The Predetermined Overhead Rate Is Calculated

Holbox

Mar 17, 2025 · 6 min read

Table of Contents

The Predetermined Overhead Rate: A Comprehensive Guide to Calculation and Application

Understanding how to calculate and apply the predetermined overhead rate is crucial for accurate cost accounting and effective business management. This comprehensive guide will delve into the intricacies of this vital calculation, exploring its purpose, the various methods used, and its practical implications for businesses of all sizes.

What is a Predetermined Overhead Rate?

A predetermined overhead rate (POHR) is a cost accounting method used to allocate manufacturing overhead costs to products or services. Unlike direct costs (like direct materials and direct labor) that are easily traceable to specific units, overhead costs are indirect and must be allocated. These indirect costs include things like rent, utilities, depreciation on equipment, and factory supervisor salaries. Because these costs are incurred throughout the production process and aren't directly tied to individual units, the POHR provides a systematic approach to assigning them.

The key word here is "predetermined." This means the rate is calculated before the accounting period begins, typically at the start of the year or a production cycle. This proactive approach ensures timely cost allocation and avoids the delay associated with waiting until the end of the period to determine actual overhead costs. This pre-calculation allows for more accurate cost estimations for pricing, budgeting, and performance evaluation.

Why Use a Predetermined Overhead Rate?

There are several compelling reasons why businesses rely on the predetermined overhead rate:

-

Timely Costing: Determining actual overhead costs at the end of a period is a time-consuming and resource-intensive process. The POHR allows for immediate cost allocation, improving efficiency.

-

Accurate Costing and Pricing: Using estimated overhead costs at the beginning of a period leads to more accurate product costing, which is crucial for setting competitive prices.

-

Better Budgeting and Forecasting: With a predetermined rate, businesses can create more accurate budgets and forecasts, improving financial planning.

-

Improved Performance Evaluation: By tracking actual overhead costs against the predetermined rate, businesses can identify areas for improvement in efficiency and cost control.

-

Facilitates Management Decision-Making: Provides a more reliable figure for better management decision-making related to pricing, production, and resource allocation.

How to Calculate the Predetermined Overhead Rate

The calculation of the POHR involves two key components:

-

Estimated Overhead Costs: This includes all indirect costs expected to be incurred during the accounting period. Carefully analyze previous periods' data, considering any anticipated changes in production volume, technology, or external factors (e.g., rising energy costs). The more accurate this estimation, the more accurate the POHR will be.

-

Estimated Activity Base (or Allocation Base): This is a measure of production activity used to allocate overhead costs. Common activity bases include:

-

Direct Labor Hours: The total number of labor hours used in production. This is a traditional and widely used method.

-

Machine Hours: The total number of machine hours used in production. This is particularly suitable for automated or machine-intensive industries.

-

Direct Labor Costs: The total cost of direct labor incurred during production.

-

Units Produced: The total number of units produced during the period. Simpler to use, but potentially less accurate.

-

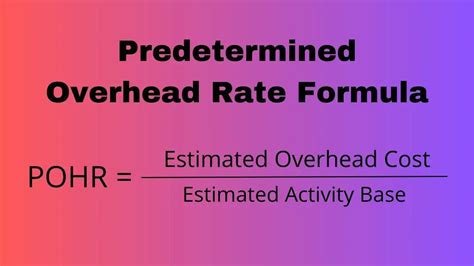

The formula for calculating the predetermined overhead rate is:

Predetermined Overhead Rate = Estimated Overhead Costs / Estimated Activity Base

Example:

Let's assume a manufacturing company estimates its total overhead costs for the next year to be $500,000. They also estimate that they will use 100,000 direct labor hours during the year.

Predetermined Overhead Rate = $500,000 / 100,000 direct labor hours = $5 per direct labor hour

This means that for every direct labor hour used in production, $5 of overhead costs will be allocated to the product.

