The Smaller The Price Elasticity Of Demand The

Holbox

Mar 28, 2025 · 6 min read

Table of Contents

- The Smaller The Price Elasticity Of Demand The

- Table of Contents

- The Smaller the Price Elasticity of Demand, the… What? A Deep Dive into Price Inelasticity

- Understanding Price Elasticity of Demand

- The Implications of a Smaller Price Elasticity of Demand (Inelastic Demand)

- 1. Increased Revenue for Businesses

- 2. Limited Impact of Price Wars

- 3. Predictable Demand

- 4. Higher Profit Margins

- Factors Determining Price Inelasticity

- 1. Necessity versus Luxury

- 2. Availability of Substitutes

- 3. Proportion of Income Spent on the Good

- 4. Time Horizon

- 5. Brand Loyalty

- 6. Habit and Addiction

- The Societal Implications of Inelastic Demand

- 1. Regulating Prices of Essential Goods

- 2. Taxation and Excise Duties

- 3. Access and Affordability

- 4. Market Power and Monopoly

- Conclusion: Navigating the Landscape of Price Inelasticity

- Latest Posts

- Latest Posts

- Related Post

The Smaller the Price Elasticity of Demand, the… What? A Deep Dive into Price Inelasticity

Price elasticity of demand (PED) is a fundamental concept in economics, measuring the responsiveness of quantity demanded to a change in price. Understanding PED is crucial for businesses making pricing decisions, governments implementing policies, and consumers making purchasing choices. This article delves deep into the implications of a smaller price elasticity of demand – often referred to as price inelasticity – exploring its causes, consequences, and real-world examples.

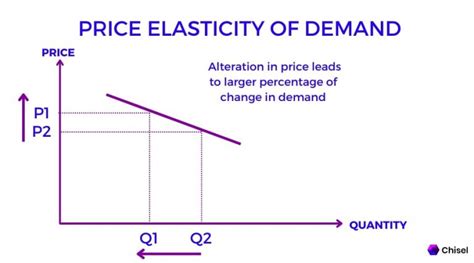

Understanding Price Elasticity of Demand

Before we explore the implications of low PED, let's solidify our understanding of the concept itself. Price elasticity of demand is calculated as the percentage change in quantity demanded divided by the percentage change in price:

PED = (% Change in Quantity Demanded) / (% Change in Price)

The result can be:

- Elastic (PED > 1): A small price change leads to a proportionally larger change in quantity demanded. Consumers are highly sensitive to price changes.

- Inelastic (PED < 1): A price change leads to a proportionally smaller change in quantity demanded. Consumers are relatively insensitive to price changes.

- Unitary Elastic (PED = 1): The percentage change in quantity demanded equals the percentage change in price.

- Perfectly Inelastic (PED = 0): Quantity demanded remains unchanged regardless of price changes. This is a theoretical extreme.

- Perfectly Elastic (PED = ∞): Any price increase results in zero quantity demanded. This is also a theoretical extreme.

The Implications of a Smaller Price Elasticity of Demand (Inelastic Demand)

When the price elasticity of demand is smaller, meaning it's inelastic (PED < 1), it signifies that consumers are relatively unresponsive to price fluctuations. This has several important implications:

1. Increased Revenue for Businesses

A key advantage for businesses with inelastic demand products is the ability to increase revenue by raising prices. Since the quantity demanded won't fall drastically, the higher price per unit more than offsets the slight reduction in sales volume, leading to a net increase in total revenue. This is a powerful tool for profit maximization, particularly for businesses facing rising costs.

Example: A pharmaceutical company selling a life-saving drug likely faces inelastic demand. Even if the price increases, patients needing the medication will likely still purchase it, leading to higher revenue for the company. This, however, raises ethical questions about accessibility and affordability, which we'll address later.

2. Limited Impact of Price Wars

Businesses with price-inelastic products are less vulnerable to price wars. While competitors might attempt to undercut prices, the impact on sales volume for each firm will be relatively small. This reduces the incentive for destructive price competition and allows for greater price stability in the market.

3. Predictable Demand

The relative stability of demand regardless of price fluctuations makes forecasting and inventory management easier for businesses. This reduces the risk of overstocking or stockouts, leading to better efficiency and cost control.

