The Ge Business Screen Portfolio Model Evaluates Business On Dimetion

Holbox

Mar 26, 2025 · 7 min read

Table of Contents

- The Ge Business Screen Portfolio Model Evaluates Business On Dimetion

- Table of Contents

- GE Business Screen Portfolio Model: Evaluating Businesses on Multiple Dimensions

- Understanding the Two Dimensions of the GE Business Screen

- 1. Industry Attractiveness: A Multifaceted Assessment

- 2. Business Unit Competitive Strength: A Measure of Internal Capabilities

- Constructing the GE Business Screen: A Visual Representation

- Advantages and Limitations of the GE Business Screen

- Case Study: Applying the GE Business Screen

- Conclusion: A Valuable Tool for Strategic Decision-Making

- Latest Posts

- Latest Posts

- Related Post

GE Business Screen Portfolio Model: Evaluating Businesses on Multiple Dimensions

The General Electric (GE) Business Screen, also known as the GE McKinsey Matrix, is a powerful strategic portfolio management tool used to evaluate the attractiveness of various business units within a larger corporation. Unlike simpler portfolio matrices like the Boston Consulting Group (BCG) Matrix, which primarily focuses on market share and market growth, the GE Business Screen incorporates a wider range of factors to provide a more nuanced and comprehensive assessment. This article delves into the intricacies of the GE Business Screen, explaining its dimensions, application, advantages, limitations, and providing practical examples to illuminate its usage.

Understanding the Two Dimensions of the GE Business Screen

The GE Business Screen uses two primary dimensions to evaluate business units: Industry Attractiveness and Business Unit Competitive Strength. Unlike the simplistic axes of the BCG matrix, these dimensions are not simply binary measures but rather complex assessments derived from multiple factors.

1. Industry Attractiveness: A Multifaceted Assessment

Industry attractiveness gauges the overall appeal and potential profitability of the market in which a business unit operates. It's not simply about market growth, but a holistic view considering various economic, social, and competitive factors. Key factors considered include:

- Market Size and Growth: A large and rapidly expanding market offers significant opportunities for growth and profitability. Stagnant or shrinking markets present considerable challenges.

- Industry Profitability: High profit margins indicate a healthy and attractive industry. Low margins suggest fierce competition and potentially lower returns.

- Competitive Intensity: The number and strength of competitors significantly impact profitability. Highly competitive industries require significant investment and strategic maneuvering to succeed.

- Technological Change: Rapid technological advancements can disrupt industries, creating both opportunities and threats. Adaptability and innovation become critical success factors.

- Government Regulations: Industry regulations can significantly impact profitability and operational costs. Stringent regulations might increase barriers to entry but also limit flexibility.

- Social and Economic Factors: Macroeconomic conditions, societal trends, and consumer preferences all influence industry attractiveness. Factors like economic recessions or changing consumer tastes can significantly impact market dynamics.

- Seasonality & Cyclical Nature: Industries prone to significant seasonal fluctuations or cyclical downturns pose additional risk and complexity.

- Barriers to Entry & Exit: High barriers to entry protect established players, while high barriers to exit might trap businesses in unprofitable ventures.

Each of these factors is assigned a weight based on its perceived importance to the specific industry and company strategy. These weighted scores are then combined to create an overall industry attractiveness score, typically ranging from low to high.

2. Business Unit Competitive Strength: A Measure of Internal Capabilities

Business unit competitive strength assesses the internal capabilities and resources of a specific business unit within its industry. This goes beyond simple market share and considers a range of factors reflecting the unit's ability to compete effectively. Key factors include:

- Market Share: A large market share often translates to greater influence and economies of scale. However, it's not the sole determinant of competitive strength.

- Product Quality: High-quality products command premium prices and enhance brand loyalty.

- Brand Recognition & Reputation: Strong brands provide a competitive advantage, attracting customers and commanding higher prices.

- Distribution Network: Effective distribution channels ensure products reach the target market efficiently and cost-effectively.

- Pricing Strategies: Competitive pricing strategies influence market share and profitability.

- Production Efficiency & Cost: Efficient production processes and cost control are crucial for profitability.

- Research & Development Capabilities: Innovation and technological leadership are vital in many industries.

- Management Quality & Expertise: Skilled and experienced management teams are essential for effective strategy execution.

- Financial Resources: Access to capital and financial resources is crucial for investment and expansion.

- Customer Loyalty & Retention: High customer retention rates indicate strong customer relationships and brand loyalty.

Similar to industry attractiveness, each factor is weighted based on its relevance to the specific business unit and overall corporate strategy. These weighted scores are then aggregated to produce an overall competitive strength score, again ranging from low to high.

Constructing the GE Business Screen: A Visual Representation

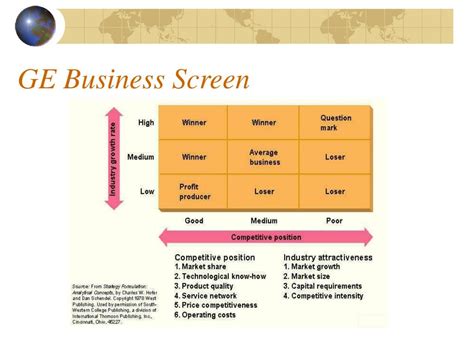

The GE Business Screen is typically represented as a nine-cell matrix, with industry attractiveness plotted on the vertical axis and business unit competitive strength on the horizontal axis. Each axis is divided into three zones: high, medium, and low. The intersection of these axes creates nine cells, each representing a different strategic position for a business unit.

