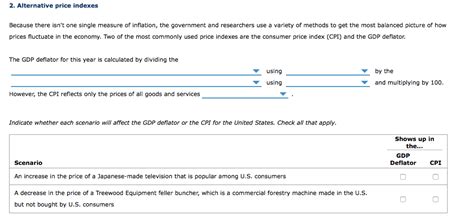

The Cpi For This Year Is Calculated By Dividing The

Holbox

Mar 18, 2025 · 7 min read

Table of Contents

Decoding the CPI: How This Year's Inflation Rate is Calculated

The Consumer Price Index (CPI) is a crucial economic indicator that measures the average change in prices paid by urban consumers for a basket of consumer goods and services. Understanding how the CPI is calculated is essential for interpreting inflation data and its impact on the economy. This year's CPI, like those of previous years, is determined through a complex yet systematic process involving meticulous data collection, weighting, and calculation. Let's delve into the intricacies of this process.

The Foundation: The Market Basket

The CPI calculation begins with the construction of a "market basket," a representative sample of goods and services consumed by urban households. This basket isn't static; it's regularly updated to reflect changing consumer spending patterns. Think of it as a snapshot of everyday spending, encompassing everything from groceries and housing to transportation and entertainment. The specific items included and their relative importance are determined through rigorous surveys and data analysis. This ensures the CPI accurately reflects current consumption habits and prevents outdated items from skewing the results.

The composition of the market basket varies across countries and even within regions of the same country, reflecting differences in lifestyle, income, and consumer preferences. For example, the market basket in a rural area might place more emphasis on agricultural products, while an urban basket might prioritize transportation and entertainment. These regional variations are considered when compiling national CPI figures.

Data Collection: Tracking Prices Across the Nation

Once the market basket is established, the next crucial step is collecting price data. This involves a vast network of data collectors who systematically monitor prices for each item in the basket across numerous geographical locations. This extensive data collection ensures that the CPI captures price variations across different regions and demographics. Data is collected from a wide variety of sources, including:

- Retail stores: Prices are recorded from supermarkets, department stores, specialty shops, and online retailers.

- Service providers: Prices for services like healthcare, transportation, and education are gathered from providers.

- Government agencies: Data on government-regulated prices, such as utility rates, are obtained directly from relevant agencies.

The frequency of price collection varies depending on the item's price volatility. Highly volatile items like gasoline are priced more frequently than stable items like durable goods. Sophisticated statistical techniques are employed to account for variations in quality and product specifications to prevent inconsistencies from distorting the results.

Weighting: Assigning Importance to Each Item

Not all items in the market basket are equally important. The CPI assigns weights to each item based on its relative expenditure share in the overall consumer budget. This weighting reflects the economic significance of each item to the average consumer. For instance, housing typically receives a significant weight because it represents a substantial portion of most household budgets. Conversely, items with a smaller expenditure share receive a proportionally smaller weight.

The weights are determined using data from consumer expenditure surveys, which provide detailed information on household spending patterns. These surveys regularly update the weights to account for shifts in consumption habits over time. Changes in weighting are crucial because consumer priorities shift, impacting the overall CPI calculation. For example, a significant increase in the price of housing would have a much more substantial impact on the CPI than a similar increase in the price of a less significant expenditure item.

Calculating the CPI: From Raw Data to Index Number

With price data collected and weights assigned, the CPI is calculated using a complex formula. The most common method is the Laspeyres index, which compares the current cost of the market basket to its cost in a base period. The base period is a reference year whose value is set to 100. Subsequent CPI values are expressed as indices relative to this base year.

The formula for calculating the CPI using the Laspeyres index is as follows:

(Cost of Market Basket in Current Period / Cost of Market Basket in Base Period) x 100 = CPI

This formula essentially quantifies the percentage change in the cost of the market basket from the base period to the current period. The calculation involves summing the weighted price changes of all items in the basket. Sophisticated statistical techniques are used to account for seasonal variations and other factors that can influence price fluctuations.

This calculation results in the CPI figure for a given period, representing the average change in prices paid by urban consumers. A CPI of 110, for example, indicates that prices have increased by 10% compared to the base period. Changes in the CPI from month to month or year to year are used to track inflation rates.

Understanding the Implications of CPI Calculations

The CPI's calculation is not without its complexities and limitations. Several factors can influence the accuracy and interpretation of CPI data:

- Substitution bias: Consumers may switch to cheaper alternatives when prices rise, a phenomenon that the CPI might not fully capture.

- Quality bias: Improvements in product quality may not be fully reflected in the CPI, potentially underestimating the true rate of inflation.

- New product bias: The introduction of new products takes time to be incorporated into the market basket, potentially delaying their effect on the CPI.

Despite these limitations, the CPI remains a valuable tool for measuring inflation and understanding its impact on the economy. It is used by governments, businesses, and individuals to make informed decisions regarding wages, investments, and policy. The accuracy of the CPI is continuously improved through ongoing methodological refinements and data collection improvements.

CPI and its Use in Economic Policy

The CPI plays a pivotal role in several aspects of economic policy:

-

Inflation Targeting: Central banks often use the CPI as a primary indicator when setting monetary policy to achieve price stability. If inflation, as measured by the CPI, rises above the target rate, the central bank may take measures to cool down the economy, such as raising interest rates.

-

Wage Adjustments: Collective bargaining agreements and government policies often link wages to the CPI. This helps to ensure that workers’ purchasing power is maintained in the face of rising prices. "Cost of living adjustments" (COLAs) are common examples.

-

Government Benefits: Many government benefit programs, such as Social Security and Supplemental Security Income (SSI), are adjusted annually based on changes in the CPI to maintain their purchasing power. These adjustments help protect vulnerable populations from the effects of inflation.

-

Business Decisions: Businesses use CPI data to make strategic decisions regarding pricing, investments, and production. Understanding the trends in consumer spending and inflation helps them adapt to market conditions and maintain profitability.

CPI vs. Other Inflation Measures

While the CPI is the most widely used inflation measure, other indices exist, including the Producer Price Index (PPI) and the Personal Consumption Expenditures (PCE) price index. The PPI measures price changes from the perspective of producers, while the PCE tracks changes in prices paid by consumers for all goods and services.

Each index has its strengths and weaknesses. The CPI's broad scope makes it a useful indicator for general inflation, but its limitations related to substitution, quality, and new products need to be considered when interpreting the data. The differences between these indices can provide a more nuanced understanding of inflation's dynamics within an economy.

Conclusion: The CPI - A Complex Yet Crucial Economic Tool

Calculating the CPI is a multifaceted process that necessitates meticulous data collection, weighting, and statistical analysis. Understanding the intricacies of this calculation is critical for accurate interpretation of inflation data and its implications for economic policy and personal finance. While limitations exist, the CPI remains a cornerstone of economic measurement, offering invaluable insights into the health and direction of an economy. By consistently monitoring and refining the CPI methodology, economists and policymakers can work towards a more accurate and comprehensive understanding of inflation's impact on society. This continuous improvement ensures the CPI remains a reliable indicator for years to come, guiding crucial economic decisions.

Latest Posts

Latest Posts

-

Which Of The Following Statements About Phi Is False

Mar 19, 2025

-

An Aircraft Component Is Fabricated From An Aluminum Alloy

Mar 19, 2025

-

A Business Plan Is A Document That Outlines

Mar 19, 2025

-

What Is The Difference Between Tough And Tuff

Mar 19, 2025

-

Locking Out Tagging Out Refers To The Practice Of

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about The Cpi For This Year Is Calculated By Dividing The . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.