Select The Statement Below That Describes A Post-closing Trial Balance.

Holbox

Mar 22, 2025 · 6 min read

Table of Contents

- Select The Statement Below That Describes A Post-closing Trial Balance.

- Table of Contents

- Understanding the Post-Closing Trial Balance: A Comprehensive Guide

- What is a Post-Closing Trial Balance?

- Permanent Accounts vs. Temporary Accounts: A Critical Distinction

- The Accounting Cycle and the Role of the Post-Closing Trial Balance

- Preparing a Post-Closing Trial Balance: A Step-by-Step Guide

- Why is the Post-Closing Trial Balance Important?

- Addressing the Question: Selecting the Correct Statement

- Common Mistakes in Preparing a Post-Closing Trial Balance

- Conclusion: The Importance of Accuracy

- Latest Posts

- Latest Posts

- Related Post

Understanding the Post-Closing Trial Balance: A Comprehensive Guide

The post-closing trial balance is a crucial financial statement that provides a snapshot of a company's financial health after all temporary accounts have been closed. Understanding its purpose, composition, and significance is vital for accurate financial reporting and effective business management. This comprehensive guide delves deep into the post-closing trial balance, explaining its characteristics, preparation, and its role in the accounting cycle. We'll address the question, "Select the statement below that describes a post-closing trial balance," by exploring the key features that distinguish it from other trial balances.

What is a Post-Closing Trial Balance?

A post-closing trial balance is a list of all the permanent accounts (also known as real accounts) and their balances at the end of an accounting period, after closing entries have been made. Unlike the unadjusted trial balance or adjusted trial balance, which include temporary accounts (revenue, expense, and dividend accounts), the post-closing trial balance only shows the balances of permanent accounts. These accounts carry their balances forward to the next accounting period.

Key Characteristics of a Post-Closing Trial Balance:

- Only Permanent Accounts: It exclusively lists permanent accounts, including assets, liabilities, and owner's equity.

- Zero Balances for Temporary Accounts: All temporary accounts should have a zero balance after closing entries are posted.

- Verification of Accuracy: It serves as a crucial verification step, ensuring that the closing entries were correctly processed and the accounting equation (Assets = Liabilities + Owner's Equity) remains balanced.

- Beginning Balance for the Next Period: The balances in the post-closing trial balance become the starting point (beginning balances) for the next accounting period.

Permanent Accounts vs. Temporary Accounts: A Critical Distinction

To fully appreciate the post-closing trial balance, it's essential to understand the difference between permanent and temporary accounts:

Permanent Accounts (Real Accounts): These accounts maintain their balances across accounting periods. They represent the ongoing financial position of the business. Examples include:

- Assets: Cash, Accounts Receivable, Inventory, Equipment, Buildings, Land.

- Liabilities: Accounts Payable, Salaries Payable, Notes Payable, Loans Payable.

- Owner's Equity: Capital Stock, Retained Earnings.

Temporary Accounts (Nominal Accounts): These accounts are closed at the end of each accounting period. They reflect the financial performance of the business during that specific period. Examples include:

- Revenues: Sales Revenue, Service Revenue, Interest Revenue.

- Expenses: Cost of Goods Sold, Salaries Expense, Rent Expense, Utilities Expense.

- Dividends: Dividends Paid.

The closing process transfers the balances of temporary accounts to the retained earnings account, resetting their balances to zero. This is why the post-closing trial balance only reflects the permanent accounts.

The Accounting Cycle and the Role of the Post-Closing Trial Balance

The post-closing trial balance is a critical step within the accounting cycle. Let's briefly review the entire cycle to understand its place:

- Analyzing Transactions: Recording business transactions.

- Journalizing: Recording transactions in a journal.

- Posting: Transferring journal entries to the ledger.

- Unadjusted Trial Balance: Preparing a trial balance before adjusting entries.

- Adjusting Entries: Making necessary adjustments for accruals, deferrals, etc.

- Adjusted Trial Balance: Preparing a trial balance after adjusting entries.

- Preparing Financial Statements: Preparing the income statement, statement of owner's equity, and balance sheet.

- Closing Entries: Closing temporary accounts to retained earnings.

- Post-Closing Trial Balance: Preparing a trial balance after closing entries – This is our focus!

- Reversing Entries (Optional): Reversing certain adjusting entries at the beginning of the next period.