-

High Attractiveness, High Strength (Invest/Grow): Businesses in this quadrant represent prime opportunities for investment and growth. Resources should be aggressively allocated to these units to capitalize on their strong position.

-

High Attractiveness, Medium Strength (Selective Investment/Grow): These units have potential but require strategic investments to enhance their competitive strength. Growth strategies should be carefully considered, focusing on areas where the unit possesses strengths.

-

High Attractiveness, Low Strength (Divest/Harvest): These units operate in attractive markets but lack the competitive strength to thrive. Strategies like divestment or harvesting (maximizing short-term profits before exit) might be appropriate.

-

Medium Attractiveness, High Strength (Hold/Maintain): These units maintain a strong competitive position in a moderately attractive market. Resources should be allocated to maintain the status quo and defend market share.

-

Medium Attractiveness, Medium Strength (Hold/Maintain): These units occupy a relatively neutral position. Investments should be balanced and focus on maintaining competitiveness and avoiding decline.

-

Medium Attractiveness, Low Strength (Divest/Harvest): These units are neither attractive nor strong. Divestment or harvesting are likely the most appropriate strategies.

-

Low Attractiveness, High Strength (Harvest/Divest): These units possess considerable strength but operate in an unattractive market. Harvesting or divestment might be considered, particularly if the market is expected to continue its decline.

-

Low Attractiveness, Medium Strength (Divest/Harvest): Similar to the above, but with less strength, making divestment a more likely strategy.

-

Low Attractiveness, Low Strength (Divest): These units represent the least attractive options and are prime candidates for immediate divestment.

Advantages and Limitations of the GE Business Screen

The GE Business Screen offers several advantages over simpler portfolio models:

-

Holistic Perspective: It considers a broader range of factors than the BCG Matrix, offering a more nuanced and comprehensive assessment of business units.

-

Flexibility and Customization: The weighting of factors can be adjusted to reflect the specific priorities and circumstances of the company.

-

Strategic Guidance: The matrix provides clear strategic guidance for each business unit, ranging from aggressive investment to divestment.

-

Improved Decision-Making: The framework facilitates more informed and data-driven decision-making regarding resource allocation and strategic priorities.

However, the GE Business Screen also has limitations:

-

Subjectivity: The weighting of factors and the assessment of individual scores can be subjective, leading to potential biases.

-

Complexity: The model's complexity can make it challenging to implement and interpret, particularly for smaller companies with limited resources.

-

Data Intensity: Accurate implementation requires significant data collection and analysis, which can be time-consuming and resource-intensive.

-

Static Nature: The model provides a snapshot of the current situation, and doesn't inherently account for dynamic market changes or unforeseen events.

Case Study: Applying the GE Business Screen

Imagine a diversified conglomerate with three business units:

Unit A: A leading manufacturer of high-end kitchen appliances. (High Industry Attractiveness, High Competitive Strength)

Unit B: A regional chain of grocery stores. (Medium Industry Attractiveness, Medium Competitive Strength)

Unit C: A manufacturer of outdated consumer electronics. (Low Industry Attractiveness, Low Competitive Strength)

Using the GE Business Screen:

-

Unit A: Would fall into the "Invest/Grow" quadrant, suggesting aggressive investment in R&D, marketing, and expansion.

-

Unit B: Would likely fall into the "Hold/Maintain" quadrant, suggesting strategic investments to enhance competitiveness while maintaining the status quo.

-

Unit C: Would clearly be in the "Divest" quadrant, indicating a need for a strategic exit from this underperforming business.

Conclusion: A Valuable Tool for Strategic Decision-Making

The GE Business Screen is a valuable tool for strategic portfolio management, providing a more comprehensive and nuanced assessment of business units than simpler models. While it presents certain limitations, particularly regarding subjectivity and data intensity, its holistic approach and strategic guidance make it a powerful instrument for organizations seeking to optimize their portfolio and make informed resource allocation decisions. By carefully considering the various factors contributing to industry attractiveness and business unit competitive strength, companies can use the GE Business Screen to identify growth opportunities, prioritize investments, and manage underperforming assets effectively. Remember that the GE Business Screen is just one tool in the strategic planning arsenal; it's most effective when used in conjunction with other strategic analysis methods and informed by a deep understanding of the business environment.

Latest Posts

Latest Posts

-

Identify Whether Each Monosaccharide Is An Aldose Or A Ketose

Mar 30, 2025

-

In Which Domains Are Algae Protozoa And Cyanobacteria Classified

Mar 30, 2025

-

Which Of The Following Is An Instance Of Persuasive Speaking

Mar 30, 2025

-

Job Rotation Helps Lower Level Managers Prepare For Higher Level Positions By

Mar 30, 2025

-

In Person Centered Group Therapy The Leader

Mar 30, 2025

Related Post

Thank you for visiting our website which covers about The Ge Business Screen Portfolio Model Evaluates Business On Dimetion . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.