Supply Creates Its Own Demand Arrows

Holbox

Mar 18, 2025 · 6 min read

Table of Contents

Supply Creates Its Own Demand: A Deep Dive into Say's Law and Its Modern Interpretations

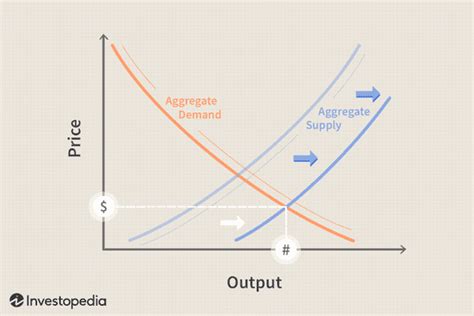

Say's Law, the assertion that "supply creates its own demand," is a cornerstone of classical economics, yet it remains a subject of intense debate. While often simplified and misunderstood, understanding its nuances is crucial for grasping macroeconomic principles and the intricacies of market dynamics. This article will delve into Say's Law, exploring its original formulation, its criticisms, and its relevance in contemporary economic thought. We'll examine its implications for various economic scenarios and explore its enduring influence on economic policy.

The Genesis of Say's Law: Understanding the Core Principle

Jean-Baptiste Say, a prominent 19th-century French economist, articulated the principle now bearing his name. In its simplest form, Say's Law posits that the production of goods and services (supply) generates the income necessary to purchase those goods and services (demand). The act of creating something simultaneously creates the means to acquire it. This implies that general gluts, or widespread overproduction leading to sustained economic downturns, are essentially impossible under a properly functioning market system.

The Production-Income-Expenditure Cycle:

Say's Law highlights a circular flow of economic activity:

- Production: Businesses produce goods and services.

- Income Generation: This production generates income for factors of production (labor, capital, land).

- Expenditure: This income is then spent on goods and services, creating demand.

This cycle suggests that the very act of supplying goods and services generates the purchasing power needed to absorb those supplies. Any unsold goods are seen as a temporary imbalance that the market will naturally correct, as prices adjust and resources shift to more profitable ventures.

Criticisms and Challenges to Say's Law: Unveiling the Limitations

Despite its intuitive appeal, Say's Law has faced significant criticism, leading to modifications and reinterpretations. Key criticisms include:

The Role of Savings and Investment:

A major critique centers on the treatment of saving. If individuals save a portion of their income instead of spending it, this reduces aggregate demand. Say's Law, in its simplest form, doesn't adequately account for this leakage from the circular flow. While savings can fund investment, there's no guarantee that savings will automatically translate into investment at a level sufficient to maintain aggregate demand. A gap between savings and investment can lead to a decline in overall economic activity.

The Problem of Aggregate Demand Deficiency:

The Great Depression of the 1930s posed a significant challenge to Say's Law. The prolonged period of high unemployment and underutilized productive capacity directly contradicted the notion that supply automatically creates its own demand. Keynesian economics emerged as a direct response to this, emphasizing the crucial role of aggregate demand in driving economic growth and employment. Keynes argued that insufficient aggregate demand, not supply-side issues, was the primary cause of economic downturns.

The Importance of Money and Liquidity:

Classical economists, including Say, largely neglected the role of money in the economy. However, the existence of money introduces the possibility of hoarding, where individuals hold onto money rather than spending it. This can disrupt the circular flow and reduce aggregate demand, even if there is sufficient productive capacity. Money is not simply a neutral medium of exchange; it affects the timing and volume of transactions, influencing the relationship between supply and demand.

Rigidities in the Market:

Say's Law assumes perfect market flexibility—prices adjust rapidly to equilibrate supply and demand. However, in reality, many markets exhibit significant rigidities. Wages might be sticky downwards, meaning they don't easily adjust to accommodate lower demand. Similarly, prices might be slow to adjust due to contracts, regulations, or monopolistic practices. These rigidities can hinder the market's ability to self-correct and lead to persistent imbalances between supply and demand.

