The Tax In Cell F2 Must Be Applied

Holbox

Mar 10, 2025 · 6 min read

Table of Contents

The Tax in Cell F2 Must Be Applied: A Comprehensive Guide to Accurate Tax Calculation and Reporting

The seemingly simple phrase, "The tax in cell F2 must be applied," hides a multitude of complexities. Accurate tax calculation is crucial for individuals, businesses, and governments alike. This statement, often found within spreadsheets or accounting software, underscores the critical role of precise data entry and formula application in ensuring compliance and avoiding costly errors. This comprehensive guide will delve into the multifaceted aspects of applying taxes correctly, covering everything from understanding tax rates and structures to troubleshooting common issues and employing best practices.

Understanding the Context: What Does "The Tax in Cell F2" Refer To?

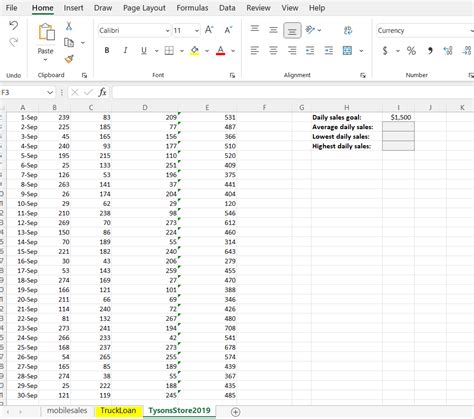

Before diving into the mechanics of applying the tax, we must first understand the context. Cell F2, in this instance, represents a cell within a spreadsheet or database designed to hold a specific tax value. This value could be:

- A fixed tax amount: A predetermined sum, possibly representing a flat tax or a specific levy.

- A calculated tax rate: A percentage derived from a formula, often based on a taxable income or transaction value found in other cells. This rate is then multiplied by the taxable amount to determine the tax.

- A lookup value: The tax could be derived from a lookup table, pulling the appropriate tax rate or amount based on criteria such as income brackets, location, or goods/services.

Regardless of how the value in cell F2 is obtained, its accurate application is paramount. Incorrect values lead to inaccurate financial reporting, potential legal issues, and financial losses.

Methods of Applying the Tax in Cell F2

There are several ways to apply the tax value from cell F2 to calculate the total cost or assessable income. The choice depends on the context and the desired outcome.

1. Direct Addition: Simple and Transparent

If cell F2 contains a fixed tax amount, the simplest method is direct addition. Let's assume cell E2 contains the pre-tax amount. The total amount, including tax, can be calculated in cell G2 using the following formula:

=E2+F2

This formula directly adds the pre-tax amount (E2) and the tax amount (F2), providing a clear and easily auditable calculation.

2. Multiplication for Percentage-Based Taxes: More Versatile

When cell F2 contains a tax rate (expressed as a decimal, e.g., 0.06 for 6%), the tax is calculated by multiplying the pre-tax amount by the tax rate. The formula in cell G2 would then be:

=E2*(1+F2)

This formula first calculates the tax (E2*F2) and then adds it to the pre-tax amount (E2). The (1+F2) part efficiently combines both steps into a single calculation.

3. Using VLOOKUP or INDEX/MATCH for Complex Tax Structures: Handling Multiple Brackets

Many tax systems use progressive tax brackets, where the tax rate changes depending on the taxable income. In such cases, using functions like VLOOKUP or INDEX/MATCH becomes necessary. These functions look up the appropriate tax rate from a table based on the taxable income in cell E2.

For example, a VLOOKUP formula might look like this:

=E2*(1+VLOOKUP(E2,TaxTable,2,TRUE))

Where:

E2is the taxable income.TaxTableis a named range containing the tax brackets and corresponding rates.2specifies the column containing the tax rate withinTaxTable.TRUEensures approximate match within the tax brackets.

The INDEX/MATCH combination offers more flexibility and control, especially when dealing with non-contiguous tax brackets.