4. Higher Profit Margins

The ability to raise prices without significantly affecting sales allows businesses with inelastic demand to command higher profit margins. This is particularly advantageous in industries with high fixed costs, such as manufacturing or infrastructure.

Factors Determining Price Inelasticity

Several factors contribute to a smaller price elasticity of demand:

1. Necessity versus Luxury

Goods considered necessities tend to have inelastic demand. Essentials like food, healthcare, and utilities are purchased regardless of price changes, within reasonable limits. Conversely, luxury goods and services are more price-elastic, as consumers are more sensitive to price fluctuations.

2. Availability of Substitutes

Fewer available substitutes lead to inelastic demand. If a product has few or no close substitutes, consumers have limited options and are less likely to reduce consumption even if the price rises. The lack of alternatives makes the product less responsive to price changes.

3. Proportion of Income Spent on the Good

Goods that represent a small proportion of a consumer's income tend to have inelastic demand. A small price increase on a relatively inexpensive item like salt is less likely to impact consumption than a price increase on a large-ticket item like a car.

4. Time Horizon

Demand tends to be more inelastic in the short run and more elastic in the long run. In the short term, consumers may lack the time to find substitutes or adjust their consumption habits. However, over time, consumers have more opportunities to adapt to price changes, leading to a more elastic demand curve.

5. Brand Loyalty

Strong brand loyalty can lead to inelastic demand. Consumers who are highly loyal to a particular brand are less likely to switch to a competitor even if prices rise, making demand less responsive to price changes.

6. Habit and Addiction

Habit-forming or addictive products often exhibit inelastic demand. Consumers' reliance on these products makes them less sensitive to price fluctuations. This is particularly true for goods like cigarettes or certain prescription medications.

The Societal Implications of Inelastic Demand

While inelastic demand presents advantages for businesses, it also raises several societal concerns:

1. Regulating Prices of Essential Goods

Governments often intervene to regulate the prices of essential goods with inelastic demand, preventing businesses from exploiting consumers through excessive price increases. Price controls, however, can lead to shortages and inefficiencies in the market.

2. Taxation and Excise Duties

Governments often levy taxes on goods with inelastic demand, such as cigarettes and alcohol. This is because the demand is less responsive to price changes, allowing governments to raise significant revenue without drastically reducing consumption. The revenue generated can then be used to fund social programs. However, this policy also raises ethical questions regarding the impact on lower-income individuals who may be disproportionately affected by these taxes.

3. Access and Affordability

The high prices associated with inelastic demand goods can create accessibility issues, especially for low-income individuals. Essential goods like medicine and healthcare can become unaffordable for certain segments of the population. This often calls for government subsidies and social welfare programs to ensure equitable access.

4. Market Power and Monopoly

Inelastic demand can create opportunities for businesses to gain significant market power, potentially leading to monopolies or oligopolies. With less sensitivity to price changes, these businesses can charge higher prices and limit output, hindering competition and reducing consumer welfare.

Conclusion: Navigating the Landscape of Price Inelasticity

Understanding price elasticity of demand, particularly the implications of inelastic demand, is crucial for businesses, policymakers, and consumers. Businesses can leverage inelastic demand to optimize pricing strategies and maximize profits. However, the societal implications of price inelasticity require careful consideration, particularly regarding affordability, access, and market fairness. Balancing the interests of businesses with the needs of consumers remains a critical challenge in navigating the complexities of price-inelastic markets. The interplay between economic efficiency and social equity necessitates a nuanced approach to managing markets where demand is less responsive to price changes. Ongoing research and policy discussions are essential for finding optimal solutions that address both economic growth and social welfare.

Latest Posts

Latest Posts

-

Which Of The Following Is Not A Possible R Value

Apr 01, 2025

-

Record The Adjusting Entry For Uncollectible Accounts

Apr 01, 2025

-

Como Se Llama El Padre De Sara

Apr 01, 2025

-

Managerial Reporting Systems Are Rigid Flexible Standardized

Apr 01, 2025

-

Physical Examination And Health Assessment By Jarvis

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about The Smaller The Price Elasticity Of Demand The . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.