Regardless Of The Inventory Costing System Used

Holbox

Mar 29, 2025 · 6 min read

Table of Contents

- Regardless Of The Inventory Costing System Used

- Table of Contents

- Regardless of the Inventory Costing System Used: A Comprehensive Guide to Inventory Management

- Understanding the Core Principles of Inventory Management

- 1. Accurate Inventory Tracking: The Foundation of Success

- 2. Demand Forecasting: Predicting Future Needs

- 3. Regular Inventory Audits: Ensuring Accuracy and Identifying Discrepancies

- 4. Efficient Storage and Handling: Minimizing Losses and Damage

- 5. Effective Supplier Relationships: Ensuring Timely Delivery and Quality

- Inventory Costing Systems: Commonalities Across Methods

- Optimizing Inventory Management Across All Costing Methods

- The Importance of Choosing the Right System

- Conclusion: A Holistic Approach to Inventory Management

- Latest Posts

- Latest Posts

- Related Post

Regardless of the Inventory Costing System Used: A Comprehensive Guide to Inventory Management

Inventory management is a critical function for any business, regardless of its size or industry. Effective inventory management ensures that businesses have the right amount of stock on hand to meet customer demand while minimizing storage costs and waste. A key aspect of inventory management is choosing the right inventory costing system. While the specific method used – FIFO (First-In, First-Out), LIFO (Last-In, First-Out), weighted-average cost, or specific identification – impacts the cost of goods sold (COGS) and ultimately the reported net income, several crucial principles apply regardless of the inventory costing system employed.

Understanding the Core Principles of Inventory Management

Before delving into the specifics applicable to all inventory costing methods, it’s crucial to understand the fundamental principles that underpin effective inventory management. These principles remain consistent whether you're using FIFO, LIFO, weighted-average cost, or specific identification.

1. Accurate Inventory Tracking: The Foundation of Success

Accurate inventory tracking is the bedrock of any successful inventory management system. This involves maintaining a detailed record of all inventory items, including:

- Item descriptions: Precise and consistent descriptions are vital for accurate identification and tracking.

- Quantity on hand: Real-time tracking of stock levels prevents stockouts and overstocking.

- Location: Knowing the physical location of each item streamlines picking and packing processes.

- Cost: This is where the chosen inventory costing system comes into play, but accurate cost tracking is essential regardless of the method used.

- Receiving and shipping dates: Tracking these dates helps in understanding inventory flow and potential issues.

Utilizing technologies like barcode scanners, RFID tags, and dedicated inventory management software significantly improves accuracy and efficiency in tracking inventory. Manual tracking is prone to errors and inefficiencies, especially with larger inventories.

2. Demand Forecasting: Predicting Future Needs

Accurate demand forecasting is crucial for optimizing inventory levels. This involves analyzing historical sales data, market trends, seasonality, and other relevant factors to predict future demand. Overestimating demand leads to unnecessary storage costs and potential obsolescence, while underestimating demand can result in lost sales and dissatisfied customers. Sophisticated forecasting techniques, including statistical modeling and machine learning algorithms, can enhance the accuracy of demand predictions.

3. Regular Inventory Audits: Ensuring Accuracy and Identifying Discrepancies

Regular inventory audits are essential for verifying the accuracy of inventory records and identifying any discrepancies between physical inventory and recorded inventory. These audits can be conducted manually or using automated systems. Identifying and rectifying discrepancies promptly minimizes financial losses and ensures the reliability of inventory data. Discrepancies might highlight issues with tracking processes, theft, damage, or obsolescence.

4. Efficient Storage and Handling: Minimizing Losses and Damage

Efficient storage and handling practices are crucial for minimizing inventory losses and damage. This involves properly storing inventory in designated areas, using appropriate storage containers and equipment, and implementing procedures to prevent damage during handling and transportation. Proper storage conditions are critical for perishable goods, pharmaceuticals, and other sensitive items. Implementing a robust warehouse management system (WMS) can significantly improve efficiency in storage and handling.

5. Effective Supplier Relationships: Ensuring Timely Delivery and Quality

Maintaining strong relationships with reliable suppliers is essential for ensuring a consistent supply of inventory. This involves establishing clear communication channels, negotiating favorable terms, and selecting suppliers who consistently meet quality standards and delivery deadlines. Diversifying suppliers mitigates the risk of supply chain disruptions.