Different Methods for Estimating Overhead Costs

Several methods exist for estimating overhead costs. The choice depends on the complexity of the business and the level of accuracy required:

-

Past Data Analysis: Examining historical overhead costs and adjusting for anticipated changes. This is a common and relatively simple approach.

-

Engineering Approach: A more detailed method that involves carefully analyzing each cost driver and estimating costs based on engineering specifications. This is more accurate but also more time-consuming.

-

Statistical Methods: Using statistical techniques like regression analysis to predict overhead costs based on past data and various factors.

-

Trend Analysis: Extrapolating past trends to predict future costs. This method is best suited when there are consistent and predictable trends.

Applying the Predetermined Overhead Rate

Once the POHR has been calculated, it's applied to production throughout the accounting period. The process is straightforward:

-

Track the Activity Base: Monitor the actual activity base (e.g., direct labor hours, machine hours) used in producing each product or job.

-

Allocate Overhead Costs: Multiply the actual activity base for each product or job by the POHR to determine the allocated overhead cost.

Example (continued):

If a particular product requires 10 direct labor hours to produce, the allocated overhead cost would be:

10 direct labor hours * $5 per direct labor hour = $50

This $50 would then be added to the direct materials and direct labor costs of the product to determine its total cost.

Dealing with Underapplied and Overapplied Overhead

The predetermined overhead rate is, by definition, an estimate. At the end of the accounting period, the actual overhead costs may differ from the estimated overhead costs. This leads to either:

-

Underapplied Overhead: Actual overhead costs exceed the overhead costs allocated using the POHR.

-

Overapplied Overhead: Actual overhead costs are less than the overhead costs allocated using the POHR.

When this discrepancy occurs, businesses must adjust their cost accounts. Common methods for adjusting for underapplied or overapplied overhead include:

-

Proration: Distribute the difference proportionally across work-in-process (WIP), finished goods, and cost of goods sold (COGS).

-

Write-off: Adjust the difference directly to cost of goods sold. This is a simpler approach but may distort the cost of goods sold for the period.

The choice of method depends on the materiality of the difference and company policy.

Choosing the Right Activity Base

Selecting the appropriate activity base is critical for accurate overhead allocation. The best activity base is one that has a strong correlation with overhead costs. Consider the following factors:

-

Causality: Does the activity base directly influence overhead costs? For instance, more machine hours generally mean higher utility costs.

-

Ease of Measurement: The activity base should be easily and accurately measurable.

-

Cost-Effectiveness: The cost of tracking the activity base should be justified by the benefits of improved accuracy.

Advanced Considerations: Multiple Overhead Rates

For businesses with diverse production processes or departments, using a single predetermined overhead rate might not be accurate. In such cases, using multiple overhead rates can improve accuracy. This involves calculating separate overhead rates for each department or cost pool based on their specific cost drivers and activity bases. This ensures a more precise allocation of overhead costs to the products or services generated within each department.

Conclusion

The predetermined overhead rate is a fundamental tool in cost accounting, essential for accurate product costing, budgeting, pricing, and performance evaluation. While the calculation may seem straightforward, understanding the underlying principles, choosing the appropriate activity base, and managing potential variances between estimated and actual costs are crucial for maximizing the effectiveness of this vital accounting tool. Through careful planning, accurate estimation, and a thorough understanding of the process, businesses can effectively utilize the POHR to gain valuable insights into their cost structure and make informed decisions to improve profitability and operational efficiency. Remember to regularly review and adjust your POHR based on changing circumstances to ensure its continued accuracy and relevance.

Latest Posts

Latest Posts

-

Did The Precipitated Agcl Dissolve Explain

Mar 18, 2025

-

Which Of The Following Documents Are Considered A Record

Mar 18, 2025

-

Chegg Tinder Gold Code Not Working

Mar 18, 2025

-

Supply Creates Its Own Demand Arrows

Mar 18, 2025

-

Can You Delete A Question On Chegg

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about The Predetermined Overhead Rate Is Calculated . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.