The Materiality Constraint As Applied To Bad Debts

Holbox

Mar 19, 2025 · 6 min read

Table of Contents

The Materiality Constraint as Applied to Bad Debts: A Comprehensive Guide

The accounting treatment of bad debts is a crucial aspect of financial reporting, directly impacting a company's profitability and balance sheet. While generally accepted accounting principles (GAAP) and International Financial Reporting Standards (IFRS) provide frameworks for recognizing and reporting bad debts, the materiality constraint plays a significant role in determining the appropriate accounting method and level of detail. This article delves deep into the materiality constraint as it relates to bad debts, exploring its implications and practical applications.

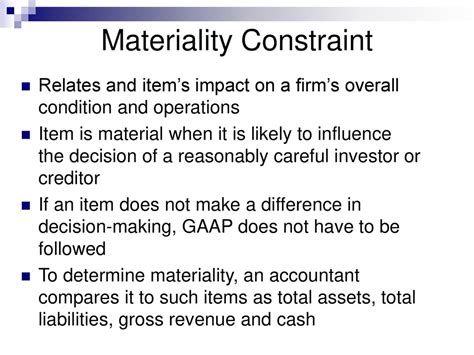

Understanding the Materiality Constraint

The materiality constraint, a cornerstone of accounting, dictates that only information that is significant enough to influence the decisions of financial statement users needs to be disclosed. Information deemed immaterial can be aggregated, simplified, or even omitted entirely. The essence lies in focusing on information that is material, meaning it could reasonably be expected to influence the decisions of users who rely on the financial statements. This constraint is crucial because it prevents unnecessary complexity and cost while ensuring the financial statements remain useful and reliable.

Determining Materiality:

Determining materiality is a judgment call, not a precise mathematical calculation. There’s no single, universally applicable threshold. Several factors influence the materiality assessment, including:

- Quantitative factors: The absolute size of the misstatement (e.g., the total amount of bad debts) in relation to total revenue, total assets, or net income. A larger misstatement is more likely to be material.

- Qualitative factors: The nature of the misstatement. Certain types of misstatements, even if relatively small in absolute terms, can be considered material due to their qualitative implications. For example, a small misstatement related to a company's compliance with regulations might be considered material, even if the monetary amount is insignificant.

- Company-specific factors: The company's size, industry, and financial position. A small misstatement might be material for a small company with low profitability but immaterial for a large, profitable corporation.

- User expectations: What information would users of the financial statements reasonably expect to see? Information crucial to understanding the company's financial health would likely be considered material.

Materiality and Bad Debts: A Practical Application

Bad debts, representing uncollectible accounts receivable, significantly impact a company's financial position. The materiality constraint affects how these bad debts are accounted for and disclosed.

Methods of Accounting for Bad Debts:

Two primary methods are used to account for bad debts:

-

Direct write-off method: This method recognizes bad debts only when they are deemed uncollectible. It's simple but lacks the accuracy of providing an estimate for future bad debts. This method is generally not permitted under GAAP or IFRS unless the amount of bad debts is immaterial.

-

Allowance method: This method estimates the potential bad debts at the end of each accounting period and creates an allowance for doubtful accounts. This approach provides a more accurate reflection of the receivables' net realizable value. The allowance is a contra-asset account that reduces the accounts receivable balance to its estimated net realizable value.

Materiality's Influence on Method Selection:

If the total amount of bad debts is immaterial, the direct write-off method might be acceptable. However, the allowance method is generally preferred under GAAP and IFRS as it provides a more accurate and complete picture of the company's financial position, even if the materiality of the specific bad debts might be questionable. The choice often depends on the professional judgment of the accountant, considering both quantitative and qualitative factors.

Materiality and Disclosure:

Even if the overall amount of bad debts is immaterial, certain qualitative aspects might require disclosure. For example:

- Significant changes in the allowance for doubtful accounts: A sudden and substantial increase or decrease in the allowance, even if the absolute amount remains immaterial, should be disclosed to provide context and explain the change. This might indicate a shift in credit policy or deteriorating economic conditions impacting the company's ability to collect receivables.

- Unusual write-offs: A large write-off of a single account, even if the total amount of write-offs for the period is immaterial, might require disclosure if it represents a significant event or unusual circumstance. This could include a significant customer default that indicates underlying problems or risks.

- Concentrations of credit risk: If a significant portion of the company's receivables is concentrated with a few customers, this information should be disclosed, regardless of the materiality of the overall bad debts. This indicates a heightened risk that a default by a key customer could disproportionately affect the company's financial health.

Practical Examples Illustrating Materiality

Let's illustrate with examples how materiality influences bad debt accounting:

Example 1: Small Company

A small retail business with annual revenue of $50,000 experiences $500 in bad debts. While $500 represents 1% of revenue, it might be considered immaterial. The direct write-off method might be acceptable, provided that the business maintains proper records and adheres to all other accounting principles.

Example 2: Large Corporation

A large corporation with annual revenue of $500 million experiences $500,000 in bad debts. Although seemingly significant in absolute terms, this only represents 0.1% of revenue. Despite the absolute value, this amount might still be considered immaterial given the company's size and profitability. However, consistent monitoring and analysis of the trend of bad debts remain crucial.

Example 3: Sudden Change in Bad Debt Levels

A company consistently reported $10,000 in bad debts annually. Suddenly, the bad debts jump to $50,000. Even if the $50,000 is not material in absolute terms, the significant change is material and requires explanation. This unexpected increase would necessitate investigation and disclosure, regardless of the overall materiality threshold. The company should disclose the reasons behind this substantial increase and its potential impact.

The Importance of Professional Judgment

Applying the materiality constraint requires sound professional judgment. Accountants must consider all relevant factors – quantitative and qualitative – to reach a well-reasoned conclusion. This judgment is crucial in ensuring that financial statements are both informative and reasonably free from bias. Consistent application of professional skepticism and adherence to the relevant accounting standards are paramount.

Conclusion: Materiality and the Big Picture

The materiality constraint, when applied appropriately to bad debts, ensures that financial statements provide a fair and reasonably accurate representation of a company's financial position. While quantitative factors play a role, qualitative aspects such as changes in bad debt patterns, concentrations of credit risk, and unusual write-offs should also be considered. Accountants must exercise professional judgment and maintain a balanced approach, ensuring that all material information is disclosed while avoiding unnecessary complexity. This approach ensures the integrity and usefulness of the financial statements for all stakeholders, ultimately fostering trust and confidence in the financial reporting process. The ultimate goal is to strike a balance between accuracy and practicality, providing information that is both relevant and easily understandable for decision-making. A clear understanding and application of the materiality constraint are critical for accurate and meaningful financial reporting.

Latest Posts

Latest Posts

-

Serviceability Is The Dimension Of Quality That Refers To

Mar 19, 2025

-

A Company Sells 10000 Shares Indeed

Mar 19, 2025

-

The Velocity Field Of A Flow Is Given By

Mar 19, 2025

-

The Hawthorne Studies Found That Employees In The Experimental Group

Mar 19, 2025

-

Why Does Cmg Have A Higher Wacc Than Sbux

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about The Materiality Constraint As Applied To Bad Debts . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.