The Term Permanent Current Assets Implies

Holbox

Mar 29, 2025 · 7 min read

Table of Contents

- The Term Permanent Current Assets Implies

- Table of Contents

- The Term Permanent Current Assets Implies: A Deep Dive into Long-Term Current Asset Management

- Understanding Current Assets: The Basics

- What are Permanent Current Assets?

- Why Maintain Permanent Current Assets?

- Determining the Level of Permanent Current Assets

- The Implications of Ignoring Permanent Current Assets

- Permanent Current Assets in Financial Statements

- Permanent Current Assets and Financing Decisions

- Permanent Current Assets and Budgeting

- Permanent Current Assets and Financial Risk Management

- Permanent Current Assets and Business Strategy

- Analyzing Permanent Current Assets: Key Ratios and Metrics

- Conclusion: Strategic Significance of Permanent Current Assets

- Latest Posts

- Latest Posts

- Related Post

The Term Permanent Current Assets Implies: A Deep Dive into Long-Term Current Asset Management

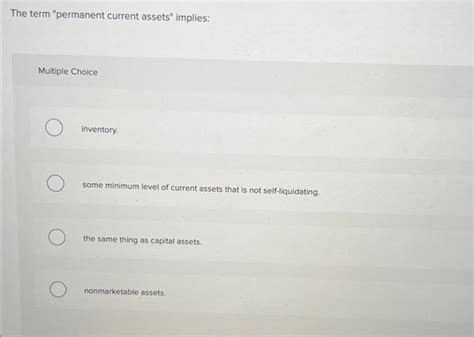

The term "permanent current assets" might seem like an oxymoron. After all, "current assets" are, by definition, assets expected to be converted into cash within a year. How can something be both permanent and current? The key lies in understanding the nuances of working capital management and the strategic implications of maintaining a certain level of current assets even during periods of low sales or production. This article delves into the concept of permanent current assets, exploring its implications for financial planning, budgeting, and overall business strategy.

Understanding Current Assets: The Basics

Before dissecting the concept of permanent current assets, let's establish a firm understanding of what current assets are. These are short-term assets readily convertible into cash within one operating cycle (usually one year). They typically include:

- Cash and Cash Equivalents: This encompasses readily available funds, short-term investments, and money market instruments.

- Accounts Receivable: Money owed to the company by customers for goods or services sold on credit.

- Inventory: Raw materials, work-in-progress, and finished goods held for sale.

- Prepaid Expenses: Payments made in advance for services or goods that will benefit future periods.

What are Permanent Current Assets?

Permanent current assets represent the minimum level of current assets a company needs to maintain its day-to-day operations, regardless of seasonal or cyclical fluctuations in sales. They represent a base level of inventory, accounts receivable, and cash necessary to sustain operations even during periods of low demand. Think of it as the "floor" below which current assets should not fall.

This contrasts with temporary current assets, which fluctuate with sales volume. For instance, inventory levels might spike during peak seasons and then decline afterward. Permanent current assets, however, remain relatively constant.

Why Maintain Permanent Current Assets?

The strategic rationale behind maintaining permanent current assets stems from several key factors:

- Maintaining Operational Efficiency: A sufficient level of inventory ensures smooth production and prevents costly production stoppages. Similarly, maintaining adequate cash reserves prevents liquidity crises and allows for timely payment of suppliers and employees.

- Meeting Customer Demand: Holding a certain level of inventory allows companies to meet unexpected surges in demand and avoid lost sales opportunities. Similarly, efficient accounts receivable management ensures timely payments from customers.

- Taking Advantage of Purchasing Opportunities: Maintaining a healthy cash balance enables companies to take advantage of bulk purchasing discounts or other favorable supplier terms.

- Reducing Costs: While maintaining permanent current assets involves some investment, it often leads to significant cost savings by avoiding stockouts, production delays, and the associated disruption to operations.

- Protecting Creditworthiness: Adequate levels of current assets enhance a company's creditworthiness and borrowing capacity, offering more flexibility in financing operations.

Determining the Level of Permanent Current Assets

Determining the optimal level of permanent current assets requires careful analysis and consideration of several factors:

- Sales Forecasts: Accurate sales projections are crucial in determining the level of inventory needed to meet anticipated demand.

- Production Cycles: Longer production cycles require higher levels of raw materials and work-in-progress inventory.

- Collection Periods: The time it takes to collect payments from customers impacts the required level of accounts receivable.

- Payment Terms: Negotiated terms with suppliers affect the level of cash required for timely payments.

- Economic Conditions: General economic conditions and industry trends influence demand and supply chain dynamics, impacting the need for permanent current assets.