Inventory Costing Systems: Commonalities Across Methods

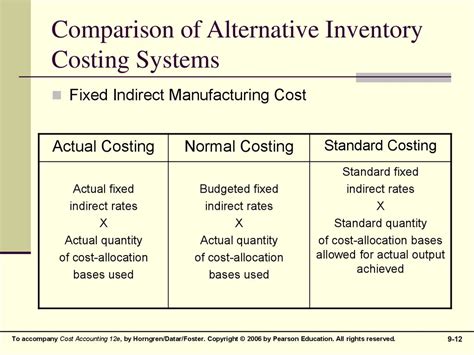

While different inventory costing systems result in variations in COGS and reported profits, certain principles and considerations apply regardless of the chosen method:

- Cost of Goods Sold (COGS) Calculation: All methods aim to calculate the cost of goods sold, which is a crucial figure for determining profitability and tax liabilities. The difference lies in how this cost is determined.

- Impact on Financial Statements: The chosen method directly impacts the reported COGS and net income on financial statements. This affects key financial ratios and can have implications for financial analysis and decision-making.

- Tax Implications: The inventory costing method can influence tax liabilities, as COGS is a deductible expense. Understanding the tax implications of each method is essential for compliance.

- Inventory Valuation: Regardless of the system, the goal is to accurately value the remaining inventory at the end of the accounting period. This valuation is reported on the balance sheet.

- Materiality: For small businesses with low inventory turnover, the choice of method might have a minimal impact. For larger businesses with high-value inventory, the choice is more critical.

Optimizing Inventory Management Across All Costing Methods

Regardless of the specific inventory costing system in place, several strategies contribute to optimizing inventory management:

- Implementing an Inventory Management System (IMS): This software streamlines inventory tracking, forecasting, ordering, and reporting. An IMS provides real-time visibility into inventory levels, facilitating better decision-making.

- Regular Stocktaking and Reconciliation: This involves physically counting inventory and comparing it with recorded levels to identify discrepancies. It’s crucial for maintaining accuracy and preventing losses.

- Just-in-Time (JIT) Inventory Management: This approach minimizes inventory holding costs by ordering materials only when needed. It requires close collaboration with suppliers and efficient production processes.

- Economic Order Quantity (EOQ): EOQ calculations help determine the optimal order quantity to minimize ordering and holding costs.

- ABC Analysis: This technique classifies inventory items based on their value and consumption rate, allowing for focused management of high-value items.

- Safety Stock: Maintaining a certain level of safety stock helps mitigate the risk of stockouts due to unexpected demand fluctuations or supply chain disruptions.

The Importance of Choosing the Right System

While the principles above apply universally, the choice of inventory costing system does significantly impact financial reporting and tax implications. The best system depends on factors like industry, inventory turnover rate, and the nature of the inventory. For example:

-

FIFO (First-In, First-Out): Assumes that the oldest inventory is sold first. It's generally preferred in industries with perishable goods or rapidly changing product lines. It results in a higher COGS during inflation and lower net income.

-

LIFO (Last-In, First-Out): Assumes that the newest inventory is sold first. It's less commonly used due to limitations under IFRS, but it can result in lower COGS during inflation and higher net income.

-

Weighted-Average Cost: Calculates the average cost of all inventory items and assigns this average cost to the cost of goods sold. It simplifies calculations but may not accurately reflect the true cost of goods sold.

-

Specific Identification: Tracks the cost of each individual item. This is suitable for businesses with unique or high-value inventory items, but it's more complex and time-consuming.

The selection of the most appropriate inventory costing system requires a thorough understanding of your specific business needs and the implications of each method. Consulting with an accountant or financial advisor is highly recommended.

Conclusion: A Holistic Approach to Inventory Management

Regardless of the chosen inventory costing system, successful inventory management relies on a holistic approach that integrates accurate tracking, demand forecasting, efficient storage, strong supplier relationships, and the use of appropriate technology. By focusing on these core principles, businesses can optimize their inventory levels, minimize costs, and improve overall profitability. While the specific accounting method impacts financial reporting, the fundamental principles of effective inventory management remain consistent and crucial for long-term success. Remember that continuous monitoring, analysis, and adaptation are key to staying ahead in the dynamic world of inventory management. Regular reviews of your chosen system and procedures ensure it remains optimal for your business's evolving needs.

Latest Posts

Latest Posts

-

Minor Violations May Be Granted Upwards Of

Apr 02, 2025

-

Determine The Ending Balance Of Each Of The Following T Accounts

Apr 02, 2025

-

Draw The Correct Product For The Reaction

Apr 02, 2025

-

Percent Of Oxygen In Potassium Chlorate Lab Answers

Apr 02, 2025

-

A Local School Administrator Observes An Increase

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about Regardless Of The Inventory Costing System Used . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.