The Allowance For Uncollectible Accounts Is A Contra Account To

Holbox

Mar 26, 2025 · 7 min read

Table of Contents

- The Allowance For Uncollectible Accounts Is A Contra Account To

- Table of Contents

- The Allowance for Uncollectible Accounts: A Contra Account to Accounts Receivable

- What is a Contra Account?

- Understanding Accounts Receivable

- The Allowance for Uncollectible Accounts: A Necessary Evil

- Why is it important?

- Calculating the Allowance for Uncollectible Accounts

- 1. Percentage of Sales Method

- 2. Percentage of Accounts Receivable Method

- 3. Aging of Receivables Method

- Writing Off Uncollectible Accounts

- Recovery of Accounts Written Off

- Impact on Financial Statements

- Choosing the Right Method

- Conclusion: Accuracy and Prudence in Financial Reporting

- Latest Posts

- Latest Posts

- Related Post

The Allowance for Uncollectible Accounts: A Contra Account to Accounts Receivable

The allowance for uncollectible accounts is a crucial element of financial accounting, impacting a company's balance sheet and income statement. Understanding its function, calculation, and implications is vital for both financial professionals and business owners. This comprehensive guide will delve into the intricacies of this contra account, explaining its relationship with accounts receivable and its overall impact on financial reporting.

What is a Contra Account?

Before diving into the specifics of the allowance for uncollectible accounts, let's define what a contra account is. A contra account is an account that reduces the balance of another account. It's always paired with a related account and its balance is subtracted from the related account's balance on the financial statements. Think of it as an offsetting account. It doesn't stand alone; its purpose is to modify the balance of its paired account.

Understanding Accounts Receivable

Accounts receivable (A/R) represents money owed to a business by its customers for goods or services sold on credit. It's a crucial asset on a company's balance sheet, reflecting the expected future cash inflows. However, not all accounts receivable are guaranteed to be collected. Some customers may default on their payments, leading to losses for the business. This is where the allowance for uncollectible accounts comes into play.

The Allowance for Uncollectible Accounts: A Necessary Evil

The allowance for uncollectible accounts (also known as the allowance for doubtful accounts) is a contra-asset account. This means it reduces the balance of accounts receivable, providing a more realistic picture of the amount of money a company expects to actually receive. It's not a direct write-off of bad debt; instead, it's a reserve set aside to cover anticipated losses from uncollectible accounts. The allowance account acts as an estimate of the percentage of accounts receivable that are likely to become uncollectible.

Why is it important?

The allowance method reflects the principle of matching revenue and expenses. Revenue is recognized when the sale is made (accrual accounting), even if payment isn't received immediately. The corresponding expense (the potential loss from uncollectible accounts) is recognized in the same accounting period, creating a more accurate portrayal of the company's profitability. Using the allowance method provides a more conservative and accurate reflection of a company’s financial position than simply writing off bad debts when they occur.

Calculating the Allowance for Uncollectible Accounts

There are several methods used to estimate the allowance for uncollectible accounts:

1. Percentage of Sales Method

This method estimates bad debt expense based on a percentage of credit sales for a specific period. The percentage is determined by historical data, industry benchmarks, or management's judgment. It's a simpler method, but it doesn't consider the existing balance in the allowance account.

Formula: Bad Debt Expense = Credit Sales x Estimated Percentage of Uncollectible Accounts

Example: If a company has $1,000,000 in credit sales and estimates 2% will be uncollectible, the bad debt expense would be $20,000. This amount would be debited to Bad Debt Expense and credited to Allowance for Uncollectible Accounts.

2. Percentage of Accounts Receivable Method

This method estimates bad debt expense based on a percentage of the ending balance of accounts receivable. This method is considered superior to the percentage of sales method in that it factors in what accounts receivable are currently outstanding. It's better suited for companies with relatively stable accounts receivable balances.

Formula: Required Allowance = Accounts Receivable x Estimated Percentage of Uncollectible Accounts

Example: If a company has $500,000 in accounts receivable and estimates 5% will be uncollectible, the required allowance is $25,000. If the existing balance in the allowance account is $10,000, then an additional $15,000 needs to be recorded as bad debt expense. This would be a debit to Bad Debt Expense and a credit to Allowance for Uncollectible Accounts.

3. Aging of Receivables Method

This is the most sophisticated and accurate method. It categorizes accounts receivable by their age (e.g., 0-30 days, 31-60 days, 61-90 days, over 90 days). Each age category is assigned a different percentage of uncollectibility, reflecting the increasing risk of non-payment as accounts age. This method provides a more detailed and realistic estimate.

