The Primary Goal Of Financial Management Is To Maximize

Holbox

Mar 15, 2025 · 6 min read

Table of Contents

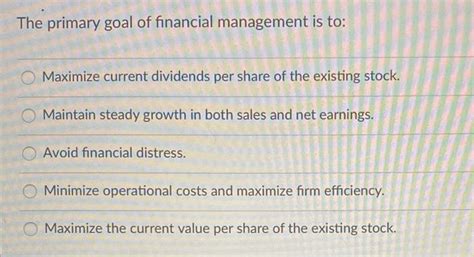

The Primary Goal of Financial Management is to Maximize Shareholder Wealth

The primary goal of financial management is a topic often debated, yet the most widely accepted answer is maximizing shareholder wealth. This doesn't simply mean making the most profit; it's a more nuanced concept encompassing a longer-term perspective and considering various financial factors. This article delves deep into this crucial aspect of financial management, exploring its intricacies, challenges, and the implications for effective decision-making.

Understanding Shareholder Wealth Maximization

Shareholder wealth maximization focuses on increasing the market value of a company's shares. This is achieved by making decisions that enhance the company's profitability, growth, and sustainability, thereby attracting investors and increasing demand for the stock. It's a multifaceted goal, considering several key elements:

1. Profit Maximization vs. Shareholder Wealth Maximization

While profit maximization might seem synonymous, there are critical differences. Profit maximization is a short-term, often myopic goal, neglecting crucial factors like risk, timing, and the overall long-term health of the business. Shareholder wealth maximization, on the other hand, embraces a long-term perspective, considering the time value of money, risk-adjusted returns, and the overall impact on the company's future prospects.

For instance, investing in research and development might temporarily decrease short-term profits but could significantly increase long-term value and shareholder wealth through innovation and market dominance. A purely profit-maximizing approach might neglect this crucial investment.

2. The Role of Risk and Return

Shareholder wealth maximization isn't about reckless risk-taking. Instead, it emphasizes achieving the highest possible return for a given level of risk. Investors are risk-averse, meaning they demand a higher return for taking on more risk. Financial managers need to strike a balance between maximizing returns and mitigating risk. This involves:

- Diversification: Spreading investments across various assets to reduce exposure to any single risk.

- Risk Assessment: Evaluating the potential downsides of each investment decision.

- Capital Budgeting: Carefully selecting projects that offer the best risk-adjusted returns.

3. Time Value of Money

A core principle of shareholder wealth maximization is the time value of money. A dollar received today is worth more than a dollar received in the future due to its potential earning capacity. Financial decisions must consider the present value of future cash flows, using techniques like discounted cash flow (DCF) analysis to determine the true value of an investment.

Ignoring the time value of money can lead to poor investment decisions, undervaluing future opportunities, and ultimately hindering shareholder wealth maximization.

4. Agency Problem and Corporate Governance

The agency problem arises when the interests of managers (agents) diverge from those of shareholders (principals). Managers might prioritize their own self-interest, such as excessive salaries or perks, over maximizing shareholder wealth. Strong corporate governance mechanisms are essential to mitigate this problem. These include:

- Independent Boards of Directors: Overseeing management and ensuring accountability.

- Executive Compensation Schemes: Aligning management incentives with shareholder interests through performance-based bonuses and stock options.

- Transparency and Accountability: Regular reporting and audits to ensure financial integrity.

Strategies for Maximizing Shareholder Wealth

Several key strategies contribute directly to maximizing shareholder wealth:

1. Effective Capital Budgeting

Careful evaluation and selection of capital projects is crucial. This involves:

- Net Present Value (NPV): Measuring the present value of future cash flows, subtracting the initial investment. Positive NPV projects increase shareholder wealth.

- Internal Rate of Return (IRR): Determining the discount rate at which the NPV of a project equals zero. Projects with an IRR exceeding the cost of capital are attractive.

