The Standard Overhead Rate Is Computed Separately For:

Holbox

Mar 21, 2025 · 6 min read

Table of Contents

- The Standard Overhead Rate Is Computed Separately For:

- Table of Contents

- Decoding the Standard Overhead Rate: A Comprehensive Guide

- What is a Standard Overhead Rate?

- Why Compute the Standard Overhead Rate Separately?

- Common Cost Pools Requiring Separate Standard Overhead Rates

- Calculating the Standard Overhead Rate: A Step-by-Step Guide

- Dealing with Variances: Actual vs. Standard

- Advanced Considerations

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

Decoding the Standard Overhead Rate: A Comprehensive Guide

The standard overhead rate is a crucial element in cost accounting, providing a predetermined cost allocation method for indirect manufacturing expenses. Unlike direct costs, which are easily traceable to specific products, overhead costs (like rent, utilities, and depreciation) are indirect and need a systematic approach for allocation. Understanding how the standard overhead rate is computed, and for what cost pools, is vital for accurate costing, pricing strategies, and effective management control. This article will delve deep into the complexities of standard overhead rate calculation, exploring the various cost pools and considerations involved.

What is a Standard Overhead Rate?

A standard overhead rate is a predetermined rate used to apply overhead costs to products or services. It's calculated before the production period begins, using estimated overhead costs and a chosen allocation base (like machine hours or direct labor hours). This allows for a more efficient and timely cost assignment compared to using actual overhead costs, which become available only after the production period ends. The rate is applied to the actual allocation base used during production.

The use of a standard rather than actual cost offers several advantages:

- Improved cost control: By comparing actual results to the predetermined standard, management can identify variances and take corrective actions promptly.

- More timely cost information: Costs are allocated promptly, aiding in quicker decision-making.

- Simplified accounting: The process is streamlined, reducing the complexity of cost accounting.

- Facilitates budgeting and forecasting: Provides a consistent basis for predicting future costs.

Why Compute the Standard Overhead Rate Separately?

The standard overhead rate isn't a single, monolithic figure. It's often calculated separately for different cost pools or departments to reflect the unique cost drivers and cost structures within an organization. This approach offers greater accuracy and allows for more nuanced cost analysis. Computing separately ensures that overhead costs are allocated more fairly and accurately to the products or services responsible for incurring them.

Here’s why separate calculation is crucial:

- Different Cost Drivers: Different departments or production processes might have varying cost drivers. For example, a highly automated department might use machine hours as the allocation base, while a labor-intensive department might use direct labor hours. Using a single rate would distort the cost allocation.

- Varying Overhead Costs: The composition of overhead costs can differ significantly across departments. One department might have higher rent costs, while another might have higher utility costs. Separate calculations reflect these disparities.

- Enhanced Accuracy: Allocating overhead based on individual department-specific rates enhances the accuracy of product costing, leading to more realistic pricing and better profitability analysis.

- Improved Performance Evaluation: By comparing actual overhead costs to the standard rate for each department, management can assess individual department performance more effectively and identify areas for improvement.

Common Cost Pools Requiring Separate Standard Overhead Rates

Several cost pools commonly necessitate separate standard overhead rate calculations. These include:

1. Departments: Manufacturing companies often have different departments like machining, assembly, finishing, and quality control. Each department possesses unique overhead costs and cost drivers. A separate standard overhead rate for each department allows for a more precise allocation of costs based on the specific resources consumed by each product.

2. Product Lines: If a company manufactures diverse product lines with varying production processes and resource needs, separate standard overhead rates for each line become essential. This ensures that overhead costs are allocated fairly, reflecting the distinct resource consumption patterns of each product line. A highly complex product line will consume more resources and incur more overhead than a simpler one.

3. Geographic Locations: For organizations with multiple production facilities in different geographic locations, it’s crucial to compute separate standard overhead rates for each location. This accounts for variations in rent, utilities, labor costs, and other overhead expenses influenced by geographic factors.

4. Major Equipment: In some cases, significant pieces of equipment might warrant their own cost pool and standard overhead rate. For example, a large, specialized machine could justify its own rate if it significantly impacts overhead costs and is used differently across products.