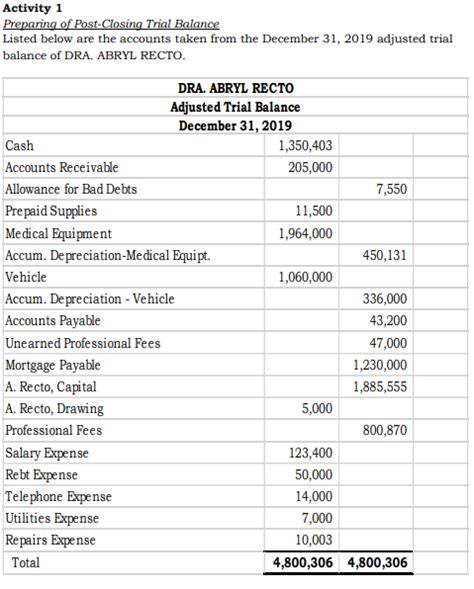

Preparing a Post-Closing Trial Balance: A Step-by-Step Guide

The preparation of a post-closing trial balance is a straightforward process once the closing entries have been completed. Here's a step-by-step guide:

- Ensure Closing Entries are Posted: Verify that all closing entries have been correctly posted to the general ledger. This ensures the temporary accounts have zero balances.

- Gather Account Balances: Obtain the ending balances of all permanent accounts from the general ledger.

- Prepare the Trial Balance Worksheet: Create a worksheet with three columns: Account Name, Debit, and Credit.

- List Permanent Accounts: List all permanent accounts (assets, liabilities, and owner's equity) in the Account Name column.

- Enter Balances: Enter the debit or credit balances of each permanent account in the appropriate column.

- Verify the Balance: The total debits should equal the total credits. If they don't, an error exists that needs to be identified and corrected. This is a crucial check to ensure the accuracy of the closing process.

Why is the Post-Closing Trial Balance Important?

The post-closing trial balance serves several crucial purposes:

- Error Detection: It helps identify errors in the closing process. If the debits and credits don't balance, it signifies a mistake in the closing entries or posting.

- Verification of Accounting Equation: It confirms that the accounting equation (Assets = Liabilities + Owner's Equity) remains balanced after the closing entries. This fundamental principle of accounting must always hold true.

- Starting Point for the Next Period: The balances on the post-closing trial balance become the beginning balances for the next accounting period. This ensures a clean start and accurate financial reporting.

- Basis for Financial Reporting: Although it’s not a formal financial statement, it forms the basis for preparing subsequent financial statements at the start of the new accounting period.

Addressing the Question: Selecting the Correct Statement

Now, let's directly address the question prompting this article: "Select the statement below that describes a post-closing trial balance." To answer this accurately, you would need to be provided with several statements to choose from. However, based on our detailed explanation, a correct statement would likely include the following elements:

- It only shows permanent accounts (assets, liabilities, and owner's equity).

- All temporary accounts (revenues, expenses, and dividends) have zero balances.

- It proves the equality of debits and credits after closing entries have been processed.

- It represents the financial position of the business at the end of an accounting period after closing entries have been made.

- It serves as a starting point for the next accounting period.

Any statement accurately reflecting these points would correctly describe a post-closing trial balance. A statement that includes temporary accounts with non-zero balances or fails to mention the crucial role of closing entries would be incorrect.

Common Mistakes in Preparing a Post-Closing Trial Balance

Several common mistakes can occur during the preparation of a post-closing trial balance. These include:

- Incorrect Posting of Closing Entries: Errors in posting closing entries will result in an imbalance and inaccurate financial reporting. Double-checking each entry is crucial.

- Inclusion of Temporary Accounts: Mistakenly including temporary accounts with non-zero balances is a frequent error. Remember, only permanent accounts should appear.

- Mathematical Errors: Simple calculation mistakes during the summation of debits and credits can lead to an imbalance. Careful attention to detail is essential.

- Omission of Accounts: Failing to include all relevant permanent accounts will result in an incomplete and inaccurate trial balance.

Conclusion: The Importance of Accuracy

The post-closing trial balance is a fundamental component of the accounting cycle. Its primary function is to ensure accuracy and consistency in financial reporting by verifying that the accounting equation remains balanced after the closing process. By understanding its purpose, preparation, and significance, businesses can strengthen their financial management practices and improve the reliability of their financial statements. Maintaining accuracy throughout the accounting process, particularly during the closing entries and the preparation of the post-closing trial balance, is vital for successful financial reporting and decision-making. Addressing errors promptly and thoroughly is crucial for avoiding inaccuracies that can have significant implications for the business.

Latest Posts

Latest Posts

-

At The Time Of Creation Of Cui Material

Mar 24, 2025

-

Reviewers Have A Responsibility To Promote Ethical Peer Review By

Mar 24, 2025

-

Label The Bony Structures Of The Shoulder And Upper Limb

Mar 24, 2025

-

On July 15 The Payment Should Be

Mar 24, 2025

-

Shigleys Mechanical Engineering Design 11th Edition

Mar 24, 2025

Related Post

Thank you for visiting our website which covers about Select The Statement Below That Describes A Post-closing Trial Balance. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.