly. Product differentiation allows for some degree of market segmentation and price variation. Equilibrium price and quantity are determined by the interaction of supply and demand for each firm's specific product.

Oligopoly

An oligopoly involves a few dominant firms, often characterized by significant barriers to entry. Firms' decisions are interdependent, meaning that each firm's actions affect the others. The equilibrium price and output are complex and depend on factors such as the firms' strategies, level of collusion (or competition), and the demand elasticity.

External Factors: Shifting the Curves

Beyond the inherent forces of supply and demand, external factors can shift the curves, altering the equilibrium price and quantity:

-

Changes in consumer income: Increased income shifts the demand curve to the right for normal goods, increasing both price and quantity.

-

Government regulations: Environmental regulations can shift the supply curve to the left, increasing price and reducing quantity.

-

Technological advancements: Technological improvements shift the supply curve to the right, reducing price and increasing quantity.

-

Natural disasters: Natural disasters can disrupt supply chains, shifting the supply curve to the left, increasing price and reducing quantity.

-

Economic shocks (recessions, booms): Recessions reduce consumer spending, shifting the demand curve to the left. Booms increase consumer spending, shifting the demand curve to the right.

-

Changes in expectations: Shifting consumer or producer expectations can shift both the demand and supply curves, leading to a complex interplay of changes in price and quantity.

Conclusion: A Dynamic System

The determination of market price and equilibrium output is a dynamic process, constantly influenced by the interplay of supply and demand and a host of external factors. Understanding these forces, and the different market structures within which they operate, is critical for comprehending how markets function and how prices and quantities are ultimately determined. While models offer a simplified representation of reality, they provide a crucial framework for analyzing market behavior and making informed predictions about economic outcomes. Further research into specific market dynamics, econometric modelling, and behavioral economics can offer even deeper insights into the intricacies of price and output determination. The continuous evolution of markets underscores the need for ongoing analysis and adaptation of these fundamental principles.

Latest Posts

Latest Posts

-

A First Course In Differential Equations Dennis Zill

Apr 02, 2025

-

Sports In American History 3rd Edition

Apr 02, 2025

-

Correctly Label The Anatomical Features Of A Neuromuscular Junction

Apr 02, 2025

-

Labor Costs Charged To Manufacturing Overhead Represent

Apr 02, 2025

-

Match The Fungal Structure With Its Description

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about What Determines Market Price And Equilibrium Output In A Market . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.