Modern Interpretations and Refinements: A Contemporary Perspective

While the strict interpretation of Say's Law faces significant challenges, its underlying principle—the link between production and income—remains relevant. Modern interpretations often acknowledge the limitations of the classical view and incorporate insights from Keynesian and other macroeconomic schools of thought.

The Supply-Side Focus:

Modern supply-side economics acknowledges the importance of stimulating supply to foster economic growth. Policies aimed at reducing regulations, lowering taxes, and improving infrastructure are often justified on the basis that increasing supply will boost income and, subsequently, demand. However, this approach also recognizes that insufficient demand can hinder the effectiveness of supply-side measures.

The Role of Expectations and Confidence:

Modern interpretations emphasize the role of expectations and confidence in shaping economic activity. If businesses and consumers are pessimistic about the future, they may reduce investment and spending, even if the underlying supply capacity is high. This highlights the importance of factors outside the simple supply-demand framework in influencing economic outcomes.

The Importance of Government Intervention:

While Say's Law suggests a self-regulating market, most economists today acknowledge the potential for government intervention to stabilize the economy during periods of recession or significant economic disruption. Fiscal and monetary policies can be used to stimulate aggregate demand and address imbalances between saving and investment. These interventions aim to mitigate the potential for prolonged periods of underutilized capacity, a scenario inconsistent with the simple form of Say's Law.

Say's Law and its Implications for Economic Policy

The debate surrounding Say's Law continues to shape economic policy discussions. While a purely laissez-faire approach based on the strict interpretation of Say's Law is generally rejected, the principle's emphasis on productivity and supply-side factors remains influential.

Supply-Side Policies:

Many economic policies, particularly those favored by conservative or free-market proponents, focus on boosting supply-side factors. Tax cuts, deregulation, and investments in infrastructure are all aimed at stimulating production and creating jobs. The underlying assumption is that increased supply will generate increased demand. However, the effectiveness of these policies often depends on the state of aggregate demand and the overall macroeconomic environment.

Demand-Side Policies:

Conversely, Keynesian-inspired policies often focus on managing aggregate demand. During recessions, government spending and monetary easing can be used to stimulate demand and alleviate unemployment. This approach acknowledges the possibility of aggregate demand deficiency and the limitations of relying solely on supply-side factors to resolve economic downturns.

The Ongoing Debate:

The tension between supply-side and demand-side policies reflects the ongoing debate about the relative importance of supply and demand in determining economic outcomes. While Say's Law provides a valuable framework for understanding the relationship between production and income, it does not provide a complete explanation of economic fluctuations and the role of government in managing the economy.

Conclusion: A Balanced Perspective

Say's Law, while not entirely accurate in its simplest form, offers valuable insights into the link between production, income, and demand. The principle’s core idea – that production creates the means for its own consumption – remains relevant. However, modern economic theory has significantly refined and expanded on this principle, incorporating the role of savings, investment, money, expectations, and government intervention. A balanced perspective acknowledges the importance of both supply-side and demand-side factors in influencing economic growth and stability. The ongoing debate surrounding Say's Law reflects the complexity of macroeconomic phenomena and the continuing evolution of economic thought. The challenge lies not in rejecting Say's Law outright, but in understanding its limitations and integrating its insights into a more nuanced and comprehensive understanding of how markets function and how economies grow. Understanding this evolution is crucial for developing effective economic policies and navigating the complexities of the modern global economy.

Latest Posts

Latest Posts

-

The Heart Is Medial To The Lungs

Mar 18, 2025

-

Which Statement Summarizes The Main Idea Of Reciprocal Determinism

Mar 18, 2025

-

Chegg Press And Hold Not Working

Mar 18, 2025

-

Which Of The Following Is Not A Component Of Dna

Mar 18, 2025

-

Can You Highlight Rented Books From Chegg

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about Supply Creates Its Own Demand Arrows . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.