Two Main Inventory Accounting Systems Are The

Holbox

Mar 21, 2025 · 7 min read

Table of Contents

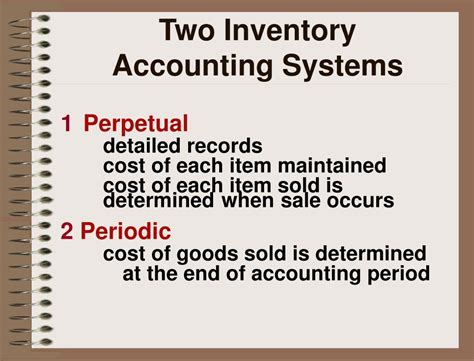

Two Main Inventory Accounting Systems Are the: A Deep Dive into Periodic and Perpetual Methods

Inventory management is the backbone of any successful business, regardless of size or industry. Accurate tracking of inventory directly impacts profitability, operational efficiency, and ultimately, the bottom line. Two primary accounting systems govern how businesses account for their inventory: the periodic inventory system and the perpetual inventory system. Understanding the differences between these systems is crucial for selecting the right method for your business and ensuring accurate financial reporting.

Periodic Inventory System: A Snapshot in Time

The periodic inventory system, as the name suggests, updates inventory levels periodically, typically at the end of an accounting period (e.g., monthly, quarterly, or annually). It's a simpler system, often favored by small businesses with limited inventory or those dealing with low-value goods. However, its simplicity comes at a cost – a lack of real-time inventory data.

How it Works:

-

Beginning Inventory: The process begins with the recorded value of inventory at the start of the accounting period. This is usually the ending inventory from the previous period.

-

Purchases: Throughout the period, all purchases of inventory are recorded in a separate purchases account. This account tracks the cost of goods acquired but doesn't adjust the inventory balance until the end of the period.

-

Cost of Goods Sold (COGS) Calculation: At the end of the period, a physical inventory count is conducted to determine the ending inventory. The COGS is then calculated using the following formula:

Beginning Inventory + Purchases – Ending Inventory = Cost of Goods Sold

-

Financial Statement Reporting: The calculated COGS is then reported on the income statement, affecting the gross profit and ultimately the net income. The ending inventory is reported on the balance sheet as a current asset.

Advantages of Periodic Inventory System:

- Simplicity and Low Cost: Requires less sophisticated technology and fewer resources to implement and maintain.

- Suitable for Small Businesses: Ideal for businesses with smaller inventory volumes and less frequent transactions.

- Less Data Entry: Reduces the need for constant data entry compared to the perpetual system.

Disadvantages of Periodic Inventory System:

- Lack of Real-Time Data: Provides no real-time visibility into inventory levels, potentially leading to stockouts or overstocking.

- Inaccurate Inventory Records: Relies on a physical count, which can be time-consuming, prone to errors, and disruptive to operations.

- Difficult to Identify Shrinkage: Makes it challenging to promptly detect and address inventory shrinkage due to theft, damage, or obsolescence.

- Limited Management Insights: Offers limited insights into inventory turnover rates, demand forecasting, and other crucial operational metrics.

Perpetual Inventory System: A Continuous Update

In contrast to the periodic system, the perpetual inventory system provides real-time tracking of inventory levels. Every purchase, sale, and adjustment is recorded immediately, resulting in a continuously updated inventory balance. Larger businesses with high inventory turnover rates frequently adopt this system.

How it Works:

-

Inventory Tracking: The system tracks inventory levels using various methods, often integrating with point-of-sale (POS) systems, barcode scanners, or inventory management software. Each transaction is recorded, updating the inventory balance instantly.

-

Cost of Goods Sold (COGS) Calculation: COGS is automatically calculated each time a sale is made. This real-time calculation offers immediate insights into profitability.

-

Automated Inventory Adjustments: The system automatically adjusts inventory levels for returns, damages, and other adjustments.

-

Real-Time Reporting: Provides real-time data on inventory levels, COGS, and other key metrics. This data can be used for improved decision-making, forecasting, and efficient inventory management.

Advantages of Perpetual Inventory System:

- Real-Time Inventory Visibility: Offers constant awareness of inventory levels, enabling better stock management and preventing stockouts.

- Improved Accuracy: Minimizes errors by automatically updating inventory levels after each transaction.

- Efficient Inventory Control: Facilitates better control over inventory shrinkage and helps identify discrepancies early.

- Enhanced Decision-Making: Provides real-time data for informed decisions regarding purchasing, production, and pricing.

