The High-low Formula To Compute Total Costs Is

Holbox

Mar 21, 2025 · 5 min read

Table of Contents

The High-Low Method: A Comprehensive Guide to Calculating Total Costs

The high-low method is a simple technique used in cost accounting to estimate the fixed and variable components of a company's total costs. It's particularly useful when dealing with limited data or when a more sophisticated cost estimation method isn't feasible. While not perfectly accurate, it provides a quick and relatively easy way to understand the cost behavior within a business. This article will provide a comprehensive exploration of the high-low method, including its applications, limitations, and alternative approaches.

Understanding Cost Behavior

Before diving into the high-low method itself, it's crucial to grasp the concept of cost behavior. Costs are categorized into two primary types:

1. Fixed Costs:

These costs remain constant regardless of the level of production or activity. Examples include rent, salaries of administrative staff, insurance premiums, and depreciation. Fixed costs do not change with fluctuations in production volume.

2. Variable Costs:

These costs directly change with the level of production or activity. Examples include raw materials, direct labor (in some cases), and packaging costs. Variable costs increase as production increases and decrease as production decreases.

3. Mixed Costs (Semi-variable Costs):

Many costs exhibit characteristics of both fixed and variable costs. These are known as mixed or semi-variable costs. Rent on a factory that includes a fixed base rent plus additional charges based on usage is an example. The high-low method helps separate these mixed costs into their fixed and variable components.

The High-Low Method Formula

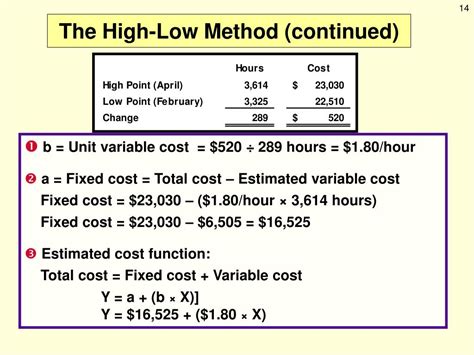

The high-low method uses the highest and lowest activity levels within a given period to separate fixed and variable costs. The formula is as follows:

Variable Cost per Unit = (Highest Cost - Lowest Cost) / (Highest Activity - Lowest Activity)

Once the variable cost per unit is calculated, the fixed cost can be determined by substituting the variable cost per unit back into the cost equation for either the highest or lowest activity level:

Fixed Costs = Total Cost - (Variable Cost per Unit * Activity Level)

Let's illustrate this with an example:

Example:

A manufacturing company collected the following data on its total production costs and units produced over the past six months:

| Month | Units Produced | Total Production Costs |

|---|---|---|

| January | 1,000 | $15,000 |

| February | 1,500 | $18,000 |

| March | 2,000 | $21,000 |

| April | 1,200 | $16,000 |

| May | 1,800 | $20,000 |

| June | 2,500 | $24,000 |

Solution:

-

Identify the highest and lowest activity levels:

- Highest activity: 2,500 units (June)

- Lowest activity: 1,000 units (January)

-

Calculate the variable cost per unit:

- Variable Cost per Unit = ($24,000 - $15,000) / (2,500 - 1,000) = $9,000 / 1,500 = $6 per unit

-

Calculate fixed costs using the highest activity level:

- Fixed Costs = $24,000 - ($6 * 2,500) = $24,000 - $15,000 = $9,000

-

Calculate fixed costs using the lowest activity level (for verification):

- Fixed Costs = $15,000 - ($6 * 1,000) = $15,000 - $6,000 = $9,000

Therefore, the company's total production cost function is: Total Cost = $9,000 + ($6 * Number of Units Produced)

This equation allows the company to estimate its total production costs at various activity levels.

Advantages of the High-Low Method

- Simplicity: It's easy to understand and calculate, requiring minimal mathematical skills.

- Ease of Use: It requires only two data points (highest and lowest activity levels), making it suitable for situations with limited data.

- Cost-Effective: It’s a low-cost method requiring minimal resources.

- Quick Estimation: Provides a rapid estimation of fixed and variable costs.

Limitations of the High-Low Method

- Sensitivity to Outliers: The method is highly sensitive to outliers (abnormally high or low data points). If the highest or lowest data points are inaccurate or unusual, the resulting cost estimates will be significantly affected.

- Inaccuracy: It only considers two data points, ignoring the information contained in the remaining data. This can lead to inaccurate estimations, particularly if the relationship between cost and activity is not perfectly linear.

- Assumption of Linearity: The method assumes a linear relationship between cost and activity. In reality, this relationship may be curvilinear (non-linear).

- Ignoring Relevant Data: It ignores potentially useful data points outside of the highest and lowest activity levels.

Alternative Cost Estimation Methods

While the high-low method is straightforward, it's not always the most accurate. Other methods offer greater precision, including:

- Scattergraph Method: This method plots all cost and activity data points on a graph, allowing for visual identification of the relationship between the two variables. It is less susceptible to outliers than the high-low method.

- Least Squares Regression Analysis: This statistical method calculates the best-fitting line through all the data points, minimizing the sum of squared differences between the actual costs and the predicted costs. It's considered the most accurate method but requires more sophisticated statistical software or knowledge.

Choosing the Right Method

The best method for cost estimation depends on several factors, including:

- Data Availability: If you have limited data, the high-low method may be the most practical.

- Data Quality: If your data contains significant outliers, the scattergraph or regression methods may be preferred.

- Accuracy Requirements: If you require highly accurate cost estimations, least squares regression is the best choice.

- Resource Availability: The high-low method requires minimal resources, while regression analysis may require specialized software or expertise.

Conclusion: The High-Low Method in Context

The high-low method provides a valuable tool for a quick, initial estimation of fixed and variable costs. Its simplicity and ease of use make it attractive for small businesses or situations where time and resources are limited. However, its limitations must be acknowledged. Its sensitivity to outliers and its assumption of linearity can lead to inaccurate estimations. Therefore, it is crucial to understand these limitations and consider using more sophisticated methods, such as scattergraph or regression analysis, if higher accuracy is needed. Remember to always consider the context of your data and choose the method that best suits your needs and resources. By carefully considering the strengths and weaknesses of each approach, you can make informed decisions and gain valuable insights into your company's cost structure. The high-low method should be viewed as a preliminary step, perhaps followed by more rigorous analyses to refine your understanding of cost behavior within your business.

Latest Posts

Latest Posts

-

Two Hormones That Have Additive Effects Are Called

Mar 21, 2025

-

When A Medical Professional Gives A Prognosis He Is Indicating

Mar 21, 2025

-

Enter The Orbital Diagram For The Ion Cd2

Mar 21, 2025

-

Would A Cell That Was Missing The Kinetochores

Mar 21, 2025

-

Jarvis Physical Examination And Health Assessment

Mar 21, 2025

Related Post

Thank you for visiting our website which covers about The High-low Formula To Compute Total Costs Is . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.