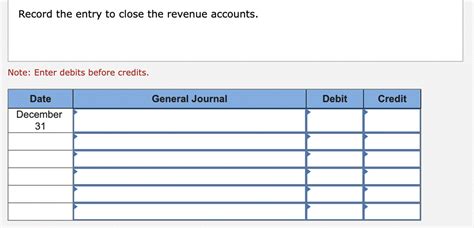

Record The Entry To Close The Revenue Accounts.

Holbox

Mar 12, 2025 · 6 min read

Table of Contents

Recording the Entry to Close Revenue Accounts: A Comprehensive Guide

Closing revenue accounts is a crucial step in the accounting cycle, ensuring accurate financial reporting and preparing for the next accounting period. This process involves transferring the balances of revenue accounts to a temporary account, typically the Income Summary account, before ultimately closing it to the Retained Earnings account. Understanding how to correctly record this entry is vital for maintaining sound financial records. This comprehensive guide will walk you through the entire process, clarifying the steps, providing examples, and addressing common questions.

Understanding the Importance of Closing Revenue Accounts

Before diving into the mechanics, let's understand why we close revenue accounts. At the end of an accounting period (e.g., quarterly or annually), businesses need to prepare their financial statements. Revenue accounts, which track income generated from sales and services, accumulate balances throughout the period. These balances must be "zeroed out" to prepare for the next period. This "zeroing out" doesn't mean the revenue disappears; rather, it's transferred to the retained earnings account, reflecting the company's overall profitability. The process ensures the following:

- Accurate Financial Statements: Closing entries provide a clean slate for the next accounting period, preventing the current period's revenue from being included in the next period's calculations.

- Clear Picture of Profitability: By transferring revenue to retained earnings, businesses can clearly see their net income or loss for the period.

- Compliance: Accurate closing entries are essential for complying with accounting standards (like GAAP or IFRS) and for accurate tax reporting.

The Mechanics of Closing Revenue Accounts

The process involves a journal entry that debits (reduces) the revenue accounts and credits (increases) the Income Summary account. The Income Summary account acts as a temporary holding place, summing up all revenues and expenses before the final transfer to retained earnings.

Here's a breakdown of the process:

1. Identify Revenue Accounts: Begin by identifying all revenue accounts in your general ledger. These accounts typically have debit balances, which need to be closed. Common examples include:

- Sales Revenue: Revenue from the sale of goods.

- Service Revenue: Revenue from providing services.

- Interest Revenue: Revenue earned from interest-bearing accounts.

- Rent Revenue: Revenue from renting out property.

- Gain on Sale of Assets: Revenue from the sale of assets at a profit.

2. Prepare the Closing Entry: The closing entry will debit all revenue accounts and credit the Income Summary account. The debit reduces the balance of each revenue account to zero, while the credit increases the balance of the Income Summary account to reflect the total revenue for the period.

Example:

Let's assume the following balances at the end of the period:

- Sales Revenue: $100,000

- Service Revenue: $50,000

- Interest Revenue: $5,000

The closing entry would be:

| Account Name | Debit | Credit |

|---|---|---|

| Sales Revenue | $100,000 | |

| Service Revenue | $50,000 | |

| Interest Revenue | $5,000 | |

| Income Summary | $155,000 |

3. Post the Closing Entry: After preparing the entry, post it to the general ledger. This updates the balances of the revenue accounts to zero and reflects the total revenue in the Income Summary account.

4. Closing the Income Summary Account: The Income Summary account now holds the total revenue for the period. The next step is to close the Income Summary account. This involves transferring the balance to the Retained Earnings account. This step requires another journal entry.

5. Closing the Income Summary to Retained Earnings: To close the Income Summary account, you'll need to consider the expenses. After closing the revenue accounts, you’ll next close the expense accounts (which have credit balances), debiting the Income Summary account and crediting the various expense accounts. Once this is complete, the Income Summary account will reflect the net income (or net loss) for the period. The final closing entry will then transfer this net income or net loss to Retained Earnings.

Example (Continuing from above):

Let's assume total expenses were $80,000. The Income Summary account now has a credit balance of $75,000 ($155,000 revenue - $80,000 expenses). The closing entry would be:

| Account Name | Debit | Credit |

|---|---|---|

| Income Summary | $75,000 | |

| Retained Earnings | $75,000 |

This entry reduces the Income Summary account to zero and increases the Retained Earnings account, reflecting the net income for the period.

Handling Multiple Revenue Streams

Many businesses have numerous revenue streams. The process remains the same, even with multiple revenue accounts. You simply list each revenue account in the closing entry, ensuring the total debit equals the total credit. For example, if a business had sales revenue, service revenue, and consulting revenue, each would be debited individually, with the Income Summary account credited for the total of all three.

Advanced Considerations: Contra Revenue Accounts

Some revenue accounts have related contra accounts. Contra revenue accounts reduce the balance of their corresponding revenue accounts. For example, Sales Returns and Allowances is a contra revenue account that reduces Sales Revenue. When closing revenue accounts, you'll need to consider these contra accounts. You need to net the contra revenue accounts against their related revenue accounts before closing them.

Example:

Let's say Sales Revenue is $100,000, and Sales Returns and Allowances is $5,000. Before closing, the net sales revenue is $95,000 ($100,000 - $5,000). The closing entry would reflect this net amount.

Potential Errors and Troubleshooting

Several common errors can occur during the closing process. These can lead to inaccurate financial statements:

- Incorrect Debits and Credits: Ensure you correctly debit revenue accounts and credit the Income Summary and Retained Earnings accounts. Reversing the debits and credits will lead to significant inaccuracies.

- Forgetting to Close all Revenue Accounts: Make sure to close all revenue accounts listed on the trial balance.

- Incorrect Calculation of Net Income/Loss: Double-check your calculations to ensure the net income or loss is accurately transferred to Retained Earnings.

To troubleshoot potential errors, always carefully review your journal entries and the resulting general ledger balances. Reconcile your balances to ensure everything adds up correctly.

The Importance of Accurate Closing Entries for Financial Reporting

The accuracy of your financial statements directly depends on the proper closing of revenue accounts. Incorrect closing entries will lead to inaccurate net income and retained earnings figures, potentially misleading stakeholders and impacting critical business decisions. It is essential to prioritize accuracy and double-check your work to ensure your financial reports reflect the true financial health of your business.

Regularly reviewing your financial reports and comparing them to previous periods can help you catch errors and identify any unusual trends that need further investigation. This proactive approach not only ensures accuracy but also helps you gain a better understanding of your business’s financial performance.

By following the detailed steps outlined in this guide and maintaining careful attention to detail, you can confidently record the entry to close your revenue accounts and ensure the integrity of your financial statements. Remember that consistency and accuracy are paramount in maintaining sound financial records.

Latest Posts

Latest Posts

-

You Open A Document To Find The Text Illegible

Mar 12, 2025

-

On July 1 A Company Receives An Invoice For 800

Mar 12, 2025

-

Match Each Term With Its Definition

Mar 12, 2025

-

Question Pierce You Are Given An Alkene In The

Mar 12, 2025

-

The Marketing Manager Of A Furthnire Compnay

Mar 12, 2025

Related Post

Thank you for visiting our website which covers about Record The Entry To Close The Revenue Accounts. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.