The Basic Npv Investment Rule Is:

Holbox

Mar 13, 2025 · 6 min read

Table of Contents

The Basic NPV Investment Rule: A Comprehensive Guide

The Net Present Value (NPV) investment rule is a cornerstone of financial decision-making, providing a robust framework for evaluating the profitability of potential investments. Understanding this rule is crucial for individuals, businesses, and governments alike, as it allows for a systematic comparison of projects with different cash flows and time horizons. This comprehensive guide will delve into the intricacies of the NPV rule, exploring its application, limitations, and practical considerations.

What is Net Present Value (NPV)?

At its core, NPV is a calculation that determines the difference between the present value of cash inflows and the present value of cash outflows over a period of time. A positive NPV suggests that the investment is expected to generate more value than it costs, while a negative NPV indicates the opposite. The basic NPV investment rule is straightforward: Accept projects with a positive NPV and reject projects with a negative NPV.

The calculation considers the time value of money, acknowledging that a dollar received today is worth more than a dollar received in the future due to its potential earning capacity. This is accounted for by discounting future cash flows back to their present value using a discount rate, which typically reflects the opportunity cost of capital or the required rate of return.

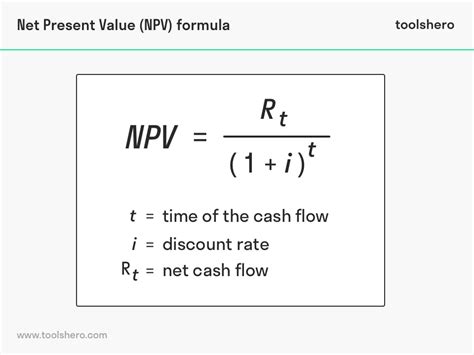

Formula:

The formula for calculating NPV is as follows:

NPV = ∑ [Ct / (1 + r)^t] - C0

Where:

- Ct: Net cash inflow during the period t

- r: Discount rate (or rate of return)

- t: Number of time periods

- C0: Initial investment (cash outflow at time 0)

The summation (∑) represents the sum of the discounted cash flows over the entire investment period.

Understanding the Components of the NPV Calculation

To effectively utilize the NPV rule, a thorough understanding of its constituent elements is vital. Let's break down each component:

1. Cash Flows (Ct):

Accurately forecasting future cash flows is paramount. This requires a realistic assessment of revenue generation, operating expenses, capital expenditures, and any other relevant financial inflows and outflows. The process involves:

- Revenue Projections: Estimating future sales based on market analysis, historical data, and anticipated growth rates.

- Cost Estimation: Predicting operating costs, including labor, materials, and overhead, as well as any potential capital expenditures needed throughout the project's life.

- Tax Implications: Considering the impact of taxes on cash flows, as taxes can significantly affect the profitability of an investment.

- Depreciation and Amortization: Incorporating these non-cash expenses, as they can affect tax liabilities and ultimately influence net cash flows.

2. Discount Rate (r):

The discount rate is a crucial parameter that reflects the risk and opportunity cost associated with the investment. A higher discount rate indicates a higher level of risk or a greater opportunity cost, reducing the present value of future cash flows. Determining the appropriate discount rate involves considering:

- Risk-Free Rate: This represents the return on a virtually risk-free investment, such as a government bond.

- Risk Premium: This accounts for the additional risk associated with the specific investment, taking into consideration factors such as market volatility, industry competition, and the financial health of the company.

- Weighted Average Cost of Capital (WACC): For corporate investments, the WACC, which considers the cost of equity and debt financing, is often used as the discount rate.

3. Time Periods (t):

The investment's timeframe must be clearly defined. Accurate prediction of cash flows and the selection of an appropriate discount rate are heavily influenced by the investment's projected duration. Longer-term projects usually carry greater uncertainty and therefore demand a higher discount rate.

4. Initial Investment (C0):

This represents the initial cash outflow required to undertake the investment. This includes the cost of acquiring assets, undertaking initial setup, and any other upfront expenses.

Applying the NPV Rule in Practice

The NPV rule provides a clear-cut decision-making process:

- Positive NPV: Indicates that the investment is expected to generate more value than it costs, creating a net increase in wealth. Accept the project.

