The Adjustment For Overapplied Overhead Blank______ Net Income.

Holbox

Mar 15, 2025 · 6 min read

Table of Contents

The Adjustment for Overapplied Overhead: Impact on Net Income

When it comes to managing a business's finances, accurately tracking and allocating overhead costs is crucial. Overhead, encompassing indirect expenses like rent, utilities, and administrative salaries, often requires an allocation process to assign costs to individual products or services. This process can sometimes lead to discrepancies, resulting in either overapplied or underapplied overhead. This article delves into the intricacies of overapplied overhead, its impact on net income, and the necessary accounting adjustments to rectify the imbalance.

Understanding Overhead Application

Before examining the adjustment for overapplied overhead, let's solidify the foundational concept of overhead application. Businesses employ various methods to allocate overhead costs, including:

-

Predetermined Overhead Rate: This common method involves estimating total overhead costs and a relevant activity base (e.g., direct labor hours, machine hours) for a specific period (usually a year). Dividing the estimated overhead by the estimated activity base yields a predetermined overhead rate. This rate is then applied to actual production activity to allocate overhead costs.

-

Direct Labor Hours: A popular activity base, this method assumes a direct correlation between direct labor hours worked and overhead incurred. The more direct labor hours, the higher the overhead allocation.

-

Machine Hours: This approach is suitable for manufacturing environments where machine usage significantly influences overhead costs. The more machine hours used, the greater the overhead allocation.

The accuracy of overhead allocation hinges significantly on the accuracy of the estimations involved in creating the predetermined overhead rate. Inherent in this process is the likelihood of variances – the difference between the actual overhead incurred and the overhead applied.

The Implications of Overapplied Overhead

Overapplied overhead occurs when the overhead costs applied to production exceed the actual overhead costs incurred during a specific accounting period. This situation implies that the business overestimated overhead costs or underestimated the activity base. Several factors can contribute to overapplied overhead:

-

Improved Efficiency: Unexpected improvements in operational efficiency may result in lower actual overhead costs than initially projected.

-

Underestimation of Activity Base: If the estimated activity base (e.g., direct labor hours) is lower than the actual activity base, this leads to a higher predetermined overhead rate and ultimately, overapplied overhead.

-

Cost Savings: Implementing cost-cutting measures during the period may reduce actual overhead costs below the estimated amount.

-

Inaccurate Cost Estimation: Simply put, the initial budgeting and forecasting of overhead costs might have been inaccurate.

The existence of overapplied overhead necessitates a crucial adjustment to ensure the accuracy of the financial statements. Failing to make the adjustment would misrepresent the company's profitability. The unadjusted financial statements would show a higher cost of goods sold and, consequently, a lower net income than what is actually the case.

Adjusting for Overapplied Overhead: The Accounting Treatment

The adjustment for overapplied overhead is relatively straightforward. Because the overhead was overapplied, meaning more overhead was allocated than actually incurred, the cost of goods sold is overstated. To correct this, the overapplied overhead amount is credited to reduce the cost of goods sold. Simultaneously, the overapplied overhead is debited to close the manufacturing overhead account. This adjustment restores the correct balance within the financial statements.

Here’s a simplified illustration of the journal entry:

Debit: Manufacturing Overhead (to close the account)

Credit: Cost of Goods Sold (to reduce the overstated cost)

The impact of this adjustment on the income statement is clear: Net income will increase. The reduction in the cost of goods sold directly boosts the gross profit and, consequently, the net income. This adjustment reflects the reality that the business incurred less overhead than initially anticipated, leading to a higher overall profit.

Analyzing the Causes of Overapplied Overhead: A Proactive Approach

While adjusting for overapplied overhead is a necessary accounting procedure, it’s equally important to analyze the root causes behind the discrepancy. This proactive approach helps to refine future overhead cost estimations and improve the accuracy of the predetermined overhead rate. Several key questions should be addressed:

-

Were the initial overhead cost estimates overly conservative? Perhaps, the projections were intentionally inflated to provide a safety net, leading to an overapplication.