4. Nested IF Statements: Handling Specific Scenarios

For very specific tax rules or exceptions, nested IF statements can be used. However, this approach can become complex and difficult to maintain for many scenarios. It's generally preferable to use lookup tables when possible for scalability and clarity.

Error Handling and Data Validation: Ensuring Accuracy

Preventing errors is just as important as applying the formula correctly. Here are some essential steps:

-

Data Validation: Implement data validation in cells E2 and F2 to restrict input to appropriate data types (numbers, percentages) and ranges. This prevents incorrect data entry, such as text or negative values.

-

Error Checking: Use functions like

ISERROR,IFERROR, orIFto check for errors and handle them appropriately. For example,IFERRORcan return a user-friendly message if a calculation results in an error, preventing unexpected results. -

Auditing: Regularly audit your spreadsheet or database to ensure data accuracy. Compare calculated values against manually calculated examples to detect discrepancies. Regular checks catch errors early, minimizing the risk of cascading errors.

-

Comments and Documentation: Add comments to your formulas to explain their purpose and logic. Well-documented spreadsheets are easier to understand, maintain, and audit.

Beyond the Spreadsheet: Real-World Applications

The principle of applying a tax value, similar to the "tax in cell F2," extends far beyond simple spreadsheets. It’s fundamental to various accounting and financial systems:

-

Accounting Software: Most accounting software packages automatically handle tax calculations based on predefined tax rates and rules. However, understanding the underlying principles remains crucial for accurate data entry and result interpretation.

-

Tax Preparation Software: Tax preparation software uses complex algorithms to calculate taxes based on individual circumstances. While automated, understanding the tax forms and underlying calculations is still essential for accuracy and error detection.

-

Government Systems: Government agencies use sophisticated systems to calculate and collect taxes. These systems often incorporate complex rules and regulations, highlighting the importance of accurate data and reliable systems.

-

E-commerce Platforms: Online marketplaces and e-commerce platforms often automate tax calculations based on the customer's location and the applicable tax rates.

Advanced Considerations: Indirect Taxes, Tax Deductions, and More

The scenario of applying "the tax in cell F2" simplifies the tax calculation process. Real-world tax calculations are frequently far more complex, incorporating additional elements:

-

Indirect Taxes: Sales tax, VAT, or GST are levied on transactions rather than directly on income. These require different calculation methods.

-

Tax Deductions: Allowable deductions reduce the taxable income, requiring additional calculations before applying the tax rate.

-

Tax Credits: Tax credits directly reduce the tax liability, requiring separate calculations to determine the final tax amount.

-

Progressive Tax Systems: As mentioned earlier, progressive systems with multiple tax brackets necessitate more advanced formulas like

VLOOKUPorINDEX/MATCH. -

International Taxation: International transactions introduce further complexities, involving multiple tax jurisdictions and varying tax rates.

Conclusion: The Importance of Precision in Tax Calculation

The statement, "The tax in cell F2 must be applied," highlights the fundamental importance of precise tax calculation. Whether dealing with a simple addition or a complex formula involving multiple tax brackets, accuracy is paramount. Implementing robust error handling, data validation, and regular auditing ensures reliable results, minimizes risks, and promotes financial integrity. Understanding the underlying principles and methods empowers individuals and businesses to handle their tax obligations accurately and efficiently. Remember that proper tax calculation is not just a technical exercise; it’s a crucial aspect of financial responsibility and legal compliance.

Latest Posts

Latest Posts

-

A Customer Bought A Bottle Of Wine

Mar 10, 2025

-

What Is The Iupac Name For The Following Compound

Mar 10, 2025

-

Which Of The Following Is True About Sandys Law

Mar 10, 2025

-

What Percentage Of Millionaires Started With Absolutely Nothing

Mar 10, 2025

-

Which Folder Could Be Logically Combined With The Receipts Folder

Mar 10, 2025

Related Post

Thank you for visiting our website which covers about The Tax In Cell F2 Must Be Applied . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.