- Payback Period: Estimating the time it takes for a project to recoup its initial investment. While simple, it doesn't fully account for the time value of money.

2. Optimal Capital Structure

The mix of debt and equity financing significantly impacts a company's value. The goal is to find the optimal capital structure that minimizes the cost of capital and maximizes shareholder returns. This involves considering:

- Cost of Debt: The interest rate paid on borrowed funds.

- Cost of Equity: The return required by equity investors.

- Tax Shield: The tax deductibility of interest payments.

3. Efficient Working Capital Management

Effective management of working capital—current assets and liabilities—is vital for maintaining liquidity and operational efficiency. This involves:

- Inventory Management: Minimizing inventory holding costs while ensuring sufficient stock levels.

- Receivables Management: Collecting payments promptly and efficiently.

- Payables Management: Negotiating favorable payment terms with suppliers.

4. Dividend Policy

The decision of how much profit to distribute as dividends versus reinvesting in the company impacts shareholder returns. The optimal dividend policy depends on several factors, including:

- Growth Opportunities: High-growth companies may reinvest more profits to fund expansion.

- Investor Preferences: Some investors prefer higher dividends, while others prefer capital appreciation.

- Tax Implications: Dividend taxation can influence investor preferences.

5. Mergers and Acquisitions

Strategic mergers and acquisitions can enhance shareholder wealth by:

- Expanding Market Share: Acquiring competitors or entering new markets.

- Achieving Synergies: Combining resources and expertise to reduce costs and improve efficiency.

- Acquiring Valuable Assets: Gaining access to technology, intellectual property, or other valuable assets.

Challenges to Shareholder Wealth Maximization

Several factors can impede the pursuit of shareholder wealth maximization:

1. Market Volatility and Economic Uncertainty

External factors such as economic downturns, geopolitical events, and market fluctuations can significantly impact a company's performance and share price, making it difficult to predict and control outcomes.

2. Competition

Intense competition can erode profit margins and limit growth opportunities, making it harder to increase shareholder wealth.

3. Regulatory Changes

Government regulations and changes in accounting standards can influence a company's operating environment and financial reporting, impacting its ability to maximize shareholder wealth.

4. Ethical Considerations

The pursuit of shareholder wealth maximization shouldn't come at the expense of ethical behavior. Companies must operate responsibly, considering the interests of employees, customers, suppliers, and the wider community. Ignoring these factors can lead to reputational damage and long-term losses.

5. Information Asymmetry

Unequal access to information between managers and shareholders can create opportunities for exploitation. Managers might withhold information or make decisions that benefit themselves at the expense of shareholders.

Conclusion: A Holistic Approach

Maximizing shareholder wealth is the primary goal of financial management, but it's a dynamic and complex process requiring a holistic approach. It necessitates a long-term perspective, effective risk management, and a strategic approach to capital budgeting, capital structure, working capital management, dividend policy, and potential mergers and acquisitions. Furthermore, ethical considerations and sound corporate governance are vital to ensure that the pursuit of shareholder wealth is conducted responsibly and sustainably. By embracing these principles, companies can significantly increase their chances of achieving this ultimate financial objective and building a strong and enduring business. The pursuit isn't merely about short-term gains but about fostering a sustainable and profitable enterprise that delivers consistent value to its investors over the long term. The challenge lies in navigating the complexities of the market, managing risks effectively, and making informed decisions that consistently contribute to the overall growth and market valuation of the company.

Latest Posts

Latest Posts

-

In Which Situations Can Simplifying Jobs Be Most Beneficial

Mar 17, 2025

-

For The Hr Planning Process How Should Goals Be Determined

Mar 17, 2025

-

How Does A Shortcut Link To Another File

Mar 17, 2025

-

Cash Flows From Financing Activities Do Not Include

Mar 17, 2025

-

A Positive Return On Investment For Education Happens When

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about The Primary Goal Of Financial Management Is To Maximize . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.