Example: Let’s assume the following aging schedule:

- 0-30 days: $300,000 (1% uncollectible)

- 31-60 days: $100,000 (5% uncollectible)

- 61-90 days: $50,000 (10% uncollectible)

- Over 90 days: $20,000 (25% uncollectible)

The calculation would be:

- 0-30 days: $300,000 * 0.01 = $3,000

- 31-60 days: $100,000 * 0.05 = $5,000

- 61-90 days: $50,000 * 0.10 = $5,000

- Over 90 days: $20,000 * 0.25 = $5,000

Total required allowance: $18,000

Again, the difference between the required allowance and the existing balance would be recorded as bad debt expense.

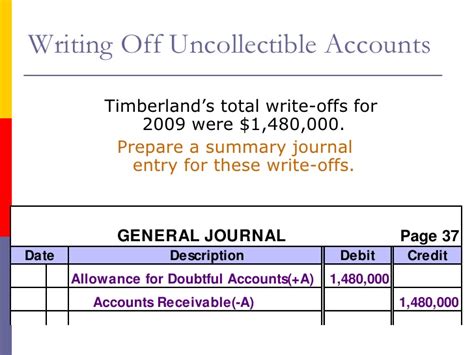

Writing Off Uncollectible Accounts

When it becomes virtually certain that an account receivable will not be collected, the account is written off. This involves debiting the Allowance for Uncollectible Accounts and crediting Accounts Receivable. This doesn't affect the net income, as the allowance account had already been adjusted. Writing off bad debts simply removes the uncollectible amount from the balance sheet.

Example: If a $1,000 account is deemed uncollectible, the journal entry would be:

- Debit: Allowance for Uncollectible Accounts ($1,000)

- Credit: Accounts Receivable ($1,000)

Recovery of Accounts Written Off

It's possible to recover accounts that were previously written off. If a customer makes a payment on an account that was previously written off, the following journal entries are made:

-

Reversing the write-off:

- Debit: Accounts Receivable ($Amount recovered)

- Credit: Allowance for Uncollectible Accounts ($Amount recovered)

-

Recording the cash receipt:

- Debit: Cash ($Amount recovered)

- Credit: Accounts Receivable ($Amount recovered)

Impact on Financial Statements

The allowance for uncollectible accounts significantly impacts a company's financial statements.

-

Balance Sheet: It directly reduces the reported value of accounts receivable, presenting a more conservative and accurate picture of the company's assets. The net realizable value of accounts receivable (Accounts Receivable - Allowance for Uncollectible Accounts) is the amount the company expects to collect.

-

Income Statement: The bad debt expense is recognized on the income statement, reducing net income for the period. This aligns with the principle of matching expenses with revenues.

Choosing the Right Method

The choice of method for estimating the allowance for uncollectible accounts depends on various factors, including:

- Company size and complexity: Smaller companies might use the percentage of sales method, while larger companies with more complex operations might prefer the aging of receivables method.

- Industry norms: Certain industries might have established benchmarks or best practices for estimating uncollectible accounts.

- Historical data: Accurate and reliable historical data is crucial for applying any method effectively. The percentage of receivables method is the most reliant on historical data.

- Management's judgment: Management's experience and understanding of the business environment also play a role in determining the appropriate method and percentage.

Ultimately, the goal is to select a method that provides a reasonable and accurate estimate of the uncollectible accounts, leading to reliable financial reporting.

Conclusion: Accuracy and Prudence in Financial Reporting

The allowance for uncollectible accounts is not simply an accounting entry; it's a vital tool for ensuring the accuracy and prudence of a company's financial statements. By properly estimating and accounting for potential bad debts, businesses can provide a more realistic representation of their financial health, facilitating better decision-making and attracting investors. The selection of an appropriate method requires careful consideration and should align with the specific circumstances of the business. Consistent application of the chosen method and regular review of its effectiveness are key to maintaining the integrity of financial reporting. Regular monitoring of outstanding accounts receivable and the aging of these accounts should be a component of effective accounts receivable management. Understanding the nuances of this contra account is critical for anyone involved in financial reporting and analysis.

Latest Posts

Latest Posts

-

Which Of These Equations Best Summarizes Photosynthesis

Mar 30, 2025

-

A Calendar Year End Reporting Period Is Defined As A

Mar 30, 2025

-

A Reduction In The Price Of Donuts Will Cause

Mar 30, 2025

-

Which Of The Following Is Correctly Matched

Mar 30, 2025

-

Suppose Smith Pays 100 To Jones

Mar 30, 2025

Related Post

Thank you for visiting our website which covers about The Allowance For Uncollectible Accounts Is A Contra Account To . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.