5. Projects: Project-based organizations, such as construction companies or consulting firms, may allocate overhead costs based on individual projects. Each project has unique requirements and costs, necessitating separate rate computations for precise cost tracking and profitability assessment.

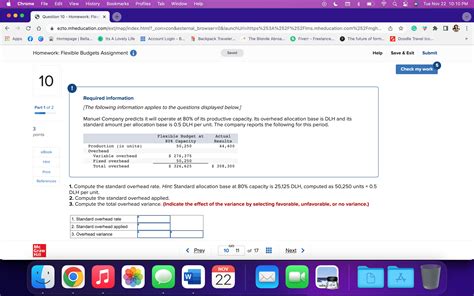

Calculating the Standard Overhead Rate: A Step-by-Step Guide

The calculation itself, while seemingly simple, requires careful planning and estimation. Here's a step-by-step process:

1. Estimate Total Overhead Costs: This involves forecasting all indirect manufacturing costs for the upcoming period. Include items like:

- Rent and utilities

- Depreciation of equipment

- Factory insurance

- Indirect labor costs (supervisors, maintenance personnel)

- Factory supplies

- Quality control costs

2. Choose an Allocation Base: This is a measure of production activity used to allocate overhead costs. Common allocation bases include:

- Direct labor hours

- Machine hours

- Direct materials cost

- Units produced

3. Estimate the Total Allocation Base: This involves forecasting the total amount of the chosen allocation base that will be used during the production period. This estimate should align with the production plan for the period.

4. Calculate the Standard Overhead Rate: The formula is:

Standard Overhead Rate = Estimated Total Overhead Costs / Estimated Total Allocation Base

Example:

Let's say a company estimates total overhead costs of $500,000 for the next year and anticipates using 100,000 machine hours. The standard overhead rate would be:

$500,000 / 100,000 machine hours = $5 per machine hour

This means that for every machine hour used in production, $5 of overhead costs will be allocated to the product.

Dealing with Variances: Actual vs. Standard

Once the production period is complete, the actual overhead costs and the actual allocation base are compared to the standard rate to identify variances. These variances help in evaluating the efficiency and effectiveness of overhead cost management.

- Overhead Spending Variance: This measures the difference between actual overhead costs and the overhead costs applied using the standard overhead rate.

- Overhead Volume Variance: This variance reflects the difference between the actual allocation base used and the budgeted allocation base, multiplied by the standard overhead rate.

Analyzing these variances can help identify areas of overspending, inefficiencies, or inaccurate estimations in the standard overhead rate calculation.

Advanced Considerations

- Multiple Overhead Rates: Larger organizations may use multiple overhead rates based on specific departments or cost centers. This increases the accuracy of cost allocation.

- Activity-Based Costing (ABC): ABC is a more sophisticated approach that allocates overhead costs based on activities rather than a single allocation base. It's particularly useful for companies with diverse product lines and complex production processes.

- Dynamic Budgeting: Regularly reviewing and adjusting the standard overhead rate as conditions change ensures its ongoing relevance and accuracy.

Conclusion

The standard overhead rate, when computed separately for relevant cost pools, is a vital tool for cost management and decision-making. While the calculation might seem straightforward, the process requires meticulous planning and estimation. Understanding the nuances of selecting appropriate cost pools and allocation bases, and interpreting the resulting variances, is essential for utilizing this tool effectively. By accurately applying overhead costs, businesses gain a clearer picture of their profitability, facilitating improved pricing strategies, resource allocation, and overall operational efficiency. The detailed, separate computation, while initially time-consuming, offers a significant return on investment in terms of enhanced accuracy, better cost control, and informed decision-making.

Latest Posts

Latest Posts

-

The Infosys Sales Team Is On The Verge

Mar 28, 2025

-

Brand Centric Demand Generation Focuses On

Mar 28, 2025

-

One Of Your Assignments At Work Is To Analyze

Mar 28, 2025

-

Draw The Product Of This Hydrogenation Reaction Ignore Inorganic Byproducts

Mar 28, 2025

-

You Sell Widgets For 80 Each

Mar 28, 2025

Related Post

Thank you for visiting our website which covers about The Standard Overhead Rate Is Computed Separately For: . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.