A Bank Reconciliation Should Be Prepared

Holbox

Mar 13, 2025 · 7 min read

Table of Contents

- A Bank Reconciliation Should Be Prepared

- Table of Contents

- A Bank Reconciliation Should Be Prepared: A Comprehensive Guide

- Why a Bank Reconciliation is Essential

- 1. Detecting Errors and Fraud

- 2. Ensuring Accurate Financial Reporting

- 3. Improving Internal Controls

- 4. Maintaining a Clear Audit Trail

- 5. Preventing Late Payment Fees and Overdraft Charges

- The Steps Involved in Preparing a Bank Reconciliation

- 1. Gather Necessary Documents

- 2. Compare the Bank Statement Balance to the Company's Book Balance

- 3. Analyze Bank Statement and Reconcile to Book Balance

- 4. Analyze Company Records and Reconcile to Bank Balance

- 5. Prepare a Bank Reconciliation Statement

- Common Discrepancies and How to Address Them

- Preventing Errors in Bank Reconciliation

- Conclusion

- Latest Posts

- Related Post

A Bank Reconciliation Should Be Prepared: A Comprehensive Guide

Bank reconciliations are a crucial part of any sound financial management system. They are a necessary process that bridges the gap between a company's internal records and its bank statement, ensuring the accuracy of its financial reporting. This comprehensive guide explores why a bank reconciliation should be prepared, the steps involved, common discrepancies, and how to effectively prevent errors. Understanding this process is vital for maintaining financial integrity and preventing potential fraud.

Why a Bank Reconciliation is Essential

A bank reconciliation is more than just a routine accounting task; it's a critical control mechanism. Here's why it should be prepared:

1. Detecting Errors and Fraud

Perhaps the most important reason is its ability to detect errors. Human error is inevitable, and mistakes can occur in both the recording of transactions in the company's books and by the bank. A bank reconciliation highlights these discrepancies, allowing for timely correction and prevention of more significant issues. This includes identifying potential fraudulent activities such as unauthorized transactions or embezzlement. Early detection through reconciliation significantly minimizes losses and strengthens internal controls.

2. Ensuring Accurate Financial Reporting

Accurate financial reporting is the cornerstone of sound business management. A bank reconciliation ensures the accuracy of the cash balance reported on the company's financial statements. Without this reconciliation, the reported cash balance might be significantly overstated or understated, leading to misleading financial information for stakeholders, including investors, creditors, and management.

3. Improving Internal Controls

The process of preparing a bank reconciliation strengthens a company's internal controls. By regularly reviewing and comparing bank statements with internal records, companies can identify weaknesses in their financial processes and implement improvements. This includes identifying and addressing any lapses in segregation of duties, which can be a major factor in preventing fraud.

4. Maintaining a Clear Audit Trail

A well-documented bank reconciliation serves as an important audit trail. It provides a clear and chronological record of all transactions, making it easier to track the movement of funds and investigate any irregularities. This is especially beneficial during internal or external audits, providing auditors with concrete evidence of financial accuracy and compliance.

5. Preventing Late Payment Fees and Overdraft Charges

By identifying outstanding checks or deposits in transit, a bank reconciliation helps prevent late payment fees and overdraft charges. Knowing the true cash balance at any given time allows companies to proactively manage their cash flow and avoid costly penalties associated with insufficient funds.

The Steps Involved in Preparing a Bank Reconciliation

The process typically involves the following key steps:

1. Gather Necessary Documents

Before beginning the reconciliation, gather all the necessary documents. This includes:

- Bank Statement: The bank statement for the period being reconciled.

- Cash Book/General Ledger: The company's internal records reflecting all cash transactions during the same period.

- Outstanding Checks Register: A list of all checks issued by the company but not yet cashed by the recipient.

- Deposits in Transit: A list of all deposits made by the company but not yet reflected on the bank statement.

2. Compare the Bank Statement Balance to the Company's Book Balance

The starting point is to compare the ending balance shown on the bank statement with the ending cash balance in the company's general ledger or cash book. These balances will almost certainly differ.

3. Analyze Bank Statement and Reconcile to Book Balance

Next, identify and adjust for items affecting the bank balance but not yet recorded in the company's books:

- Add Deposits in Transit: These are deposits made by the company but not yet credited by the bank. Add these deposits to the bank statement balance.

- Subtract Outstanding Checks: These are checks issued by the company but not yet presented to the bank for payment. Subtract these checks from the bank statement balance.

- Add or Subtract Bank Errors: The bank might make errors in processing transactions. If the bank has made an error, adjust the bank balance accordingly. This could involve adding or subtracting amounts depending on the nature of the error.