- Negative NPV: Suggests that the investment is expected to result in a net loss, reducing overall wealth. Reject the project.

- Zero NPV: Indicates that the investment is expected to break even, neither creating nor destroying wealth. The decision in this case often depends on other factors, such as strategic alignment with business goals or the availability of alternative investment opportunities.

Example:

Let's consider an investment with an initial cost of $10,000 and expected cash flows of $3,000, $4,000, and $5,000 over the next three years. Assuming a discount rate of 10%, the NPV calculation would be:

NPV = [$3,000/(1.1)^1] + [$4,000/(1.1)^2] + [$5,000/(1.1)^3] - $10,000

NPV ≈ $2,727 + $3,306 + $3,757 - $10,000 ≈ $790

Since the NPV is positive, this investment would be accepted according to the NPV rule.

Advantages of Using the NPV Rule

The NPV rule offers several significant advantages:

- Direct Measure of Value Creation: It directly measures the increase in wealth resulting from an investment, providing a clear indication of its profitability.

- Considers Time Value of Money: Accurately reflects the time value of money, which is crucial in long-term investment decisions.

- Objective and Consistent Decision-Making: Provides an objective and consistent framework for comparing investments with different cash flows and time horizons, minimizing subjectivity.

- Flexibility in Incorporating Risk: Allows for the incorporation of risk through the discount rate, enabling a more nuanced evaluation of investments with varying levels of uncertainty.

Limitations of the NPV Rule

Despite its strengths, the NPV rule does have some limitations:

- Dependence on Accurate Cash Flow Forecasts: The accuracy of the NPV calculation relies heavily on accurate forecasts of future cash flows, which can be challenging, especially for long-term investments.

- Sensitivity to Discount Rate: The NPV is sensitive to the chosen discount rate. A small change in the discount rate can significantly affect the NPV, potentially leading to different investment decisions.

- Difficulty in Handling Non-Conventional Cash Flows: Investments with non-conventional cash flows (i.e., multiple changes in sign) can lead to multiple IRRs (Internal Rate of Return), potentially confusing the interpretation of the NPV.

- Ignoring Qualitative Factors: The NPV rule focuses primarily on quantitative factors and may not adequately account for qualitative factors, such as strategic fit, social impact, or environmental considerations.

NPV vs. Other Investment Appraisal Techniques

The NPV rule is often compared to other investment appraisal techniques, such as the Internal Rate of Return (IRR), Payback Period, and Discounted Payback Period. While these techniques offer valuable insights, the NPV rule stands out due to its ability to directly measure the value created by an investment. IRR, for instance, identifies the discount rate at which the NPV equals zero; however, it can be misleading with non-conventional cash flows. Payback period and discounted payback period focus only on the time it takes to recover the initial investment, ignoring the total value created beyond that point.

Conclusion

The Net Present Value (NPV) investment rule is a powerful tool for evaluating the financial viability of projects. Its ability to incorporate the time value of money and provide a direct measure of value creation makes it a crucial element in informed investment decisions. While limitations exist, understanding the strengths and weaknesses of the NPV method enables decision-makers to utilize it effectively as part of a broader investment appraisal framework. By diligently forecasting cash flows, selecting appropriate discount rates, and considering both quantitative and qualitative factors, businesses and individuals can leverage the NPV rule to make sound investment choices that maximize wealth creation and support long-term financial success. Remember, the NPV rule is not a standalone solution, but a powerful tool within a comprehensive investment analysis process.

Latest Posts

Latest Posts

-

The Common Thread Among Great Leaders Is The Ability To

Mar 13, 2025

-

Which Molecule Is Not A Carbohydrate

Mar 13, 2025

-

Match Each Definition To The Appropriate Term

Mar 13, 2025

-

A Bank Reconciliation Should Be Prepared

Mar 13, 2025

-

Which Common Mineral Is Composed Entirely Of Silicon And Oxygen

Mar 13, 2025

Related Post

Thank you for visiting our website which covers about The Basic Npv Investment Rule Is: . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.