- Better Forecasting: Enables more accurate sales forecasting and production planning.

- Streamlined Operations: Automates many inventory-related tasks, streamlining operational efficiency.

Disadvantages of Perpetual Inventory System:

- Higher Initial Cost: Requires investment in software and technology, potentially increasing implementation costs.

- Complexity: More complex to set up and maintain than a periodic system, requiring specialized training and expertise.

- Potential for Data Errors: While less prone to errors than manual counting, data entry errors are still possible, potentially affecting accuracy.

- Ongoing Maintenance: Requires ongoing maintenance and updates to ensure system accuracy and efficiency.

Choosing the Right System: Factors to Consider

The choice between a periodic and perpetual inventory system depends on several crucial factors:

-

Business Size and Complexity: Small businesses with low inventory turnover often find the periodic system sufficient, while larger enterprises with extensive inventory benefit from the real-time data of the perpetual system.

-

Inventory Value and Volume: The value and volume of inventory directly impact the need for real-time tracking. High-value or high-volume inventory usually requires a perpetual system.

-

Budget and Resources: The perpetual system demands a higher initial investment in software and technology, as well as ongoing maintenance costs. Businesses with limited budgets may opt for the periodic system.

-

Industry and Regulations: Certain industries (e.g., pharmaceuticals, food and beverage) may have strict regulatory requirements that necessitate precise inventory tracking, often favoring the perpetual system.

-

Management Information Needs: The need for real-time data and detailed inventory insights influences system selection. Businesses requiring detailed reporting and analysis usually choose the perpetual system.

Cost of Goods Sold (COGS) Calculation: A Deeper Look

Regardless of the chosen inventory system, accurately calculating the COGS is critical for financial reporting. Here's a detailed breakdown:

Periodic System:

As discussed earlier, COGS is calculated at the end of the period using the formula:

Beginning Inventory + Purchases – Ending Inventory = Cost of Goods Sold

This calculation requires a physical inventory count to determine the ending inventory. The cost of goods purchased includes all costs directly associated with acquiring the inventory, such as purchase price, freight-in, and import duties.

Perpetual System:

In a perpetual system, COGS is calculated continuously with each sale. Different cost flow assumptions (FIFO, LIFO, weighted-average) affect the COGS calculation. Let's examine these briefly:

-

First-In, First-Out (FIFO): Assumes that the oldest inventory items are sold first. This method results in a higher ending inventory value during periods of inflation.

-

Last-In, First-Out (LIFO): Assumes that the newest inventory items are sold first. This method leads to a lower ending inventory value during periods of inflation and can result in lower tax liabilities. LIFO is not permitted under IFRS (International Financial Reporting Standards).

-

Weighted-Average Cost: Calculates the average cost of all inventory items and uses this average cost to determine the COGS for each sale. This method simplifies calculations but may not reflect the actual cost of goods sold.

Inventory Management Software: A Modern Approach

Modern inventory management software plays a crucial role in enhancing inventory accounting, regardless of the chosen system. These software solutions automate many aspects of inventory management, improving efficiency, accuracy, and data-driven decision-making. They integrate with POS systems, track inventory levels in real-time, generate reports, and assist in forecasting demand.

Features to look for in inventory management software include:

- Real-time inventory tracking: Enables continuous monitoring of inventory levels.

- Automated purchase order generation: Streamlines the purchasing process.

- Barcode and RFID integration: Improves accuracy and efficiency in inventory tracking.

- Sales forecasting: Helps predict future demand and optimize inventory levels.

- Reporting and analytics: Provides detailed reports on inventory performance, COGS, and other key metrics.

- Integration with accounting software: Seamlessly integrates with existing accounting systems for accurate financial reporting.

Conclusion: Choosing the Right System for Your Success

Choosing between a periodic and perpetual inventory system requires careful consideration of various factors, including business size, inventory complexity, budget, and regulatory requirements. Understanding the strengths and weaknesses of each system is crucial for making an informed decision that aligns with your business needs and optimizes financial reporting accuracy. Implementing efficient inventory management practices, supported by appropriate software, is vital for maintaining a healthy bottom line and achieving long-term business success. The right system, coupled with a strong understanding of COGS calculation and cost flow assumptions, will pave the way for accurate financial reporting and informed decision-making. Investing in the right inventory management strategy is not just an accounting matter—it's a strategic investment in the future of your business.

Latest Posts

Latest Posts

Related Post

Thank you for visiting our website which covers about Two Main Inventory Accounting Systems Are The . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.