4. Analyze Company Records and Reconcile to Bank Balance

Now, analyze the company's book balance to identify items recorded in the company's books but not yet reflected on the bank statement:

- Add Bank Charges: The bank might charge fees for services. These should be added to the company’s book balance.

- Add or Subtract Notes Receivable: If a loan was paid directly into the company's account, it will be reflected in the bank statement but not initially in the company’s books until the loan is processed.

- Add Interest Earned: Interest earned on the account should be added to the book balance.

- Subtract Non-Sufficient Funds (NSF) Checks: These are checks that bounced due to insufficient funds in the payer's account. Subtract these from the book balance.

- Subtract Bank Errors: Adjust the book balance to correct any errors made by the company.

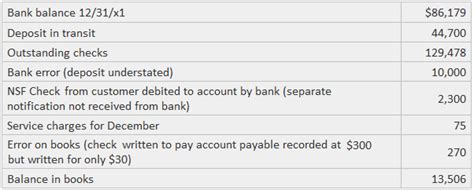

5. Prepare a Bank Reconciliation Statement

Finally, document all adjustments made to both the bank balance and the book balance in a formal bank reconciliation statement. This statement should clearly show:

- Beginning Bank Balance: The bank balance at the start of the period.

- Add: Deposits in Transit

- Less: Outstanding Checks

- Add/Less: Bank Errors

- Adjusted Bank Balance: The reconciled bank balance.

- Beginning Book Balance: The book balance at the start of the period.

- Add: Interest Earned/Notes Receivable

- Less: Bank Charges/NSF Checks

- Add/Less: Book Errors

- Adjusted Book Balance: The reconciled book balance.

The adjusted bank balance and adjusted book balance should be equal after completing all the adjustments. Any remaining difference indicates an error that needs further investigation.

Common Discrepancies and How to Address Them

Several common discrepancies can arise during a bank reconciliation. Understanding these helps in efficient troubleshooting:

- Outstanding Checks: Checks issued but not yet cashed by the payee. These should be subtracted from the bank statement balance.

- Deposits in Transit: Deposits made but not yet credited by the bank. These should be added to the bank statement balance.

- Bank Errors: Mistakes made by the bank in processing transactions. These should be adjusted on either the bank or book side depending on the nature of the error.

- Errors in Bookkeeping: Errors in recording transactions in the company's accounting system. These need to be corrected in the company's books.

- NSF Checks: Checks received that bounce due to insufficient funds. These should be subtracted from the book balance.

- Bank Charges: Fees charged by the bank for services rendered. These should be added to the company's book balance.

- Notes Receivable: Money received directly into the bank account that needs to be recorded in the company's books. These should be added to the book balance.

- Interest Earned: Interest earned on the account. This should be added to the book balance.

Preventing Errors in Bank Reconciliation

Preventing errors is just as crucial as detecting them. Here are some effective strategies:

- Establish Clear Procedures: Develop clear, documented procedures for handling cash receipts and disbursements. This includes proper authorization, recording, and reconciliation processes.

- Regular Bank Reconciliation: Conduct bank reconciliations regularly, ideally monthly, to catch errors promptly. The longer discrepancies go undetected, the harder they are to track down and correct.

- Segregation of Duties: Separate the duties of handling cash, recording transactions, and reconciling the bank statement. This reduces the risk of fraud and errors.

- Proper Documentation: Maintain accurate and complete records of all cash transactions. This includes supporting documents such as invoices, receipts, and bank statements.

- Reconcile Promptly: Don't delay the reconciliation process. The longer you wait, the more difficult it becomes to identify and correct errors.

- Use Technology: Utilize accounting software or bank reconciliation tools to automate the process and reduce manual errors.

- Regular Training: Train employees responsible for handling cash and preparing bank reconciliations on proper procedures and best practices. Regular updates on any changes in procedure will also be helpful.

- Internal Audits: Conduct regular internal audits to review the bank reconciliation process and identify areas for improvement.

Conclusion

A bank reconciliation is not just a compliance requirement; it’s a fundamental tool for maintaining sound financial management. By diligently performing this crucial process and implementing preventative measures, businesses can ensure accurate financial reporting, detect errors and fraud early, and bolster their overall financial health. The investment in time and effort for a thorough bank reconciliation far outweighs the potential costs associated with undetected errors and financial irregularities. Mastering this process is key to building a robust and trustworthy financial foundation.

Latest Posts

Related Post

Thank you for visiting our website which covers about A Bank Reconciliation Should Be Prepared . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.