The Rationing Function Of Prices Refers To The

Holbox

Mar 15, 2025 · 6 min read

Table of Contents

The Rationing Function of Prices: How Prices Allocate Scarce Resources

The rationing function of prices is a fundamental concept in economics. It describes how prices act as a mechanism to distribute scarce goods and services among competing consumers. In a free market, prices are not arbitrarily set; instead, they fluctuate based on the interplay of supply and demand, effectively determining who gets what and how much. Understanding this function is critical to comprehending how markets work and the potential consequences of interfering with price mechanisms.

Understanding Scarcity and Demand

Before delving into the rationing function, it's crucial to establish the concept of scarcity. Scarcity simply means that the resources available to satisfy human wants and needs are limited. This limitation applies to almost everything: physical goods (oil, diamonds, wheat), services (healthcare, education, entertainment), and even time itself. Because resources are scarce, choices must be made about how to allocate them effectively.

Demand, on the other hand, represents the consumer's desire and ability to purchase a particular good or service at various price points. High demand indicates strong consumer interest, while low demand suggests less enthusiasm. The interaction between scarcity and demand forms the foundation for the rationing function of prices.

The Role of Price Signals

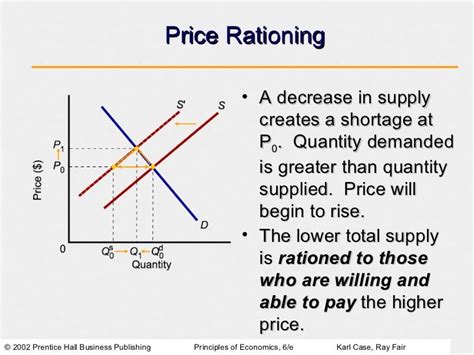

Prices act as powerful signals in the market. They communicate information about the relative scarcity of a good or service. High prices signal scarcity – either because supply is limited, demand is exceptionally high, or both. This high price acts as a deterrent to some consumers, limiting their access to the good. Conversely, low prices indicate abundance, suggesting that the resource is readily available.

Consider a simple example: a sudden frost destroys a significant portion of the orange crop. The immediate impact is a reduction in supply. Consequently, the price of oranges increases, reflecting their decreased availability. This higher price rations the limited supply; consumers who value oranges the most (those willing to pay the higher price) will purchase them, while others may opt for alternative fruits or forgo orange juice altogether.

How Prices Ration in Different Market Structures

The rationing function of prices works differently in various market structures. Let's explore some key examples:

Perfect Competition

In a perfectly competitive market (a theoretical ideal), many buyers and sellers interact, and no single entity can influence the market price. Prices are determined solely by supply and demand. The rationing function is straightforward: the market price clears the market, meaning the quantity demanded equals the quantity supplied. Consumers willing to pay the market price obtain the good, while those unwilling or unable to do so do not.

Monopoly

Monopolies, characterized by a single seller controlling the market, can manipulate prices to maximize profits. While they still implicitly ration goods through pricing, the mechanism differs significantly from a perfectly competitive market. The monopolist may restrict supply to drive up prices, thus rationing the good to a smaller number of consumers willing to pay the inflated price. This often results in allocative inefficiency – the market fails to allocate resources optimally, leading to a deadweight loss to society.

Oligopoly

Oligopolies, where a few firms dominate the market, also exhibit a complex price-rationing mechanism. Firms may collude to fix prices, restricting output and thus rationing the good, much like a monopoly. Alternatively, price competition among oligopolistic firms can lead to lower prices than under monopoly conditions, potentially increasing the number of consumers who can access the good.

Monopolistic Competition

Monopolistic competition, characterized by many firms offering differentiated products, introduces another layer of complexity. The rationing function operates through both price and product differentiation. Firms with superior products or lower prices will attract more customers, implicitly rationing their goods based on consumer preferences and price sensitivity.

The Importance of Price Signals in a Dynamic Economy

The rationing function isn't static; it's a continuous process that adapts to changing conditions. Shifts in supply and demand constantly alter market prices, sending vital signals to producers and consumers.

For producers: rising prices indicate increased demand and profitability, encouraging them to expand production or invest in new capacity. Falling prices signal reduced demand and potentially lower profits, potentially leading to reduced production or business exit.

For consumers: price increases encourage consumers to search for substitutes, reduce consumption, or simply forgo the purchase altogether. Price decreases encourage increased consumption.

These dynamic adjustments ensure that resources are allocated efficiently, given the prevailing conditions. Market prices incorporate information about technology, consumer preferences, and resource availability, making them crucial guides for economic decision-making.

Market Failures and Interventions

While the price mechanism generally allocates resources efficiently, market failures can disrupt its effectiveness. These failures may warrant government intervention, although such interventions often have unintended consequences.

Externalities

Externalities, costs or benefits imposed on third parties not involved in a transaction, can distort market prices. For example, pollution from a factory imposes a cost on society that isn't reflected in the price of the factory's goods. This leads to overproduction and inefficient resource allocation. Government intervention, such as carbon taxes or emission regulations, might be necessary to internalize these externalities and correct the market failure.

Public Goods

Public goods, such as national defense or clean air, are non-excludable (difficult to prevent people from consuming them) and non-rivalrous (one person's consumption doesn't diminish another's). The market often fails to provide these goods adequately because their price cannot effectively ration them. Governments usually step in to provide these goods through taxation and other means.

Information Asymmetry

Information asymmetry, where one party has more information than the other, can lead to inefficient resource allocation. For example, if consumers lack information about the quality of a product, they may not be able to make informed purchasing decisions, potentially leading to suboptimal outcomes. Government regulations, such as product labeling or safety standards, can help address this issue.

Price Controls

Government interventions, such as price ceilings (maximum prices) or price floors (minimum prices), interfere with the rationing function of prices. Price ceilings, intended to make goods more affordable, can lead to shortages as the quantity demanded exceeds the quantity supplied. Price floors, designed to protect producers, can result in surpluses as the quantity supplied exceeds the quantity demanded. Both create inefficiencies and distort resource allocation.

Conclusion: The Enduring Role of Prices

The rationing function of prices is a cornerstone of market economics. Prices serve as indispensable signals, conveying information about scarcity, guiding resource allocation, and encouraging efficient production and consumption. While market failures and government interventions may necessitate adjustments, understanding the fundamental role of prices in allocating scarce resources remains crucial for comprehending how economies function and for designing effective economic policies. Interfering with the price mechanism without a full grasp of its complexities can lead to unintended consequences, highlighting the importance of allowing market forces to operate as efficiently as possible, while addressing genuine market failures through carefully considered interventions. The dynamic interplay of supply, demand, and prices forms the backbone of a well-functioning market economy, ensuring resources are allocated effectively to satisfy consumer wants and needs within the constraints of scarcity.

Latest Posts

Latest Posts

-

Which Of The Following Is A True Statement

Mar 15, 2025

-

The Formula To Determine The Materials To Be Purchased Is

Mar 15, 2025

-

A Rectangular Loop Of Wire With Sides

Mar 15, 2025

-

Which Of The Following Represents A Broad Match Keyword

Mar 15, 2025

-

When Evaluating A Special Order Management Should

Mar 15, 2025

Related Post

Thank you for visiting our website which covers about The Rationing Function Of Prices Refers To The . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.