- Financial Risk Tolerance: A company’s risk appetite plays a crucial role in determining the level of cash reserves to maintain.

The Implications of Ignoring Permanent Current Assets

Failing to account for permanent current assets in financial planning can lead to several negative consequences:

- Stockouts and Lost Sales: Insufficient inventory can lead to lost sales and damage to customer relationships.

- Production Delays: A lack of raw materials can disrupt production, resulting in lost output and higher costs.

- Liquidity Problems: Insufficient cash reserves can lead to difficulty in meeting short-term obligations, potentially causing financial distress.

- Damaged Credit Rating: Consistent inability to meet payment obligations can lead to a damaged credit rating, making it more difficult to secure future financing.

Permanent Current Assets in Financial Statements

Permanent current assets aren't explicitly identified as a separate line item on financial statements. However, analysts can infer their level by analyzing trends in current assets over time, considering seasonal variations, and comparing them to sales figures and industry benchmarks. A relatively stable level of current assets, even during periods of low sales, suggests the presence of a significant permanent component.

Permanent Current Assets and Financing Decisions

The need to maintain permanent current assets has significant implications for financing decisions. Companies might need to secure long-term financing to fund these assets, as short-term financing might prove inadequate or overly expensive. Analyzing the cost of various financing options, such as term loans or lines of credit, is crucial for optimal management of permanent current assets.

Permanent Current Assets and Budgeting

Effective budgeting requires accurate forecasting of permanent current asset needs. Ignoring this component can lead to inaccurate budget projections and financial planning. A robust budgeting process should incorporate estimates of permanent current assets, taking into account seasonal variations and long-term growth projections.

Permanent Current Assets and Financial Risk Management

The management of permanent current assets is intrinsically linked to financial risk management. Maintaining adequate levels of these assets reduces the risk of liquidity crises and operational disruptions. However, excessive holdings of permanent current assets can tie up capital that could be used for more profitable investments. Therefore, striking a balance between maintaining sufficient levels of permanent current assets and optimizing capital allocation is vital for minimizing financial risks.

Permanent Current Assets and Business Strategy

The optimal level of permanent current assets is not a static number but rather a strategic decision influenced by a company's overall business strategy, growth plans, and risk tolerance. Companies with aggressive growth strategies might choose to maintain higher levels of permanent current assets to support expansion, while more conservative businesses might opt for lower levels. Regular review and adjustment of the permanent current asset level are essential as business conditions evolve.

Analyzing Permanent Current Assets: Key Ratios and Metrics

While no single ratio explicitly measures permanent current assets, several financial ratios can help assess the efficiency and effectiveness of current asset management and infer the presence and size of the permanent component:

- Current Ratio: A basic liquidity ratio (Current Assets / Current Liabilities). A consistently high current ratio, even during slow periods, might suggest a higher level of permanent current assets. However, it doesn't isolate the permanent component.

- Quick Ratio (Acid-Test Ratio): (Current Assets - Inventory) / Current Liabilities. This ratio provides a more conservative measure of liquidity, excluding inventory, which can be less liquid than other current assets. A consistently high quick ratio, even during slow periods, is another indicator.

- Inventory Turnover Ratio: Cost of Goods Sold / Average Inventory. A low inventory turnover ratio might indicate excessive inventory holdings, which could include a significant permanent component.

- Days Sales Outstanding (DSO): (Accounts Receivable / Credit Sales) * Number of Days. A consistently high DSO might suggest problems with collecting payments, leading to a higher than necessary level of permanent accounts receivable.

- Cash Conversion Cycle: Measures the time it takes to convert inventory into cash. A shorter cycle indicates efficient management of current assets, suggesting optimized permanent asset levels.

Conclusion: Strategic Significance of Permanent Current Assets

The concept of permanent current assets is a crucial element in effective working capital management. While not explicitly recognized on financial statements, understanding this concept is vital for accurate financial planning, budgeting, and risk management. Determining the appropriate level of permanent current assets requires careful consideration of several factors, including sales forecasts, production cycles, and payment terms. By strategically managing permanent current assets, companies can enhance operational efficiency, reduce financial risks, and improve overall profitability. Regular monitoring and adjustment of this crucial component are essential for sustained success in any business.

Latest Posts

Latest Posts

-

Draw The Correct Product For The Given Diels Alder Reaction

Apr 01, 2025

-

Match Each Example Below To The Correct Cost Type

Apr 01, 2025

-

Developing Person Through Childhood And Adolescence

Apr 01, 2025

-

The Following Picture Would Be Best Described As

Apr 01, 2025

-

Match Each Term With The Correct Definition

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about The Term Permanent Current Assets Implies . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.