-

Were there unforeseen efficiencies or cost savings implemented during the period? Identifying these positive factors enables businesses to leverage these best practices in future periods.

-

Were the chosen activity bases appropriate and accurately estimated? Evaluating the suitability of the activity base (e.g., machine hours vs. direct labor hours) is crucial. Incorrectly choosing or estimating the activity base can lead to significant variances.

-

Were there unexpected fluctuations in production volume or activity levels? Large deviations from the planned production volume can significantly affect overhead allocation accuracy.

-

Was there a significant change in the production process or technology? Such changes may require a reassessment of the overhead allocation method and its related activity base.

Addressing these questions allows for a more refined approach to overhead costing in subsequent periods, leading to improved accuracy and reduced variances.

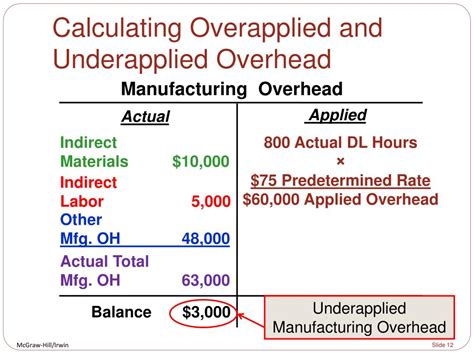

Distinguishing Overapplied Overhead from Underapplied Overhead

It’s essential to differentiate overapplied overhead from its counterpart: underapplied overhead. Underapplied overhead occurs when the actual overhead costs exceed the overhead costs applied during a period. This situation indicates that the business underestimated overhead costs or overestimated the activity base.

The adjustment for underapplied overhead is the opposite of the adjustment for overapplied overhead. The underapplied overhead amount is debited to increase the cost of goods sold, and the manufacturing overhead account is credited to close it. This adjustment reduces net income, reflecting the higher-than-anticipated overhead costs.

Beyond Net Income: Impacts on Other Financial Statements

The adjustment for overapplied overhead influences not just the income statement but also the balance sheet. Specifically, the adjustment affects the cost of goods sold, which is a component of inventory on the balance sheet. Adjusting for overapplied overhead reduces the cost of goods sold, increasing the value of ending inventory on the balance sheet. This reflects the higher-than-expected profitability stemming from the lower actual overhead.

Sophisticated Overhead Allocation Methods

While the predetermined overhead rate method is common, more sophisticated techniques can improve overhead allocation accuracy. These advanced methods, however, often require more complex calculations and data analysis. Examples include:

-

Activity-Based Costing (ABC): This method traces overhead costs to specific activities that drive those costs. ABC offers a more precise cost allocation, especially in businesses with diverse products or services.

-

Variable Costing: This method allocates only variable overhead to products, while fixed overhead is treated as a period cost. This provides a different perspective on product profitability and is useful for decision-making purposes.

Choosing an appropriate method depends on the complexity of the business operations and the desired level of cost allocation accuracy.

Conclusion: Mastering Overhead Allocation for Accurate Financial Reporting

Accurate overhead allocation is vital for generating reliable financial statements. Understanding the concept of overapplied overhead, the appropriate accounting treatment, and the underlying causes are crucial for effective financial management. While the adjustment for overapplied overhead increases net income, it is crucial to conduct a thorough analysis to pinpoint the reasons for the variance and improve future cost estimations. By implementing robust cost accounting practices and utilizing appropriate overhead allocation methods, businesses can gain valuable insights into their operations and make informed decisions that enhance profitability and long-term sustainability. The adjustment itself is merely a step in a broader process of ensuring accurate and insightful financial reporting.

Latest Posts

Latest Posts

-

In Which Situations Can Simplifying Jobs Be Most Beneficial

Mar 17, 2025

-

For The Hr Planning Process How Should Goals Be Determined

Mar 17, 2025

-

How Does A Shortcut Link To Another File

Mar 17, 2025

-

Cash Flows From Financing Activities Do Not Include

Mar 17, 2025

-

A Positive Return On Investment For Education Happens When

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about The Adjustment For Overapplied Overhead Blank______ Net Income. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.